Ca Depreciation Form

What is the California Depreciation?

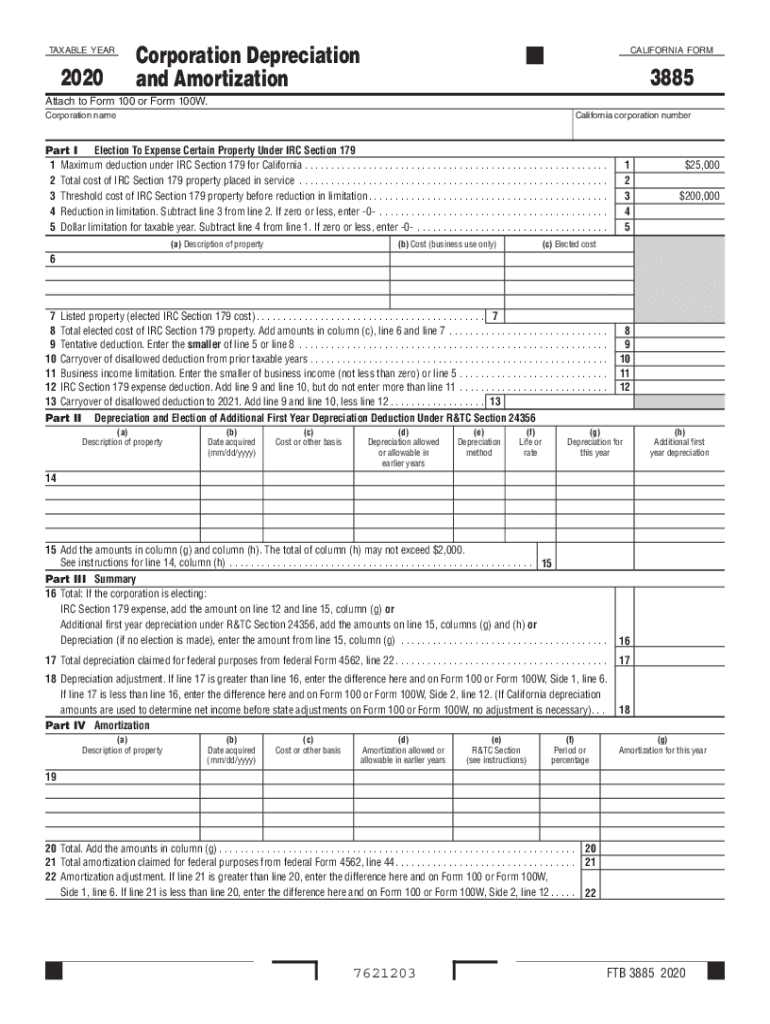

The California depreciation form, specifically the CA Form 3885, is used by businesses and individuals to report depreciation on property used in a trade or business. This form allows taxpayers to calculate the depreciation deduction for assets, which can significantly reduce taxable income. Understanding how to properly utilize this form is essential for accurate tax reporting and compliance with California tax laws.

Steps to Complete the California Depreciation Form

Filling out the California depreciation form involves several key steps:

- Gather necessary information about the assets being depreciated, including purchase dates, costs, and useful life.

- Determine the appropriate depreciation method to use, such as straight-line or declining balance.

- Complete the form by entering the required details, including asset descriptions and calculated depreciation amounts.

- Review the form for accuracy before submission to ensure all information is correct.

Legal Use of the California Depreciation

The California depreciation form must be completed in accordance with both state and federal regulations. Compliance with the Internal Revenue Service (IRS) guidelines is crucial, as discrepancies can lead to penalties or audits. Using electronic signature solutions can enhance the legal validity of the completed form, ensuring that it meets all necessary requirements for electronic submission.

Filing Deadlines / Important Dates

It is important to be aware of the deadlines for filing the California depreciation form. Typically, the form must be submitted along with your state tax return by the due date of the return, which is usually April 15 for individuals. Businesses may have different deadlines based on their fiscal year. Keeping track of these dates helps avoid late filing penalties.

Required Documents

When completing the California depreciation form, certain documents are necessary to support your claims. These may include:

- Purchase invoices for the assets being depreciated.

- Records of any improvements made to the assets.

- Previous tax returns that may provide context for current depreciation claims.

Form Submission Methods

The California depreciation form can be submitted through various methods, including:

- Online submission via the California Franchise Tax Board's e-filing system.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if preferred.

Examples of Using the California Depreciation

Businesses often utilize the California depreciation form to claim deductions on various types of assets. For instance, a corporation may depreciate machinery used in production, while a self-employed individual might claim depreciation on office equipment. These deductions can lead to significant tax savings, making it essential to accurately report and document all relevant information.

Quick guide on how to complete ca depreciation

Effortlessly Prepare Ca Depreciation on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Ca Depreciation on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign Ca Depreciation with Ease

- Find Ca Depreciation and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Ca Depreciation and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca depreciation

The way to create an eSignature for your PDF file in the online mode

The way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What is the California depreciation form printable?

The California depreciation form printable is a document used to report depreciable assets for tax purposes in California. This form allows taxpayers to calculate and claim depreciation on their property efficiently. Utilizing the California depreciation form printable ensures compliance with state tax regulations.

-

How can I obtain a California depreciation form printable?

You can easily obtain a California depreciation form printable by visiting the official California Department of Tax and Fee Administration website. Many financial and tax software providers also offer templates that you can download. Additionally, airSlate SignNow provides resources to help you create and manage this form efficiently.

-

Does airSlate SignNow provide features for California depreciation form printable?

Yes, airSlate SignNow offers features that facilitate the completion and signing of the California depreciation form printable. You can easily upload, edit, and fill out the form within our platform. Our eSigning capabilities allow for quick approvals, streamlining your tax preparation process.

-

Is the California depreciation form printable available for easy editing?

Absolutely! The California depreciation form printable can be easily edited using airSlate SignNow's user-friendly interface. You can add necessary information, make changes, and save your form seamlessly. Our platform enhances your experience by allowing you to manage forms online, saving time and effort.

-

What advantages does using airSlate SignNow for the California depreciation form printable offer?

Using airSlate SignNow for the California depreciation form printable offers numerous advantages. You benefit from an easy-to-use platform that ensures your forms are filled out correctly and securely signed. This efficiency can help you avoid delays in your tax filing process and save valuable time.

-

Are there any costs associated with using airSlate SignNow for the California depreciation form printable?

AirSlate SignNow offers a variety of pricing plans to cater to different business needs. Signing and sending the California depreciation form printable can be done at competitive rates, ensuring cost-effectiveness for your company. Visit our pricing page for detailed plans and options.

-

Can I integrate airSlate SignNow with other tax software for my California depreciation form printable?

Yes, airSlate SignNow offers integrations with various tax software platforms, allowing you to streamline your workflow when dealing with the California depreciation form printable. These integrations enhance organization and simplify the process of managing multiple tax documents. You can easily sync your information across platforms for added convenience.

Get more for Ca Depreciation

Find out other Ca Depreciation

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will