Transfer Death Deed Form

What is the Transfer Death Deed Form

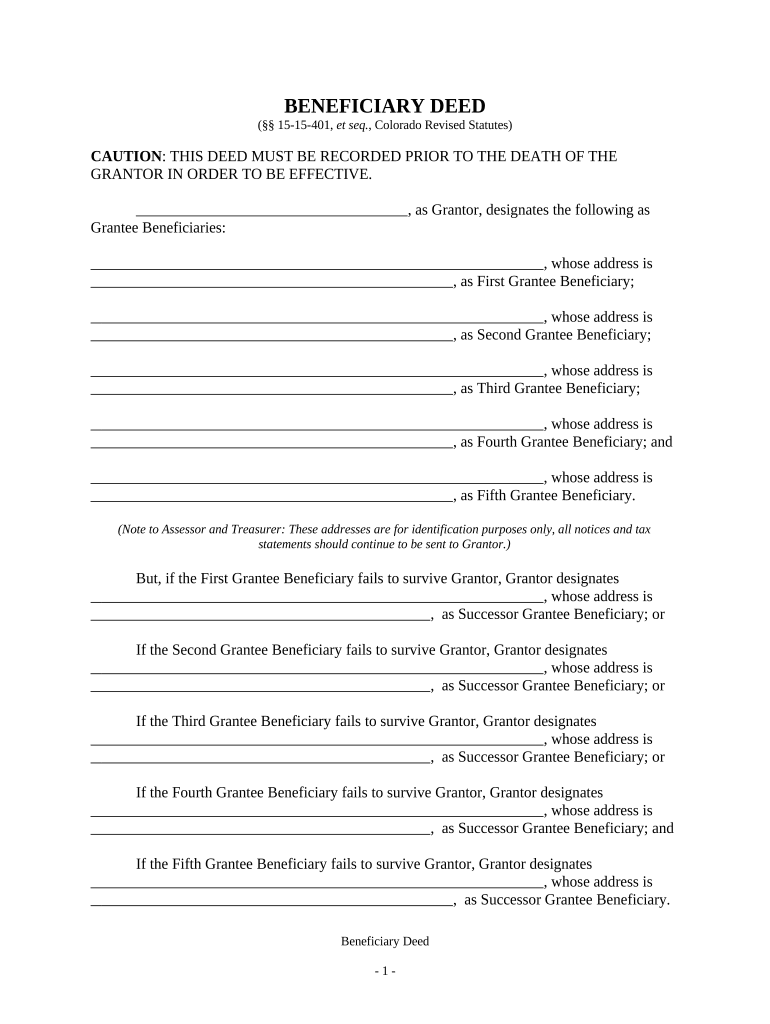

The Transfer Death Deed form is a legal document used in Colorado that allows property owners to transfer their real estate assets to designated beneficiaries upon their death. This form is particularly beneficial as it bypasses the lengthy and often costly probate process. By designating beneficiaries, property owners can ensure a smooth transition of ownership, allowing their heirs to inherit the property directly without the need for court intervention.

Steps to Complete the Transfer Death Deed Form

Completing the Transfer Death Deed form involves several key steps to ensure its validity and effectiveness:

- Gather necessary information about the property, including the legal description and the names of the beneficiaries.

- Fill out the form accurately, ensuring that all details are correct, including the names of the grantor (property owner) and grantee (beneficiary).

- Have the form signed in the presence of a notary public to validate the document.

- File the completed form with the appropriate county clerk and recorder's office to officially record the transfer.

Legal Use of the Transfer Death Deed Form

The Transfer Death Deed form is legally recognized in Colorado, provided it meets specific requirements. The form must clearly state the intent to transfer property upon death and include all necessary signatures. It is essential to comply with state laws regarding the execution and recording of the deed to ensure it is enforceable. Failure to adhere to these legal standards may result in complications for beneficiaries.

Key Elements of the Transfer Death Deed Form

Several critical elements must be included in the Transfer Death Deed form for it to be valid:

- Grantor Information: Full name and address of the property owner.

- Grantee Information: Full names and addresses of the beneficiaries.

- Property Description: A detailed legal description of the property being transferred.

- Signature and Notarization: The grantor's signature must be notarized to ensure authenticity.

How to Obtain the Transfer Death Deed Form

The Transfer Death Deed form can be obtained through various sources in Colorado. It is available at county clerk and recorder's offices, where you can request a physical copy. Additionally, many legal websites provide downloadable versions of the form. Ensure that the version you obtain complies with current Colorado laws and regulations.

State-Specific Rules for the Transfer Death Deed Form

Each state may have its own rules regarding the Transfer Death Deed form. In Colorado, the form must be executed in accordance with state laws, including proper notarization and recording. Furthermore, the beneficiaries must be clearly identified, and the property description must be accurate to avoid any disputes. It is advisable to consult with a legal professional to ensure compliance with all state-specific requirements.

Quick guide on how to complete transfer death deed form 497299764

Easily Prepare Transfer Death Deed Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without any holdups. Handle Transfer Death Deed Form on any platform using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

Effortlessly Modify and eSign Transfer Death Deed Form

- Find Transfer Death Deed Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or mask sensitive information with features provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or mistakes necessitating the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Transfer Death Deed Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Colorado transfer deed?

A Colorado transfer deed is a legal document used to transfer ownership of real property from one party to another. It plays a crucial role in the property transaction process, ensuring that the transfer is documented and legally binding. Understanding the importance of the Colorado transfer deed is essential for both buyers and sellers.

-

How do I complete a Colorado transfer deed?

Completing a Colorado transfer deed involves filling out specific information, including the names of the grantor and grantee, property description, and execution dates. You can easily prepare this document using airSlate SignNow, which streamlines the process and ensures compliance with Colorado laws. Our platform provides step-by-step guidance for accurate completion.

-

What are the benefits of using airSlate SignNow for Colorado transfer deeds?

Using airSlate SignNow to manage your Colorado transfer deed offers several benefits, including cost-effectiveness, ease of use, and time savings. Our platform allows you to electronically sign documents securely and efficiently, expediting the transfer process. Additionally, you have access to templates and resources tailored specifically for Colorado transfer deed execution.

-

Is there a fee associated with processing a Colorado transfer deed through airSlate SignNow?

Yes, while using airSlate SignNow to create and eSign a Colorado transfer deed may involve a subscription fee, it is designed to be cost-effective compared to traditional notarization options. We offer various pricing plans to suit different needs, ensuring that you receive a valuable service without breaking the bank. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other software for property management?

Absolutely! airSlate SignNow offers seamless integrations with popular property management software, making it easy to manage your Colorado transfer deed alongside other documents and processes. This feature enhances efficiency, allowing for a smoother workflow in your real estate transactions. Explore our integration options on our platform.

-

How secure is the signing process for Colorado transfer deeds with airSlate SignNow?

The signing process for Colorado transfer deeds using airSlate SignNow is highly secure. We utilize industry-leading encryption and comply with relevant regulations to ensure that your documents remain confidential and protected. You can have peace of mind knowing that your transfer deed is handled with the utmost security.

-

What types of properties require a Colorado transfer deed?

In Colorado, a transfer deed is commonly required for all real estate transactions, including residential, commercial, and vacant land transfers. This legal document ensures that the sale or transfer is officially recorded and recognized by the state. If you are involved in property transactions in Colorado, it's essential to familiarize yourself with the use of a transfer deed.

Get more for Transfer Death Deed Form

Find out other Transfer Death Deed Form

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe