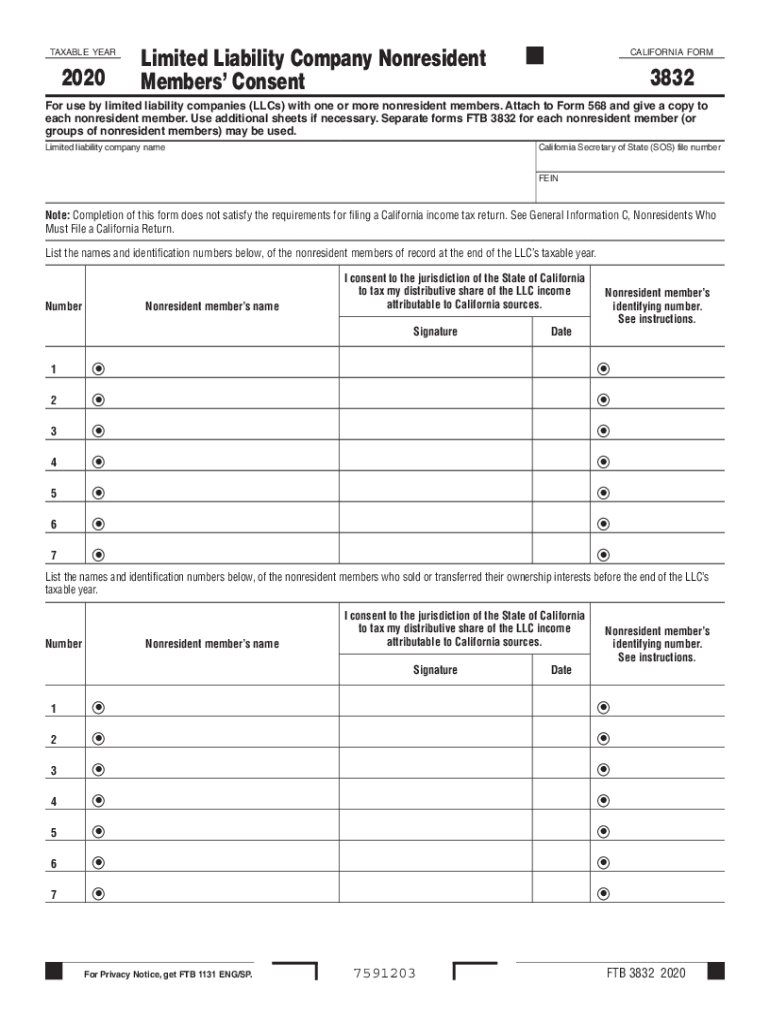

Ca Form 3832

What is the California Form 3832?

The California Form 3832, also known as the California Nonresident Members form, is a tax document used by nonresident members of a limited liability company (LLC) or partnership to report their income from California sources. This form is essential for ensuring compliance with state tax regulations, as it helps determine the tax obligations of nonresident members who earn income in California.

How to Use the California Form 3832

To use the California Form 3832 effectively, nonresident members must complete the form accurately, detailing their share of income, deductions, and credits from the LLC or partnership. This information is crucial for calculating the appropriate tax liability. The form must be submitted along with the California tax return, ensuring that all income earned in the state is reported correctly.

Steps to Complete the California Form 3832

Completing the California Form 3832 involves several key steps:

- Gather necessary financial documents, including K-1 forms from the LLC or partnership.

- Fill out personal information, including your name, address, and taxpayer identification number.

- Report your share of income, deductions, and credits as indicated on the K-1 forms.

- Calculate the total tax liability based on the reported income.

- Review the form for accuracy before submission.

Legal Use of the California Form 3832

The California Form 3832 is legally binding when completed and submitted according to state regulations. It is important for nonresident members to ensure that the information provided is truthful and accurate, as any discrepancies may lead to penalties or audits by the California Franchise Tax Board. Compliance with the legal requirements surrounding this form is essential for maintaining good standing with state tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 3832 typically align with the general tax return deadlines. Nonresident members should be aware of the following important dates:

- April 15: Standard deadline for filing individual tax returns, including Form 3832.

- October 15: Extended deadline for those who file for an extension.

Required Documents

When completing the California Form 3832, certain documents are required to ensure accurate reporting. These may include:

- K-1 forms from the LLC or partnership, detailing income and deductions.

- Personal identification information, such as Social Security number or taxpayer ID.

- Any additional documentation that supports income claims or deductions.

Quick guide on how to complete ca form 3832

Effortlessly Complete Ca Form 3832 on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Ca Form 3832 across any platform utilizing airSlate SignNow applications for Android or iOS, and enhance any document-focused procedure today.

The easiest method to edit and eSign Ca Form 3832 effortlessly

- Obtain Ca Form 3832 and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Ca Form 3832, ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca form 3832

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What is the California Form 3832?

The California Form 3832 is a tax form used for claiming a credit for taxes paid to another state. It is essential for California residents who earn income outside of the state. Utilizing airSlate SignNow can streamline the process of completing and eSigning this form digitally.

-

How can airSlate SignNow help with California Form 3832?

airSlate SignNow enhances the experience of completing the California Form 3832 by providing a user-friendly platform for document management. Users can easily fill out, sign, and send their forms electronically, eliminating the need for physical paperwork. This solution saves time and ensures the submission process is efficient.

-

Is airSlate SignNow affordable for filing California Form 3832?

Yes, airSlate SignNow offers a cost-effective solution for filing California Form 3832. The pricing plans are designed to fit different budgets and include comprehensive features that ensure users get maximum value. The investment can ultimately lead to signNow time savings and reduced administrative costs.

-

What features does airSlate SignNow offer for California Form 3832?

airSlate SignNow provides features such as customizable templates, secure eSigning, and seamless document sharing which are particularly beneficial for managing the California Form 3832. Users can easily reuse templates, ensuring consistency and compliance when filing. This helps in maintaining accuracy and increasing productivity.

-

Can I integrate airSlate SignNow with other applications while filing California Form 3832?

Absolutely! airSlate SignNow supports integration with various applications, allowing users to connect their workflow while filing the California Form 3832. Integrating with tools like Google Drive, Dropbox, and CRM systems ensures a smooth operation, enhancing efficiency in document management.

-

Is it secure to use airSlate SignNow when submitting California Form 3832?

Yes, airSlate SignNow prioritizes security, ensuring that your California Form 3832 and other documents are protected. The platform employs encryption and compliance measures that safeguard your sensitive information throughout the eSigning process. Users can trust that their data is safe and secure with airSlate SignNow.

-

Can multiple users collaborate on California Form 3832 using airSlate SignNow?

Yes, airSlate SignNow allows for multiple users to collaborate on the California Form 3832. This feature is perfect for teams that need to gather information and signatures from various stakeholders efficiently. Collaborative tools make it easy to track changes and maintain version control in real-time.

Get more for Ca Form 3832

Find out other Ca Form 3832

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form