Form 760es

What is the Form 760es

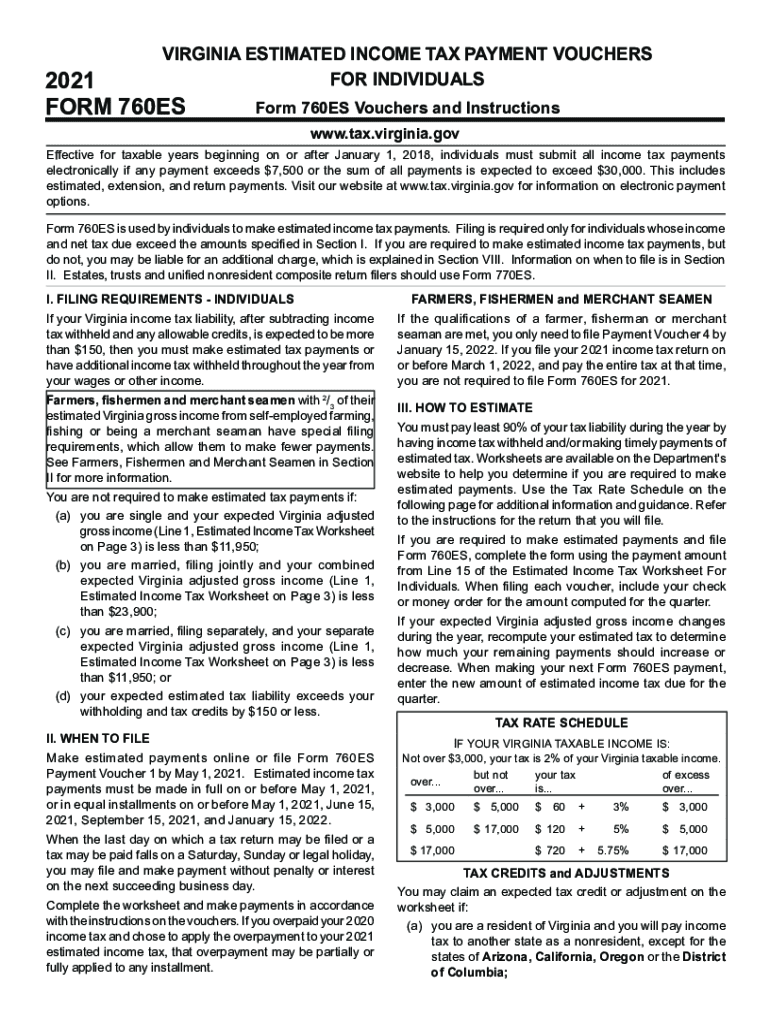

The 2021 Form 760es is a Virginia estimated tax payment voucher used by individuals and businesses to remit estimated income tax payments to the state. This form is essential for taxpayers who expect to owe tax of $150 or more when filing their annual return. The 760es allows taxpayers to make quarterly payments, ensuring they meet their tax obligations throughout the year. By using this form, individuals can avoid penalties associated with underpayment of taxes.

How to use the Form 760es

To effectively use the 2021 Form 760es, taxpayers should first determine their expected tax liability for the year. This involves estimating income, deductions, and credits. Once the estimated amount is calculated, taxpayers can complete the form by providing personal information, including name, address, and Social Security number. Each payment period requires a separate voucher, which can be submitted along with the payment. It is crucial to keep a copy of each submitted voucher for personal records.

Steps to complete the Form 760es

Completing the 2021 Form 760es involves several straightforward steps:

- Gather necessary financial information, including income and deductions.

- Calculate your estimated tax liability for the year.

- Fill out the personal information section on the form.

- Enter the estimated payment amount for each quarter.

- Sign and date the form.

- Submit the form along with your payment by the due date.

Legal use of the Form 760es

The 2021 Form 760es is legally binding when completed and submitted according to Virginia tax regulations. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Virginia Department of Taxation. This includes submitting payments on time and maintaining accurate records of all submissions. Failure to comply with these regulations may result in penalties or interest on unpaid taxes.

Filing Deadlines / Important Dates

Taxpayers must be aware of the important deadlines associated with the 2021 Form 760es. Payments are typically due on the 15th of April, June, September, and January of the following year. It is essential to mark these dates on your calendar to avoid late fees. Additionally, taxpayers should check for any updates or changes to deadlines that may arise due to legislative changes or other factors.

Form Submission Methods

The 2021 Form 760es can be submitted through various methods, providing flexibility for taxpayers. The options include:

- Online submission via the Virginia Department of Taxation's website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices.

Choosing the right submission method can help ensure timely processing of payments.

Quick guide on how to complete 2021 form 760es

Effortlessly Prepare Form 760es on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delay. Manage Form 760es on any device using airSlate SignNow's Android or iOS apps and enhance any document-related process today.

The Easiest Way to Modify and eSign Form 760es with Ease

- Find Form 760es and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 760es and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 760es

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is the 2021form760esvoucher and how does it work?

The 2021form760esvoucher is a tax voucher designed for individuals to make estimated payments on their Virginia income tax. By using this voucher, users can easily and efficiently manage their payments while ensuring they meet tax obligations without hassle.

-

How can airSlate SignNow help with the 2021form760esvoucher process?

With airSlate SignNow, you can effortlessly eSign and send the 2021form760esvoucher documents, making the process quicker and more efficient. Our platform allows you to streamline your tax payment workflow with secure electronic signatures.

-

Are there any costs associated with using airSlate SignNow for the 2021form760esvoucher?

airSlate SignNow offers various pricing plans that cater to different business needs. While there is typically a subscription fee, the cost-effectiveness of our solution ensures that you save time and resources while handling the 2021form760esvoucher.

-

Can I integrate airSlate SignNow with other software for processing the 2021form760esvoucher?

Yes, airSlate SignNow seamlessly integrates with numerous other software applications. This allows for a more efficient workflow when managing the 2021form760esvoucher and other related documents, enhancing your overall productivity.

-

What are the benefits of using airSlate SignNow for 2021form760esvoucher eSigning?

The primary benefits of using airSlate SignNow for your 2021form760esvoucher include improved compliance, reduced processing time, and enhanced document security. Our user-friendly interface ensures that you can complete your tax obligations with ease.

-

Is airSlate SignNow secure for sending sensitive 2021form760esvoucher information?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your sensitive information, including the 2021form760esvoucher. Your data is encrypted and securely stored, providing peace of mind during transactions.

-

How does airSlate SignNow improve the efficiency of managing the 2021form760esvoucher?

airSlate SignNow streamlines the entire signing and sending process for the 2021form760esvoucher, reducing the time spent on administrative tasks. Automation features help you track the document status, ensuring timely submission.

Get more for Form 760es

- Japanese verb conjugation exercises pdf form

- Firpta addendum form

- Editable employee attendance calendar template form

- Complaint for support spanish complaint for support spanish form

- Note the case number format is typeyearnumbe

- The basics of real estate title deeds form

- Intestate estate form

- Fillable online mc ala waiver of probate of will codicil form

Find out other Form 760es

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document