Form 5884 C Rev March

What is the Form 5884 C Rev March

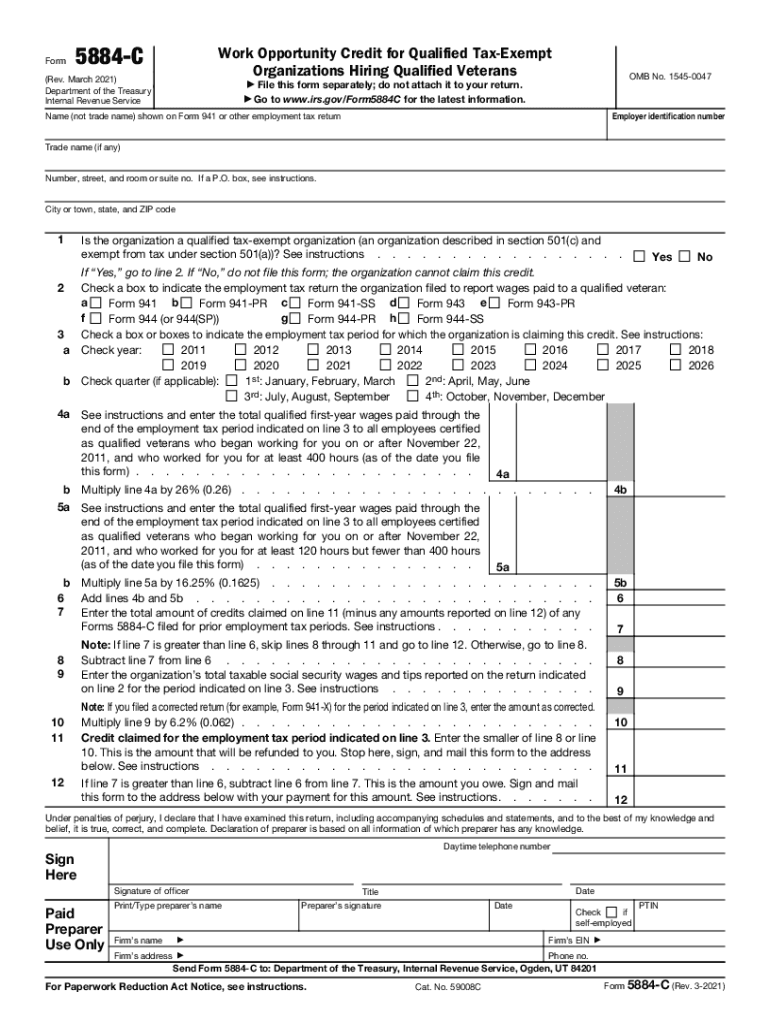

The Form 5884 C Rev March is a tax form used by employers to claim the Work Opportunity Credit for hiring qualified veterans. This credit aims to incentivize businesses to employ individuals from specific target groups, including veterans who face barriers to employment. The form requires detailed information about the employee and the employer, ensuring that the credit is accurately calculated and claimed.

Eligibility Criteria

To qualify for the Work Opportunity Credit using Form 5884 C Rev March, employers must meet certain criteria. The employee must be a qualified veteran, which includes individuals who have served in the military and meet specific requirements regarding their service and unemployment status. Additionally, the employer must be a qualified organization that is eligible to claim the credit under IRS guidelines.

Steps to Complete the Form 5884 C Rev March

Completing the Form 5884 C Rev March involves several steps:

- Gather necessary information about the veteran employee, including their Social Security number and the dates of their military service.

- Determine the amount of credit being claimed based on the employee's wages and hours worked.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for errors before submission to avoid delays or penalties.

How to Obtain the Form 5884 C Rev March

The Form 5884 C Rev March can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. Employers can also request a physical copy from a tax professional or local IRS office. It is important to ensure that the most current version of the form is used to comply with IRS regulations.

Filing Deadlines / Important Dates

Employers should be aware of the filing deadlines associated with the Form 5884 C Rev March. Generally, the form must be submitted along with the employer's tax return for the year in which the credit is being claimed. It is advisable to check the IRS website for specific deadlines, as they may vary from year to year.

Form Submission Methods (Online / Mail / In-Person)

The Form 5884 C Rev March can be submitted in several ways. Employers may file electronically through tax software that supports IRS forms, which is often the quickest method. Alternatively, the form can be mailed to the appropriate IRS address or submitted in person at a local IRS office. Each submission method has its own processing times and requirements, so employers should choose the one that best suits their needs.

Quick guide on how to complete form 5884 c rev march 2021

Manage Form 5884 C Rev March effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documentation, as you can easily find the form you need and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 5884 C Rev March on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The simplest way to modify and eSign Form 5884 C Rev March with ease

- Find Form 5884 C Rev March and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you would like to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you prefer. Alter and eSign Form 5884 C Rev March to guarantee outstanding communication at every phase of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5884 c rev march 2021

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What are the benefits of using airSlate SignNow for credit companies?

airSlate SignNow provides credit companies with an easily accessible platform to send and eSign documents efficiently. By streamlining document workflows, credit companies can reduce paper usage, save time, and enhance customer satisfaction. This solution enables businesses to stay compliant and maintain a professional image.

-

How does airSlate SignNow integrate with other tools used by credit companies?

airSlate SignNow integrates seamlessly with several tools that credit companies commonly use, such as CRM systems, accounting software, and cloud storage platforms. This allows for a more cohesive and efficient workflow, making it easy to manage documents across different applications. These integrations help credit companies to automate processes and enhance productivity.

-

What pricing options does airSlate SignNow offer for credit companies?

airSlate SignNow offers flexible pricing plans tailored to the needs of credit companies of all sizes. With options for monthly or annual subscriptions, businesses can select a plan that best fits their budget and requirements. Additionally, there is a free trial available, allowing credit companies to test the features before committing.

-

Is airSlate SignNow compliant with regulations that credit companies must follow?

Yes, airSlate SignNow is fully compliant with industry standards and regulations, including eSignature laws such as UETA and ESIGN. This compliance ensures that credit companies can confidently use the platform to manage sensitive documents securely. By leveraging airSlate SignNow, credit companies can maintain their compliance without additional headaches.

-

Can airSlate SignNow help credit companies improve their customer experience?

Absolutely! airSlate SignNow allows credit companies to provide a seamless signing experience for their clients. Customers can sign documents from anywhere, on any device, without the need for printing and scanning, which enhances their overall satisfaction with the credit company's services.

-

What types of documents can credit companies eSign with airSlate SignNow?

Credit companies can eSign a variety of documents using airSlate SignNow, including loan agreements, client contracts, disclosures, and more. The platform supports multiple file formats, allowing credit companies to manage diverse document types efficiently. This versatility helps in maintaining a smooth workflow in document processing.

-

How user-friendly is the airSlate SignNow platform for credit companies?

The airSlate SignNow platform is designed to be intuitive and user-friendly, making it easy for credit companies to navigate. With a straightforward interface, even those with limited technical skills can quickly learn how to send and sign documents. This ease of use minimizes the learning curve and encourages adoption among staff.

Get more for Form 5884 C Rev March

Find out other Form 5884 C Rev March

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast