1601c Form

What is the 1601c Form

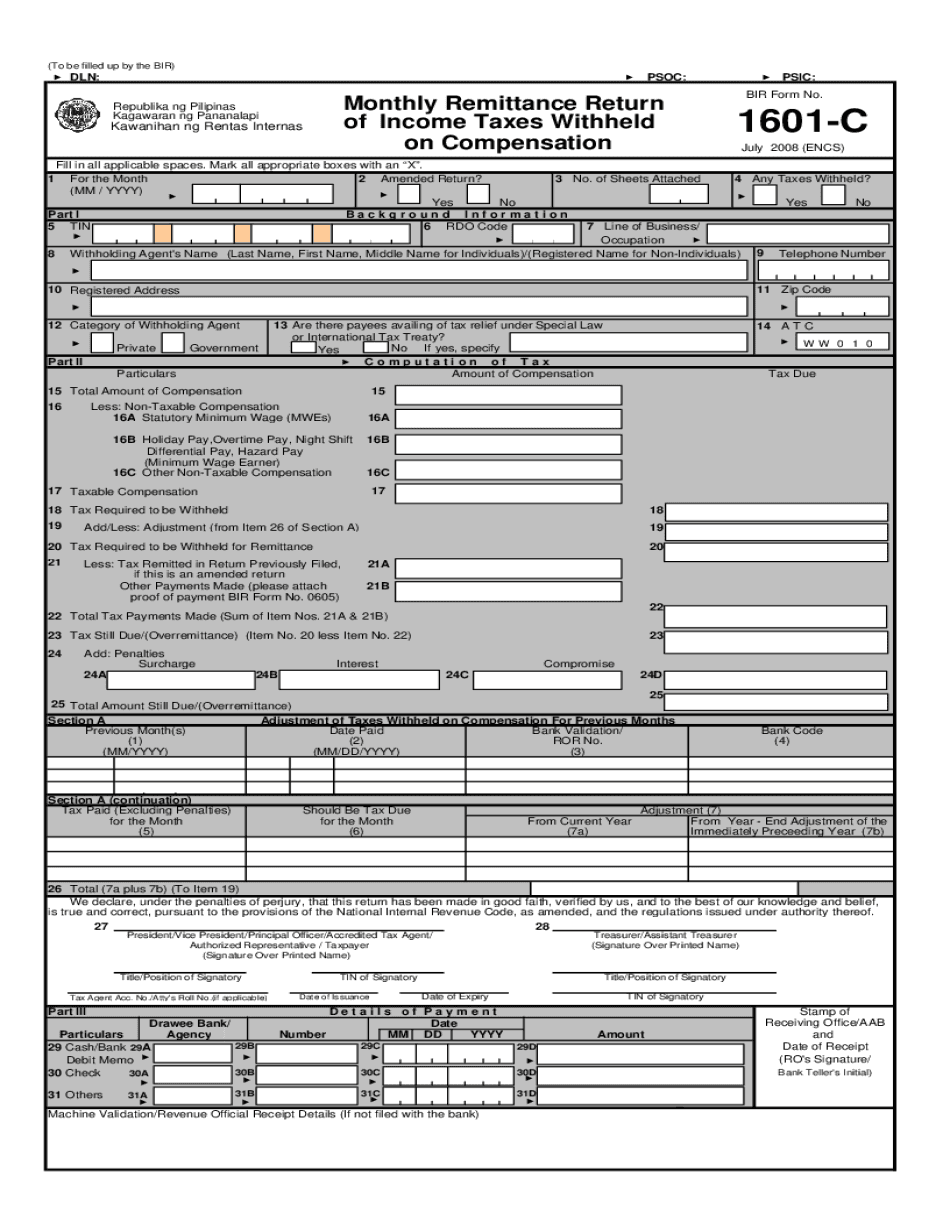

The 1601c form, also known as the BIR Form 1601-C, is a crucial document used by businesses in the Philippines for the declaration and remittance of income taxes withheld from employees and certain payments. This form is part of the Bureau of Internal Revenue's (BIR) compliance requirements, ensuring that businesses accurately report and pay their tax obligations. The 1601c form is specifically designed to capture details about the withholding tax on compensation and other income payments, making it essential for both employers and the BIR.

How to use the 1601c Form

Using the 1601c form involves several steps to ensure accurate reporting and compliance with tax regulations. First, businesses must gather all necessary information regarding employee compensation and other payments subject to withholding tax. This includes details such as employee names, Tax Identification Numbers (TIN), and the amounts withheld. Once the data is collected, the form can be filled out either in a paper format or digitally. After completing the form, it must be submitted to the BIR along with the corresponding payment. Businesses should retain copies of the submitted forms for their records.

Steps to complete the 1601c Form

Completing the 1601c form requires careful attention to detail. Follow these steps for accurate completion:

- Gather all relevant information, including employee compensation details and TINs.

- Download the 1601c form in the desired format, such as Excel or PDF.

- Fill in the required fields, ensuring accuracy in amounts and identification details.

- Review the completed form for any errors or omissions.

- Submit the form to the BIR along with the payment for the withheld taxes.

Legal use of the 1601c Form

The legal use of the 1601c form is essential for compliance with tax regulations in the Philippines. This form serves as an official record of the taxes withheld from employees and other payments, which must be reported to the BIR. Proper completion and submission of the 1601c form help businesses avoid penalties and legal issues related to tax non-compliance. It is crucial for employers to understand the legal implications of this form and ensure that it is filled out correctly and submitted on time.

Key elements of the 1601c Form

The 1601c form contains several key elements that are vital for accurate reporting. These include:

- Taxpayer Information: Details such as the name, address, and TIN of the business.

- Withholding Tax Details: Information about the total amount of compensation and the corresponding tax withheld.

- Payment Information: Sections for indicating the payment method and date.

- Signature: A declaration section where the authorized signatory must sign and date the form.

Form Submission Methods (Online / Mail / In-Person)

The 1601c form can be submitted through various methods, offering flexibility for businesses. These methods include:

- Online Submission: Many businesses opt to submit the form electronically through the BIR's online portal, which can streamline the process.

- Mail: The completed form can be printed and mailed to the appropriate BIR office.

- In-Person Submission: Businesses may also choose to submit the form in person at their local BIR office.

Quick guide on how to complete 1601c form 2019

Complete 1601c Form effortlessly on any device

Digital document management has become favored among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow supplies you with all the tools required to create, edit, and eSign your documents swiftly without interruptions. Handle 1601c Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

Ways to edit and eSign 1601c Form with ease

- Obtain 1601c Form and select Get Form to initiate.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the details and press the Done button to store your modifications.

- Select your preferred delivery method for your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign 1601c Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1601c form 2019

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the 1601c excel format and how is it used?

The 1601c excel format is a specific data structure used for financial reporting and electronic record-keeping. It enables users to manage and present their data efficiently within spreadsheets, making it easier to comply with regulatory standards. Businesses often utilize this format for streamlined processing of financial documents.

-

How does airSlate SignNow support the 1601c excel format?

airSlate SignNow fully supports the 1601c excel format, allowing users to import and export documents seamlessly. This feature enhances the efficiency of handling electronic signatures alongside financial data, ensuring compliance and accuracy in documentation. Users can easily integrate this format into their existing workflows.

-

Are there any costs associated with using the 1601c excel format in airSlate SignNow?

Using the 1601c excel format in airSlate SignNow is included in the subscription plan, with various pricing tiers available to suit different business needs. Whether your team is small or large, there are options that provide access to tools that facilitate the use of the 1601c excel format without hidden fees. Dive into our pricing page to find out more.

-

What features does airSlate SignNow offer for users working with the 1601c excel format?

airSlate SignNow offers several features that enhance the user experience with the 1601c excel format, including customizable templates, robust e-signature capabilities, and tracking tools to monitor document progress. These features ensure that you can manage the e-signing process efficiently while adhering to the standards associated with the 1601c excel format.

-

Can I integrate airSlate SignNow with other applications while using the 1601c excel format?

Yes, airSlate SignNow supports a wide range of integrations that facilitate the use of the 1601c excel format with other applications. This includes popular tools like Google Drive, Salesforce, and various CRM systems, enabling seamless data transfer and collaboration across platforms while adhering to the 1601c excel format.

-

What are the benefits of using airSlate SignNow for documents formatted in 1601c excel?

The benefits of using airSlate SignNow for documents formatted in 1601c excel include improved efficiency, enhanced security for sensitive data, and an easy-to-navigate interface. This helps businesses save time in document processing while ensuring compliance with financial reporting requirements tied to the 1601c excel format.

-

How secure is the 1601c excel format when used in airSlate SignNow?

Security is a top priority for airSlate SignNow when handling documents in the 1601c excel format. Our platform implements robust encryption and complies with industry standards, ensuring that your financial data remains secure throughout the e-signing process. You can trust that your information will be protected while using our services.

Get more for 1601c Form

Find out other 1601c Form

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast