5500 Report Form

What is the 5500 Report

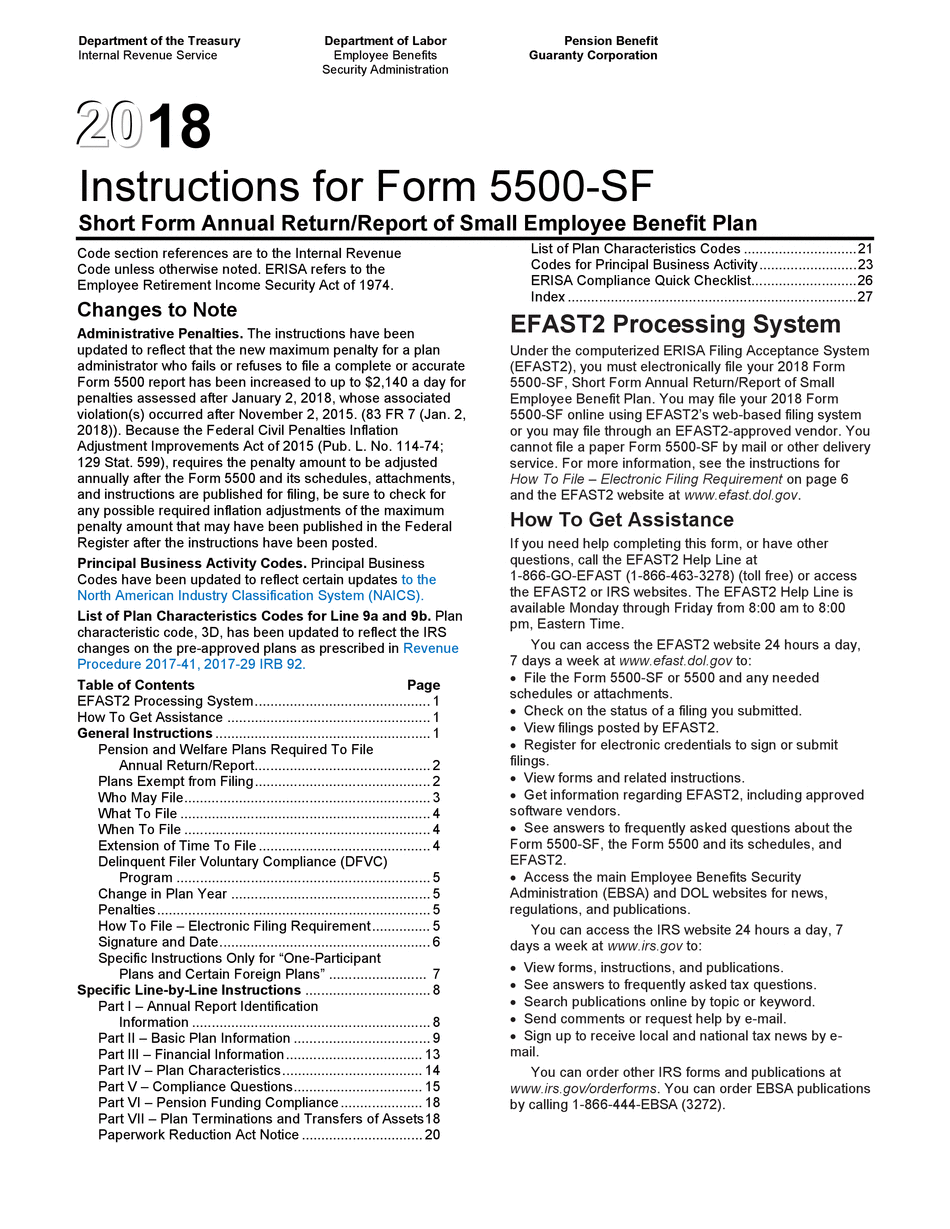

The 5500 Report is a crucial document required by the Employee Retirement Income Security Act (ERISA) for employee benefit plans in the United States. It serves to provide the federal government with information about the financial condition, investments, and operations of these plans. The 2018 form 5500 specifically pertains to the reporting year and includes various schedules that detail the plan's specifics, such as participant counts and financial statements. This report is essential for ensuring compliance with federal regulations and for maintaining transparency regarding employee benefits.

Steps to complete the 5500 Report

Completing the 2018 form 5500 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the employee benefit plan, including financial statements, participant data, and any relevant schedules. Next, fill out the main form, ensuring that each section is completed accurately. It is important to review the IRS guidelines for the 2018 instructions 5500 to ensure all required information is included. After completing the form, verify the data for accuracy before submitting it. Finally, file the form electronically or via mail by the specified deadline to avoid penalties.

Legal use of the 5500 Report

The legal use of the 5500 Report is governed by federal regulations under ERISA and the Internal Revenue Code. This report must be filed annually by plan administrators to comply with reporting requirements. The information provided in the 2018 form 5500 is used by the Department of Labor and the IRS to monitor compliance and assess the financial health of employee benefit plans. Failure to file the report or inaccuracies in the information can result in penalties, making it essential for businesses to ensure that the form is completed and submitted correctly.

Filing Deadlines / Important Dates

For the 2018 form 5500, the filing deadline is typically the last day of the seventh month after the end of the plan year. If the plan year ends on December 31, the deadline would be July 31 of the following year. Plan administrators can apply for a two-and-a-half-month extension by filing Form 5558. It is important to be aware of these deadlines to avoid late filing penalties and ensure compliance with federal regulations.

Required Documents

To complete the 2018 form 5500, several documents are necessary. These include the plan's financial statements, participant count, and any applicable schedules that provide additional details about the plan's operations. It is also important to gather any supporting documentation that may be required for specific schedules, such as Schedule A for insurance information or Schedule C for service provider information. Having these documents ready will streamline the completion process and help ensure accuracy.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the 2018 form 5500 can lead to significant penalties. The Department of Labor imposes fines for late filings, which can accumulate daily until the form is submitted. Additionally, inaccuracies in the report can result in further penalties, including potential legal action. It is crucial for plan administrators to understand these risks and take the necessary steps to ensure timely and accurate filing to avoid financial repercussions.

Digital vs. Paper Version

Filing the 2018 form 5500 can be done electronically or via paper submission. The electronic filing method is encouraged as it is more efficient and allows for easier tracking of submissions. Electronic submissions also reduce the risk of errors and provide immediate confirmation of receipt. While paper submissions are still accepted, they may result in longer processing times and increased chances of delays. Therefore, opting for the digital version is often the preferred choice for compliance.

Quick guide on how to complete 5500 report

Easily Prepare 5500 Report on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the right form and securely save it online. airSlate SignNow provides all the tools you need to quickly create, modify, and eSign your documents without delays. Manage 5500 Report on any device using the airSlate SignNow apps for Android or iOS and improve any document-related process today.

How to Modify and eSign 5500 Report Effortlessly

- Find 5500 Report and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Alter and eSign 5500 Report and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5500 report

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the 2018 Form 5500 and why is it important?

The 2018 Form 5500 is a crucial document for employee benefit plans, providing the Department of Labor with information about plan finances and operations. It's essential for compliance and helps ensure that your business meets federal reporting requirements.

-

How can airSlate SignNow help with the 2018 Form 5500?

airSlate SignNow allows you to easily eSign and send the 2018 Form 5500 securely. Our platform simplifies the signing process, ensuring that you can complete and file this important document efficiently and without hassle.

-

What features does airSlate SignNow offer for managing the 2018 Form 5500?

With airSlate SignNow, you get features like template creation, document tracking, and customizable eSignature workflows to streamline the 2018 Form 5500 process. These features reduce paperwork and save time, enhancing your overall productivity.

-

Is airSlate SignNow affordable for small businesses needing to file the 2018 Form 5500?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for businesses of all sizes, including small businesses needing to file the 2018 Form 5500. Our pricing structure ensures that you can access essential features without breaking the bank.

-

Can I integrate airSlate SignNow with other software for the 2018 Form 5500?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, allowing you to easily manage the 2018 Form 5500 alongside your existing business tools. This integration helps you maintain consistency and efficiency in your document management process.

-

What are the benefits of using airSlate SignNow for the 2018 Form 5500?

Using airSlate SignNow for the 2018 Form 5500 simplifies the signing process, reduces errors, and enhances compliance. The platform’s user-friendly interface and robust security measures ensure that your sensitive information is protected during the signing process.

-

How does airSlate SignNow ensure the security of the 2018 Form 5500?

airSlate SignNow prioritizes document security by utilizing advanced encryption technologies and secure cloud storage. This commitment ensures that your 2018 Form 5500 and other sensitive documents are protected from unauthorized access.

Get more for 5500 Report

- Form n 11 rev

- In home pet sitting release of liability form

- Da form 4651 instructions

- Dichiarazione sostitutiva cud certificazione infospibs form

- Drinking water test report pdf form

- Vaccine inventory sheet form

- Prescription medication chesterfield county public schools form

- Three day notice to perform covenant or quit

Find out other 5500 Report

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed