Instructions for Form CR a Nyc Gov

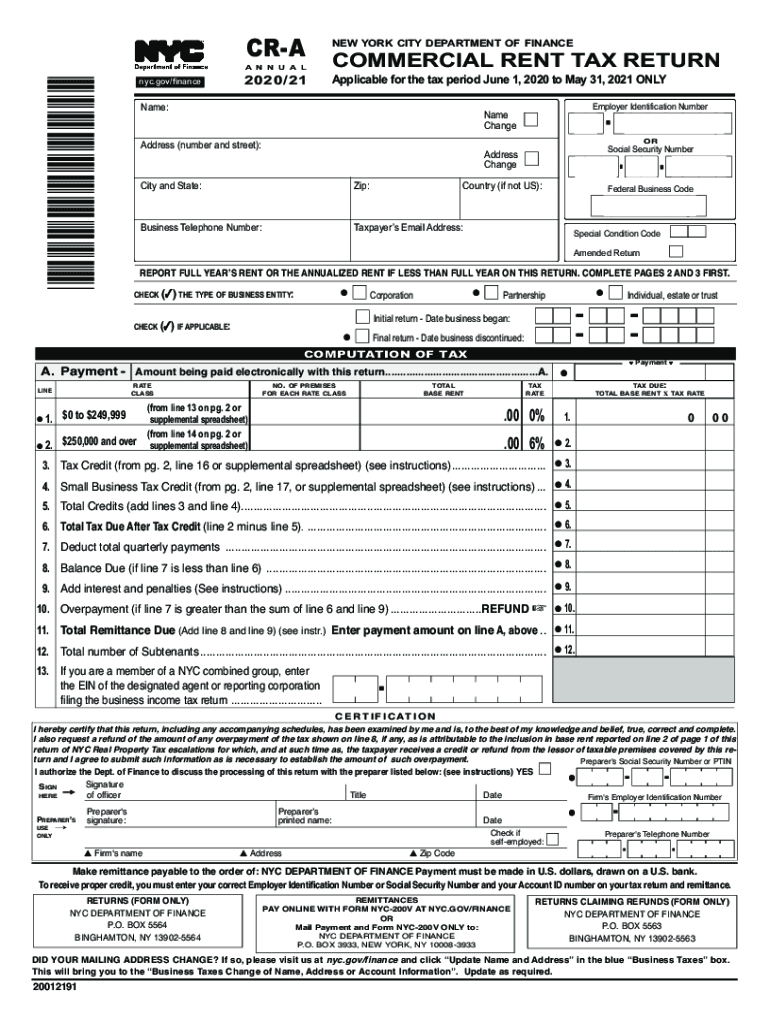

What is the Instructions for Form CR A?

The Instructions for Form CR A provide detailed guidance for businesses in New York City regarding the commercial rent tax. This form is essential for landlords and property owners who meet specific criteria related to their rental income. Understanding these instructions ensures compliance with local tax laws and helps avoid potential penalties. The form outlines eligibility requirements, filing procedures, and important deadlines that must be adhered to for successful submission.

Steps to Complete the Instructions for Form CR A

Completing the Instructions for Form CR A involves several key steps:

- Review the eligibility criteria to confirm that your business is subject to the commercial rent tax.

- Gather necessary documentation, including rental agreements and financial records.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check calculations related to rental income to ensure accuracy.

- Submit the completed form by the designated deadline to avoid penalties.

Legal Use of the Instructions for Form CR A

The Instructions for Form CR A are legally binding and must be followed to ensure compliance with New York City tax regulations. Proper use of the form protects businesses from legal repercussions and ensures that all tax obligations are met. The instructions clarify what constitutes taxable rent and provide guidance on exemptions, making them vital for landlords and property owners.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for compliance with the commercial rent tax. The Instructions for Form CR A specify key dates, including:

- The annual filing deadline for the commercial rent tax return.

- Quarterly payment due dates for businesses that are required to make estimated payments.

- Any extensions available for filing, if applicable.

Required Documents

To complete the Instructions for Form CR A, several documents are necessary. These include:

- Rental agreements that outline the terms of lease.

- Financial statements detailing rental income.

- Any previous tax returns related to commercial rent.

Having these documents ready simplifies the completion process and ensures accurate reporting of rental income.

Penalties for Non-Compliance

Failure to comply with the Instructions for Form CR A can result in significant penalties. These may include:

- Fines for late submissions or incorrect filings.

- Interest on unpaid taxes, which can accumulate over time.

- Potential legal action for persistent non-compliance.

Understanding these consequences emphasizes the importance of adhering to the instructions and filing requirements.

Quick guide on how to complete instructions for form cr a nycgov

Manage Instructions For Form CR A Nyc gov seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily locate the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Instructions For Form CR A Nyc gov on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Instructions For Form CR A Nyc gov effortlessly

- Find Instructions For Form CR A Nyc gov and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or hide sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Instructions For Form CR A Nyc gov to ensure exceptional communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form cr a nycgov

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is airSlate SignNow and how does it facilitate cr a?

airSlate SignNow is an electronic signature solution that empowers businesses to securely cr a documents with ease. It allows you to send, sign, and manage documents digitally, making the process faster and more efficient. With a user-friendly interface, cr a has never been easier for teams of all sizes.

-

How much does airSlate SignNow cost for cr a services?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Our pricing is competitive and considers the volume of cr a documents you process. You can select from monthly or annual plans, ensuring you only pay for the features you need.

-

What features does airSlate SignNow offer for cr a?

The platform includes robust features for cr a like customizable templates, document sharing, and real-time tracking. You can easily integrate advanced workflows that help streamline your cr a processes. This ensures that managing and signing documents are both efficient and secure.

-

Is airSlate SignNow secure for cr a transactions?

Yes, airSlate SignNow prioritizes security for all cr a transactions. Our platform employs industry-standard encryption and complies with legal regulations to ensure that your documents are safe and secure. You can confidently manage sensitive information without compromising on security.

-

Can I integrate airSlate SignNow with other tools for cr a?

Absolutely! airSlate SignNow offers seamless integrations with popular tools like Google Drive, Salesforce, and more, enhancing your cr a capabilities. This allows you to maintain a streamlined workflow, making it easier to manage your documents alongside other essential business applications.

-

What are the benefits of using airSlate SignNow for cr a?

Using airSlate SignNow for cr a offers numerous benefits such as reduced turnaround time and cost savings on paper and postage. The automated processes enhance productivity while providing a traceable audit trail for compliance. Ultimately, it helps your business adapt to modern, digital workflows efficiently.

-

How does airSlate SignNow handle customer support for cr a?

airSlate SignNow provides comprehensive customer support to assist with any cr a inquiries. Our support team is available via chat, email, or phone, ensuring you receive timely assistance. We also offer extensive documentation and resources to help you maximize your use of our platform.

Get more for Instructions For Form CR A Nyc gov

- Direct2hr payroll form

- Ohio behavioral health discharge form

- Contract for purchase of an unproven male alpaca installment sale form

- Idx consent form

- Blank writing paper online form

- Crystal ball words form

- Property management supplemental bapplicationb kinsale insurance form

- Download form mercy health

Find out other Instructions For Form CR A Nyc gov

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free