Cp55d 2011-2026

What is the Cp55d

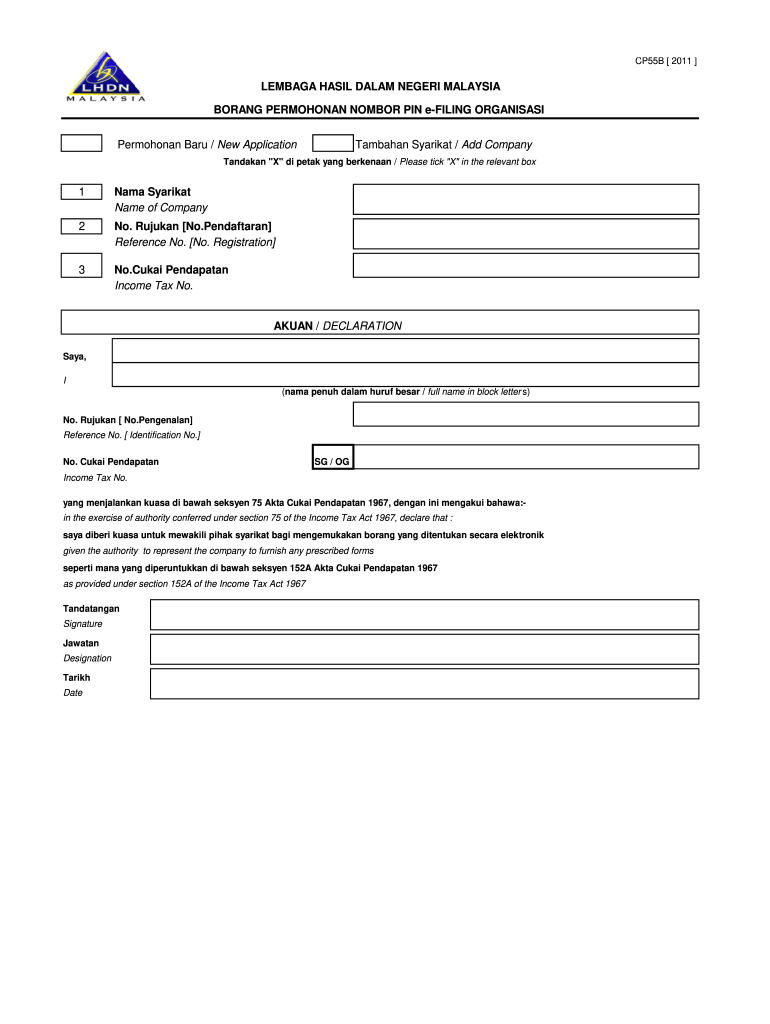

The Cp55d is a form used by individuals in the United States to apply for a Personal Identification Number (PIN) for e-filing their tax returns. This form is essential for taxpayers who wish to securely file their taxes electronically, ensuring that their submissions are processed efficiently. The Cp55d is particularly relevant for those who may not have previously filed electronically or who are transitioning from paper filing to e-filing.

How to use the Cp55d

Using the Cp55d involves several straightforward steps. First, download the form from a reliable source. After obtaining the form, fill in the required personal information, including your name, address, and Social Security number. Once completed, submit the form according to the instructions provided. It is crucial to ensure that all information is accurate to avoid delays in obtaining your PIN.

Steps to complete the Cp55d

Completing the Cp55d requires careful attention to detail. Follow these steps:

- Download the Cp55d form from a trusted source.

- Provide your personal information accurately, including your full name and Social Security number.

- Indicate your preferred method for receiving your PIN, whether by mail or electronically.

- Review the form for any errors or omissions before submission.

- Submit the completed form as directed, either online or by mail.

Legal use of the Cp55d

The Cp55d is legally recognized as a valid method for obtaining a PIN for e-filing in the United States. It complies with federal regulations regarding electronic filing and identity verification. By using this form, taxpayers can ensure that their electronic submissions are secure and legitimate, aligning with IRS guidelines for e-filing.

Required Documents

When filling out the Cp55d, certain documents may be necessary to support your application. Typically, you will need:

- A valid Social Security number or Individual Taxpayer Identification Number (ITIN).

- Proof of identity, which may include a driver's license or passport.

- Any previous tax returns if applicable, to verify your filing history.

Form Submission Methods

The Cp55d can be submitted through various methods, depending on your preference. You can choose to file it online through the IRS e-filing system or send it via traditional mail. Ensure that you follow the submission guidelines provided with the form to select the appropriate method for your situation.

Quick guide on how to complete cp55d

Prepare Cp55d effortlessly on any device

Managing documents online has gained popularity among both businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and safely store it in the cloud. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Handle Cp55d on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Cp55d with ease

- Find Cp55d and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Modify and eSign Cp55d to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cp55d

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is form CP55D and why do I need to fill it out?

Form CP55D is used for specific tax-related purposes, such as requesting an extension of time to file your taxes. Understanding how to fill form CP55D correctly is crucial, as errors can lead to delays in processing your request. airSlate SignNow offers a user-friendly interface that simplifies this process.

-

How can airSlate SignNow assist me in filling out form CP55D?

airSlate SignNow provides tools that streamline the process of filling out form CP55D. With our intuitive platform, you can easily complete, sign, and send the document securely to the appropriate tax authority. We're here to ensure you understand how to fill form CP55D without any hassle.

-

Is there a cost associated with using airSlate SignNow to fill form CP55D?

Yes, airSlate SignNow offers various pricing plans based on your needs. However, our service is designed to be cost-effective, providing great value for businesses looking to efficiently manage documents like form CP55D. Learn how to fill form CP55D while keeping your budget in check.

-

What are the key features of airSlate SignNow for form CP55D?

AirSlate SignNow includes features such as eSignature, templates, and cloud storage, all of which make it easier to manage form CP55D. You can save time with easy reusability of previously filled forms and automate workflows. By focusing on how to fill form CP55D, we ensure that you comply with all necessary requirements.

-

Can I integrate airSlate SignNow with other applications while filling form CP55D?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to fill form CP55D in coordination with your other business tools. This integration enhances productivity and ensures that you can access your documents wherever you need to. Discover how to fill form CP55D efficiently using our platform.

-

What benefits does airSlate SignNow offer for businesses filling out form CP55D?

By using airSlate SignNow to fill form CP55D, businesses benefit from enhanced security, faster processing times, and a reliable platform. Our cost-effective solution eliminates the need for physical paperwork, thereby simplifying record-keeping. Learn how to fill form CP55D and reap these benefits easily.

-

Is airSlate SignNow user-friendly for those unfamiliar with form CP55D?

Yes, airSlate SignNow is designed with users in mind, making it straightforward for anyone to learn how to fill form CP55D. The platform offers guided steps and easy navigation features to assist even those who aren't tech-savvy. You’ll find it simple and intuitive to manage your forms.

Get more for Cp55d

- Combined insurance claim form 400641r

- How do i write a deregistration letter to a company form

- Kutcher adolescent depression scale form

- Locus score sheet pdf form

- Fillable 1380 army form

- Tucson police department records request form

- Maryland police and correctional training commissions form

- Colorado post firearms qualification form

Find out other Cp55d

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile