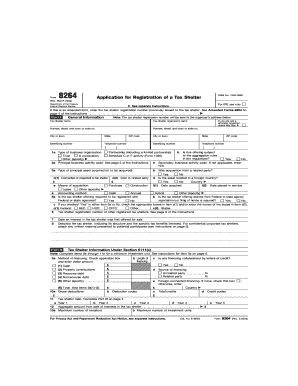

Form 8264 Rev March Fill in Capable Application for Registration of a Tax Shelter

Understanding the Form 5129

The Form 5129 is an essential document used in the registration process for tax shelters. This form is designed to collect necessary information about the tax shelter and its participants, ensuring compliance with IRS regulations. It serves as a formal application that must be completed accurately to avoid penalties and ensure legal standing. The form includes sections that require detailed information about the shelter's structure, the parties involved, and the financial aspects of the tax shelter.

Steps to Complete the Form 5129

Completing the Form 5129 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the tax shelter, including financial statements and participant details. Next, fill out each section of the form carefully, providing clear and concise information. It is crucial to review the form for any errors or omissions before submission. Lastly, ensure that all required signatures are obtained to validate the form, as incomplete forms may lead to delays or rejections.

Legal Use of the Form 5129

The legal use of the Form 5129 hinges on its compliance with IRS regulations. When properly completed and submitted, the form serves as a binding document that registers the tax shelter with the IRS. It is vital to adhere to all guidelines outlined by the IRS to maintain the legal standing of the tax shelter. Failure to comply with these regulations can result in significant penalties, including fines and disqualification of the tax shelter status.

Filing Deadlines for Form 5129

Timely filing of the Form 5129 is critical to avoid penalties. The IRS sets specific deadlines for submission, which typically align with the tax year in which the shelter is established. It is important to stay informed about these deadlines, as late submissions can lead to complications, including additional scrutiny from the IRS. Marking your calendar with these dates can help ensure that you meet all necessary requirements in a timely manner.

Required Documents for Form 5129

When preparing to submit the Form 5129, certain documents are required to support the application. These may include financial statements, identification of all parties involved in the tax shelter, and any previous correspondence with the IRS regarding the shelter. Having these documents ready can facilitate a smoother application process and help ensure that all necessary information is provided to the IRS.

Penalties for Non-Compliance with Form 5129

Non-compliance with the requirements associated with the Form 5129 can lead to serious consequences. Penalties may include financial fines, disqualification of the tax shelter, and potential legal action. Understanding these risks emphasizes the importance of accurate and timely submission of the form. It is advisable to consult with a tax professional if there are any uncertainties regarding compliance.

Quick guide on how to complete form 8264 rev march 2004 fill in capable application for registration of a tax shelter

Easily Prepare Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the features required to design, edit, and electronically sign your documents promptly without any hassles. Handle Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter on various platforms with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter Effortlessly

- Obtain Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter and select Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools available from airSlate SignNow designed for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter while ensuring outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

If a foreign citizen lives in the US on a working visa for more than a year, then what is his status? What tax form will such a person fill out when filing for taxes at the end of the tax year? Is the 1040NR the form to fill out?

In most situations, a person who is physically present in the United States for at least 183 days out of any calendar year is a US resident for tax purposes and must file Form 1040 as a tax resident. There are exceptions to this general rule, but none of them apply to people who are present in the United States in H-1B (guest worker) status. Furthermore, H-1B workers are categorically resident aliens for tax purposes and must pay taxes on the income they earn while in H-1B status as a resident alien in every year in which they earn more than the personal exemption limit. This includes both the first year and last year, even if the first or last year contains less than 183 days of residence in the United States. The short years may result in a filing as a “dual-status” alien.An H-1B worker will therefore only file Form 1040NR as his or her primary tax return in the tax year in which he or she leaves the United States permanently, and all US-connected income during that year will be taxed as if the taxpayer was a US resident, under the dual-status rules. All other tax returns during that person’s residence in the United States will be on Form 1040. The first year’s return may be under dual-status rules, with a Form 1040NR attached as a “dual status statement” as per the procedure in Chapter 6 of Publication 519 (2016), U.S. Tax Guide for Aliens. A person who resides the entire year in the United States in H-1B status may not use Form 1040NR, and is required to pay US income tax on his or her worldwide income, excepting only that income which is subject to protection under a tax treaty.See Publication 519 (2016), U.S. Tax Guide for Aliens for more information. The use of a tax professional, especially in the first and last year of H-1B status, is highly recommended as completing a dual-status return correctly is exceedingly challenging.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I fill the application form for the post of deputy manager that requires a BE degree for Aavin Recruitment 2018, when there is no option to fill BE in the education qualification section?

If you find there is no drop down menu name for the BE ( mechanical) then select the closet graduate Enineer one and complete the form quickly as your deadline is approaching fast .As an additional safety you can write application on paper too mentioning all details as per online option and send it by speed post. Remember this is additional safety excercise of not missing the opportunity.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the form 8264 rev march 2004 fill in capable application for registration of a tax shelter

How to make an electronic signature for the Form 8264 Rev March 2004 Fill In Capable Application For Registration Of A Tax Shelter in the online mode

How to create an eSignature for your Form 8264 Rev March 2004 Fill In Capable Application For Registration Of A Tax Shelter in Chrome

How to generate an eSignature for putting it on the Form 8264 Rev March 2004 Fill In Capable Application For Registration Of A Tax Shelter in Gmail

How to make an eSignature for the Form 8264 Rev March 2004 Fill In Capable Application For Registration Of A Tax Shelter from your mobile device

How to create an electronic signature for the Form 8264 Rev March 2004 Fill In Capable Application For Registration Of A Tax Shelter on iOS devices

How to create an electronic signature for the Form 8264 Rev March 2004 Fill In Capable Application For Registration Of A Tax Shelter on Android OS

People also ask

-

What is the Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter?

The Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter is a specific IRS form that allows taxpayers to register a tax shelter. This form is crucial for compliance and helps ensure that all tax benefits are appropriately claimed. Using airSlate SignNow, you can easily fill in, sign, and submit this form electronically, streamlining the registration process.

-

How can airSlate SignNow help with the Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter?

airSlate SignNow provides an intuitive platform for completing the Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter. Our eSignature solution allows you to fill out the form accurately and securely, ensuring that all necessary information is submitted without delays. This enhances your efficiency in tax compliance.

-

Is there a cost associated with using airSlate SignNow for the Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. Our plans are designed to be cost-effective, allowing you to manage the Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter and other documents without breaking the bank. You can choose a plan that best suits your volume of usage.

-

What features does airSlate SignNow offer for handling the Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter?

airSlate SignNow includes features like customizable templates, secure eSigning, and real-time document tracking, all essential for managing the Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter. These features ensure a smooth workflow, allowing you to complete your application efficiently and securely.

-

Can I integrate airSlate SignNow with other tools to manage the Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. This integration allows you to easily access and manage the Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter alongside your other documents, enhancing your productivity.

-

What security measures does airSlate SignNow provide for the Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter?

Security is a top priority at airSlate SignNow. We provide bank-level encryption and secure cloud storage for the Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter, ensuring that your sensitive information is protected. Our platform complies with industry standards to keep your data safe.

-

How do I get started with airSlate SignNow for the Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter?

Getting started with airSlate SignNow is simple! Just sign up for an account, and you can begin filling out the Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter right away. Our user-friendly interface guides you through the process, making it easy to manage your tax shelter registration.

Get more for Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter

Find out other Form 8264 Rev March Fill In Capable Application For Registration Of A Tax Shelter

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter