Form 8717 Rev June Fill in Capable User Fee for Employee Plan Determination, Opinion, and Advisory Letter Request

What is the Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request

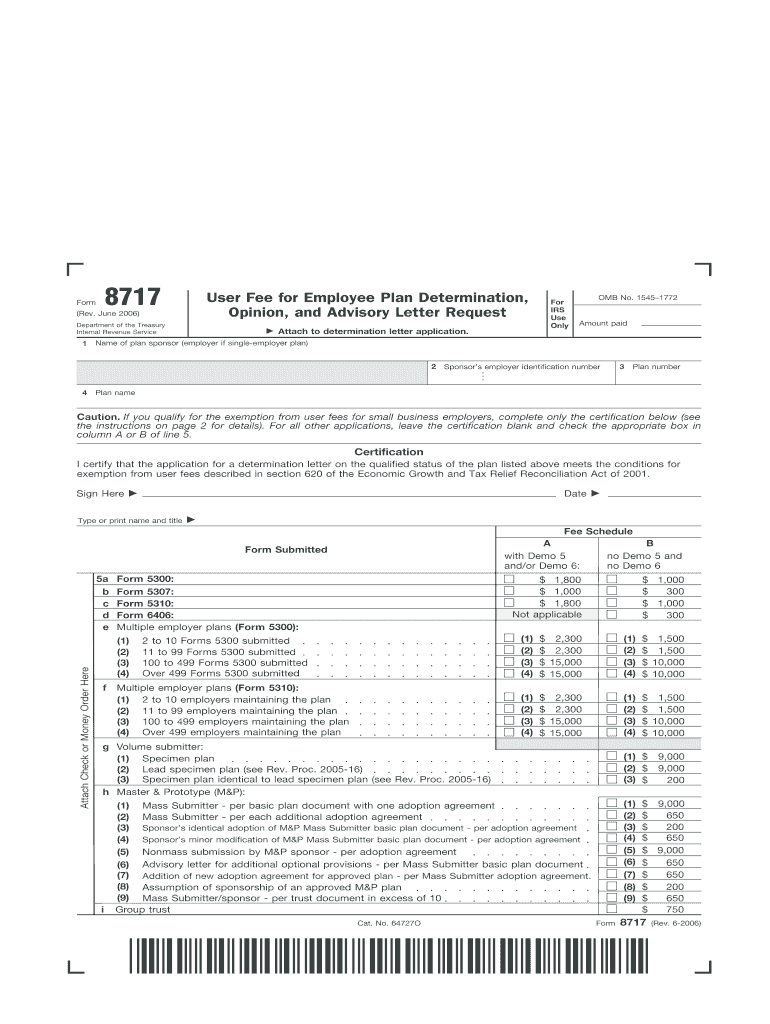

The Form 8717 is an official document used by businesses and organizations to request a determination letter from the IRS regarding the qualification of their employee benefit plans. This form is essential for those seeking an opinion or advisory letter concerning their plans' compliance with federal regulations. The user fee associated with this request helps cover the costs incurred by the IRS in reviewing and processing these requests. Understanding the purpose and implications of this form is crucial for organizations aiming to ensure their employee plans meet the necessary legal standards.

Steps to Complete the Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request

Completing the Form 8717 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your employee benefit plan, including plan details and the specific user fee required. Next, fill out the form by providing the requested information, which typically includes the plan name, employer identification number (EIN), and contact details. It is important to double-check all entries for accuracy before submission. Finally, submit the completed form along with the appropriate user fee to the IRS, either online or by mail, as per the current guidelines.

Legal Use of the Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request

The legal use of the Form 8717 is governed by IRS regulations that outline the requirements for obtaining a determination letter. This form must be completed accurately and submitted in accordance with the established guidelines to ensure its validity. The determination letter issued by the IRS serves as a legal confirmation that the employee benefit plan complies with applicable tax laws. Organizations should be aware that improper use or failure to comply with submission requirements can lead to penalties or denial of the request.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Form 8717. These guidelines outline the eligibility criteria for requesting a determination letter, the required user fee, and the necessary documentation to accompany the form. It is essential for organizations to familiarize themselves with these guidelines to ensure compliance and avoid potential issues during the review process. Adhering to IRS instructions not only facilitates a smoother submission but also increases the likelihood of receiving a favorable determination.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8717 are critical to ensure timely processing of requests. Organizations should be aware of any specific dates outlined by the IRS for submitting the form, particularly if they are seeking a determination letter for a specific plan year. Missing these deadlines can result in delays or complications in receiving the necessary approvals. It is advisable to keep track of any updates from the IRS regarding deadlines to maintain compliance and ensure that submissions are made on time.

Required Documents

When submitting the Form 8717, certain documents may be required to support the request for a determination letter. These documents typically include a copy of the plan document, any amendments, and a detailed description of the plan's operation. Additionally, organizations may need to provide financial statements or other relevant information that demonstrates compliance with IRS regulations. Ensuring that all required documents are included with the form is essential for a successful submission and timely processing.

Quick guide on how to complete form 8717 rev june 2006 fill in capable user fee for employee plan determination opinion and advisory letter request

Effortlessly prepare Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Steps to modify and electronically sign Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request effortlessly

- Find Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or redact sensitive information with the tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes only a few seconds and carries the same legal authority as a conventional ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method of submitting the form: via email, text (SMS), or shareable link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request to ensure exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8717 rev june 2006 fill in capable user fee for employee plan determination opinion and advisory letter request

How to make an electronic signature for the Form 8717 Rev June 2006 Fill In Capable User Fee For Employee Plan Determination Opinion And Advisory Letter Request online

How to generate an electronic signature for your Form 8717 Rev June 2006 Fill In Capable User Fee For Employee Plan Determination Opinion And Advisory Letter Request in Google Chrome

How to generate an electronic signature for signing the Form 8717 Rev June 2006 Fill In Capable User Fee For Employee Plan Determination Opinion And Advisory Letter Request in Gmail

How to generate an eSignature for the Form 8717 Rev June 2006 Fill In Capable User Fee For Employee Plan Determination Opinion And Advisory Letter Request from your smart phone

How to generate an electronic signature for the Form 8717 Rev June 2006 Fill In Capable User Fee For Employee Plan Determination Opinion And Advisory Letter Request on iOS devices

How to create an electronic signature for the Form 8717 Rev June 2006 Fill In Capable User Fee For Employee Plan Determination Opinion And Advisory Letter Request on Android OS

People also ask

-

What is the Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request?

The Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request is a document used by businesses to request a determination, opinion, or advisory letter regarding their employee benefit plans. This form is essential for ensuring compliance with IRS regulations and obtaining the necessary approvals for plan amendments and qualifications.

-

How can airSlate SignNow help with the Form 8717 Rev June Fill In Capable User Fee?

AirSlate SignNow streamlines the process of completing and submitting the Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request by providing an easy-to-use platform for electronic signatures and document management. This allows businesses to efficiently prepare and send their forms without the hassle of paper documents.

-

What features does airSlate SignNow offer for managing the Form 8717?

AirSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning that facilitate the completion of the Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request. These features enhance productivity by reducing time spent on paperwork and improving accuracy.

-

Is there a cost associated with using airSlate SignNow for the Form 8717?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, making it a cost-effective solution for managing the Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request. Plans vary based on features, number of users, and document volume, ensuring you find one that fits your budget.

-

Can I integrate airSlate SignNow with other applications for processing the Form 8717?

Absolutely! AirSlate SignNow provides seamless integrations with various applications, such as Google Drive, Salesforce, and Dropbox, which can help you manage the Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request more efficiently. This allows you to keep all your documents and data in one place.

-

What are the benefits of using airSlate SignNow for the Form 8717 process?

Using airSlate SignNow for the Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request offers numerous benefits, including faster processing times, reduced paperwork, and enhanced compliance tracking. The platform's user-friendly interface makes it accessible for all employees, ensuring a smooth and efficient workflow.

-

How secure is airSlate SignNow when handling the Form 8717?

AirSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request

- School teacher information form

- Next of kin form 25211804

- Axa employee benefits group form

- Medical social worker skills checklist continuum rehabilitation form

- Riverside community college transcript form

- Fun depot application form

- Hp employment acceptance form hewlett packard

- Application for employment waco hippodrome theatre form

Find out other Form 8717 Rev June Fill In Capable User Fee For Employee Plan Determination, Opinion, And Advisory Letter Request

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF