Form 8839 PDF Filler

What is the Form 8839 Qualified Adoption Expenses?

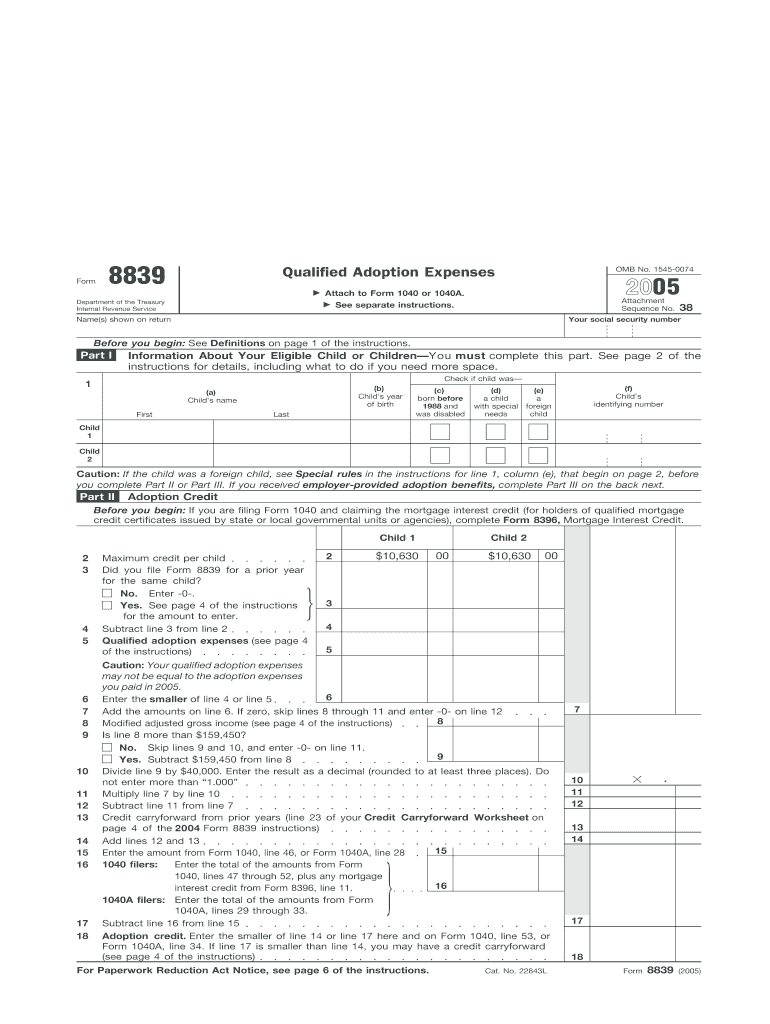

The Form 8839 is a tax form used by adoptive parents to claim a tax credit for qualified adoption expenses. This form is essential for those who have incurred expenses related to the adoption of a child, including legal fees, adoption agency fees, and other related costs. By filing this form, taxpayers can potentially reduce their tax liability, making the adoption process more financially accessible.

Steps to Complete the Form 8839

Completing the Form 8839 involves several steps to ensure accuracy and compliance with IRS guidelines. First, gather all necessary documentation related to your adoption expenses. This may include receipts, invoices, and any legal documentation associated with the adoption process. Next, fill out the form by providing your personal information, details about the adopted child, and a breakdown of qualified expenses. Finally, review the form for any errors and submit it with your tax return to the IRS.

IRS Guidelines for Form 8839

The IRS provides specific guidelines for using Form 8839, which include eligibility criteria and instructions for calculating the credit. It is important to ensure that the adoption meets the IRS definition of a qualified adoption. Additionally, the form must be filed in conjunction with your tax return, and any supporting documentation should be attached to substantiate the claimed expenses. Familiarizing yourself with these guidelines can help streamline the filing process and maximize your potential credit.

Eligibility Criteria for Claiming Adoption Expenses

To qualify for the tax credit on Form 8839, certain eligibility criteria must be met. The adoption must be finalized and the child must be under the age of eighteen at the time of adoption. Additionally, the expenses must be incurred after the adoption process has begun, and they should be directly related to the legal adoption of the child. Understanding these criteria is crucial for ensuring that you can successfully claim the credit.

Required Documents for Form 8839

When filing Form 8839, specific documents are required to substantiate your claim for qualified adoption expenses. This includes receipts for all expenses claimed, legal documents proving the adoption, and any correspondence with adoption agencies. Keeping organized records will help facilitate the filing process and provide evidence if the IRS requests further information regarding your claim.

Form Submission Methods

Form 8839 can be submitted in various ways, depending on your preference and circumstances. You can file it electronically along with your tax return using compatible tax software. Alternatively, you may choose to print the completed form and mail it to the IRS. Ensure that you follow the correct submission method to avoid delays or complications with your tax filing.

Filing Deadlines for Form 8839

It is important to be aware of the filing deadlines associated with Form 8839. Typically, this form must be submitted along with your annual tax return, which is due on April fifteenth. If you need additional time, you may file for an extension, but be sure to check the IRS guidelines for any specific requirements related to the adoption tax credit. Meeting these deadlines is essential to ensure you receive any potential tax benefits.

Quick guide on how to complete 2005 form 8839 pdf filler

Complete Form 8839 Pdf Filler with ease on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without any hold-ups. Handle Form 8839 Pdf Filler on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

Steps to modify and eSign Form 8839 Pdf Filler effortlessly

- Find Form 8839 Pdf Filler and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Mark important portions of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form—via email, SMS, invitation link, or download it to your computer.

Eliminate worries about missing or lost documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from the device of your preference. Alter and eSign Form 8839 Pdf Filler while ensuring excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

How can I electronically fill out a PDF form?

You’ll need a PDF editor to fill out forms. I recommend you PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

-

How do you fill out a form scanned as a PDF?

If you have Acrobat Reader or Foxit Phantom, you can add form to the PDF file you want to fill in. Refer to the screenshot here (Phantom). First click on Form, then you can pick option you want for your form (Text Field, Check box…) and draw it where you want to input your data. You can also change font and size of it to fit the existing text. When you are done adding the fields, you can just click on the hand icon, and you can now fill in your form and then save it as.

-

What is the best way to fill out a PDF form?

If you are a user of Mac, iPhone or iPad, your tasks will be quickly and easily solved with the help of PDF Expert. Thanks to a simple and intuitive design, you don't have to dig into settings and endless options. PDF Expert also allows you to view, edit, reduce, merge, extract, annotate important parts of documents in a click. You have a special opportunity to try it on your Mac for free!

-

Is it possible to display a PDF form on mobile web to fill out and get e-signed?

Of course, you can try a web called eSign+. This site let you upload PDF documents and do some edition eg. drag signature fields, add date and some informations. Then you can send to those, from whom you wanna get signatures.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

Is there a software or online service to fill out immigration PDF forms automatically from a web form?

If you are looking to fill out form without downloading the form and without any apps installed, then please try PDF.co ! It is capable of filling out any web form using just a link to a source fillable form:

-

What service can I use to have a website visitor fill out a form, put the data in the form into a prewritten PDF, then charge the visitor to download the PDF with the data provided filled in?

You can use signNow to set up PDF templates, which can be filled out with an online form. signNow doesn’t support charging people to download the PDF, but you could use Stripe for this (would require some programming.)

Create this form in 5 minutes!

How to create an eSignature for the 2005 form 8839 pdf filler

How to make an eSignature for the 2005 Form 8839 Pdf Filler in the online mode

How to generate an eSignature for your 2005 Form 8839 Pdf Filler in Chrome

How to create an eSignature for putting it on the 2005 Form 8839 Pdf Filler in Gmail

How to generate an eSignature for the 2005 Form 8839 Pdf Filler from your smartphone

How to generate an electronic signature for the 2005 Form 8839 Pdf Filler on iOS

How to create an eSignature for the 2005 Form 8839 Pdf Filler on Android devices

People also ask

-

What is the Form 8839 Pdf Filler and how does it work?

The Form 8839 Pdf Filler is an online tool provided by airSlate SignNow that allows users to easily fill out and eSign IRS Form 8839. With a user-friendly interface, you can quickly enter the required information and submit the form electronically, streamlining the process of tax filing.

-

Is the Form 8839 Pdf Filler free to use?

airSlate SignNow offers a variety of pricing plans, including a free trial for new users to test the Form 8839 Pdf Filler. After the trial, you can choose from affordable subscription options that provide full access to all features, including the Form 8839 Pdf Filler.

-

What features does the Form 8839 Pdf Filler offer?

The Form 8839 Pdf Filler includes features such as easy document editing, electronic signatures, and secure cloud storage. Additionally, it supports collaboration, allowing multiple users to fill out and sign the form simultaneously, making tax preparation more efficient.

-

Can I store my completed Form 8839 securely?

Yes, airSlate SignNow ensures that your completed Form 8839 is stored securely in the cloud. Our platform uses advanced encryption methods to keep your sensitive information safe while allowing you easy access to your documents whenever you need them.

-

Does the Form 8839 Pdf Filler integrate with other software?

Absolutely! The Form 8839 Pdf Filler integrates seamlessly with various applications such as Google Drive, Dropbox, and Microsoft Office. This allows you to easily import and export documents, making it a versatile tool for your tax preparation needs.

-

Is the Form 8839 Pdf Filler compliant with IRS regulations?

Yes, the Form 8839 Pdf Filler is fully compliant with IRS regulations, ensuring that your filled forms meet all necessary guidelines. By using airSlate SignNow, you can trust that your submissions will be accurate and accepted by the IRS.

-

How can I get support if I have issues with the Form 8839 Pdf Filler?

If you encounter any issues with the Form 8839 Pdf Filler, airSlate SignNow provides comprehensive customer support. You can access our help center, chat with support agents, or refer to our detailed documentation for assistance.

Get more for Form 8839 Pdf Filler

- Safeway companies employee association friends helping form

- Cuny employment application part 1 form

- W2request decisionhr com form

- Work related violence research project us department of form

- Employee self form

- Application for safety sensitive positions city of abilene texas form

- Nevada state funded sierra regional center src form

- Employee change form

Find out other Form 8839 Pdf Filler

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF