Form 1040

What is the Form 1040

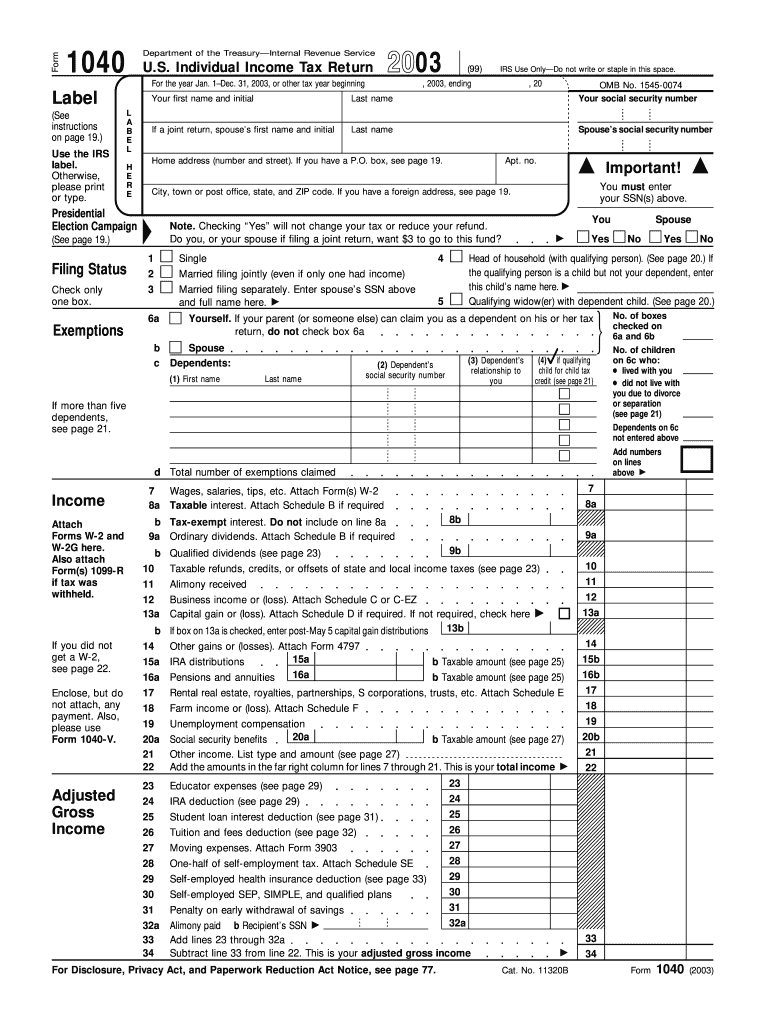

The Form 1040 is the standard federal income tax form used by individuals in the United States to report their annual income to the Internal Revenue Service (IRS). This form allows taxpayers to calculate their taxable income and determine their tax liability or refund. The 2003 Form 1040 specifically corresponds to the tax year 2003 and includes various sections for reporting income, deductions, and credits. It is essential for individuals to accurately complete this form to comply with federal tax regulations.

Steps to complete the Form 1040

Completing the 2003 Form 1040 involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and records of other income.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Use the appropriate lines to report wages, interest, dividends, and any other sources of income.

- Claim deductions: Identify and enter any deductions you qualify for, such as the standard deduction or itemized deductions.

- Calculate tax liability: Follow the instructions to determine your total tax owed or refund due based on your income and deductions.

- Sign and date the form: Ensure you sign the form and include the date to validate your submission.

Legal use of the Form 1040

The 2003 Form 1040 is legally binding when completed and submitted according to IRS guidelines. To ensure its legality, taxpayers must provide accurate information and sign the form. Electronic signatures are also acceptable, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. It is crucial to retain a copy of the submitted form for personal records and potential future audits.

Filing Deadlines / Important Dates

For the tax year 2003, the deadline to file the Form 1040 was April 15, 2004. If you were unable to file by this date, it was necessary to request an extension or face potential penalties. Understanding filing deadlines is essential for avoiding late fees and ensuring compliance with IRS regulations. Taxpayers should also be aware of any changes in deadlines for subsequent years.

Form Submission Methods

The 2003 Form 1040 could be submitted through various methods:

- By mail: Taxpayers could print the completed form and send it to the appropriate IRS address based on their location.

- Electronically: E-filing options were available, allowing taxpayers to submit their forms securely online through authorized e-filing services.

- In-person: Some taxpayers opted to deliver their forms directly to local IRS offices, ensuring immediate receipt.

Required Documents

To accurately complete the 2003 Form 1040, several documents are required:

- W-2 forms: These are issued by employers and report annual wages and taxes withheld.

- 1099 forms: These report various types of income received, including freelance or contract work.

- Receipts for deductions: Keep records of any deductible expenses, such as medical bills or charitable contributions.

- Previous year’s tax return: This can provide a useful reference for completing the current year’s form.

Quick guide on how to complete 2003 irs 1040 fillable form

Complete Form 1040 effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Form 1040 on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Form 1040 effortlessly

- Locate Form 1040 and click Get Form to begin.

- Use the available tools to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and bears the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1040 and ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Does the IRS require filling in the "cents" fields on form 1040?

No, you are not required to show the cents, however, you should round up or down any cent amount.Computations:The following information may be useful in making the return easier to complete. Rounding off dollars: You can round off cents to whole dollars on your return and schedules. If you do round to whole dollars, you must round all amounts. To round, drop amounts under 50 cents and increase amounts from 50 to 99 cents to the next dollar.For example, $1.39 becomes $1 and $2.50 becomes $3. If you have to add two or more amounts to figure the amount to enter on a line, include cents when adding the amounts and round off only the total.Equal amounts: If you are asked to enter the smaller or larger of two equal amounts, enter that amount.Negative amounts: If you file a paper return and you need to enter a negative amount, put the amount in parentheses rather than using a minus sign. To combine positive and negative amounts, add all the positive amounts together and then subtract the negative amounts.You may find this and additional information on this website: https://www.irs.gov/pub/irs-pdf/... Page 12I hope this information is helpful.

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

Create this form in 5 minutes!

How to create an eSignature for the 2003 irs 1040 fillable form

How to create an eSignature for your 2003 Irs 1040 Fillable Form online

How to generate an electronic signature for your 2003 Irs 1040 Fillable Form in Chrome

How to create an electronic signature for signing the 2003 Irs 1040 Fillable Form in Gmail

How to make an eSignature for the 2003 Irs 1040 Fillable Form straight from your smartphone

How to create an electronic signature for the 2003 Irs 1040 Fillable Form on iOS

How to generate an electronic signature for the 2003 Irs 1040 Fillable Form on Android devices

People also ask

-

What is Form 1040 and why is it important for tax filing?

Form 1040 is the standard IRS form used by individuals to file their annual income tax returns. It is essential for accurately reporting your income, claiming deductions, and determining your tax liability. Understanding how to correctly fill out Form 1040 is crucial to ensure compliance and maximize your tax refund.

-

How can airSlate SignNow help with signing Form 1040?

airSlate SignNow allows you to easily send and eSign Form 1040 securely and efficiently. With our user-friendly platform, you can collect signatures from multiple parties, ensuring that your tax documents are processed quickly. This streamlines the filing process and helps you avoid delays.

-

Is there a cost associated with using airSlate SignNow for Form 1040?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including options for individual users needing to sign Form 1040. Our plans are cost-effective and include features like unlimited document signing and cloud storage, making it an affordable choice for tax preparation.

-

What features does airSlate SignNow offer for managing Form 1040 documents?

airSlate SignNow provides a range of features including customizable templates for Form 1040, secure eSigning, and tracking capabilities. You can also integrate the platform with other applications to enhance your workflow, ensuring that your tax documents are organized and easily accessible.

-

Can I use airSlate SignNow to send Form 1040 to multiple recipients?

Absolutely! airSlate SignNow enables you to send Form 1040 to multiple recipients for eSigning. This feature is particularly useful for tax professionals who need to gather signatures from clients and partners efficiently without the hassle of printing and scanning.

-

What integrations does airSlate SignNow support for Form 1040 processing?

airSlate SignNow integrates seamlessly with various third-party applications like Google Drive, Dropbox, and CRM systems. These integrations allow you to manage your Form 1040 documents alongside other essential tools, simplifying the tax filing process and enhancing productivity.

-

Is airSlate SignNow secure for signing sensitive documents like Form 1040?

Yes, airSlate SignNow prioritizes security and compliance. Our platform utilizes advanced encryption and authentication measures to ensure that your Form 1040 and other sensitive documents are protected throughout the signing process. You can confidently eSign knowing your information is safe.

Get more for Form 1040

- Nelnet release of authorization form

- Replacement diploma order form iowa state university

- Percopo scholarship application rose hulman top ranked rose hulman form

- Medication administration permission form

- Maroon guard application planoettes planoettes form

- Touro university nevada transcript request form

- Deca statement form

- Csf community service form

Find out other Form 1040

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF