Ontario HST Rebate for New Build PersonalFinanceCanada Form

Understanding the Ontario HST Rebate for New Builds

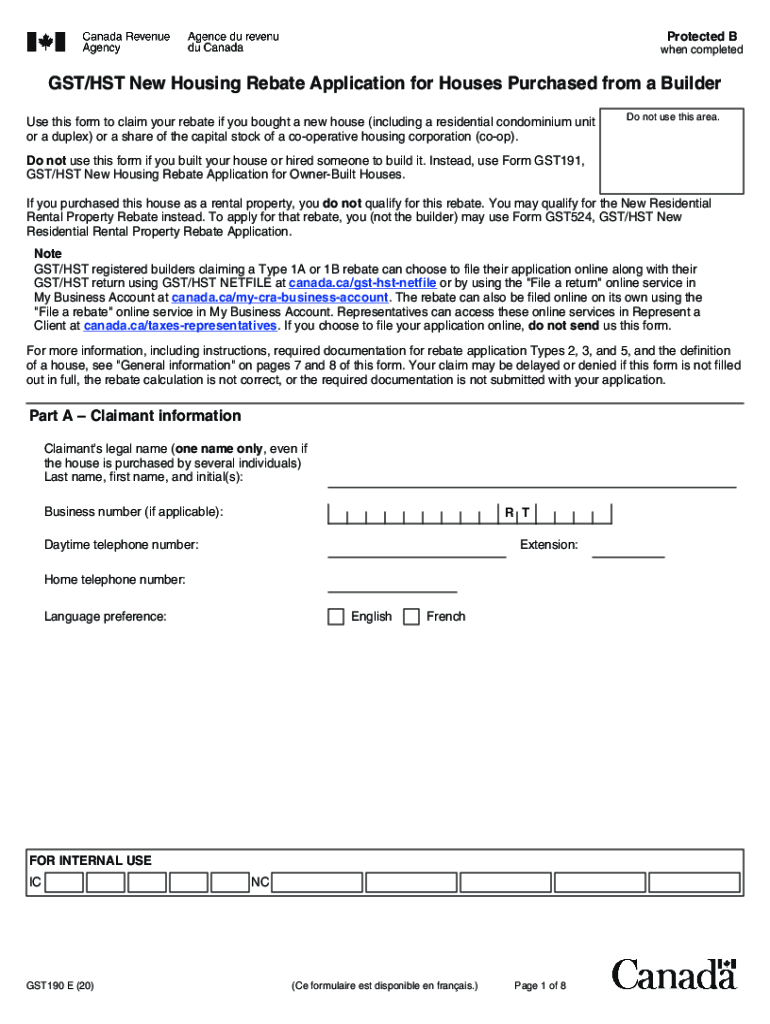

The Ontario HST rebate for new builds is a financial incentive designed to assist homebuyers in offsetting the costs associated with the Harmonized Sales Tax (HST) on newly constructed homes. This rebate is particularly relevant for individuals purchasing a new home or those who have constructed a new residence. The rebate can significantly reduce the overall tax burden, making homeownership more affordable. It is essential for applicants to understand the eligibility criteria and the specific conditions that must be met to qualify for this rebate.

Eligibility Criteria for the HST Rebate

To qualify for the Ontario HST rebate for new builds, applicants must meet certain criteria. These include:

- The home must be a newly constructed residential property.

- The property must be used as the primary place of residence.

- The purchase price must not exceed specific thresholds set by the government.

- Applications must be submitted within a designated timeframe after the home is purchased or constructed.

It is vital for applicants to review these criteria carefully to ensure they meet all necessary requirements before proceeding with the application.

Steps to Complete the HST Rebate Application

Completing the HST rebate application involves several key steps:

- Gather all required documentation, including proof of purchase and occupancy.

- Fill out the HST rebate application form accurately, ensuring all information is complete.

- Submit the application along with the necessary documents to the appropriate government agency.

- Keep a copy of the submitted application and all supporting documents for your records.

Following these steps carefully can help streamline the application process and increase the likelihood of a successful rebate claim.

Required Documents for the HST Rebate

When applying for the Ontario HST rebate for new builds, certain documents are essential to support your application. These typically include:

- A copy of the purchase agreement or contract for the new home.

- Proof of payment of the HST, such as receipts or invoices.

- Documentation demonstrating that the home is your primary residence, such as utility bills or tax documents.

Ensuring that all required documents are accurate and complete can help prevent delays in processing your application.

Form Submission Methods

The HST rebate application can be submitted through various methods, providing flexibility for applicants. These methods include:

- Online submission through the designated government portal.

- Mailing the completed application and documents to the appropriate address.

- In-person submission at local government offices, if available.

Choosing the most convenient submission method can help ensure that your application is processed in a timely manner.

Legal Use of the HST Rebate

Understanding the legal implications of the Ontario HST rebate for new builds is crucial for applicants. The rebate is governed by specific laws and regulations that dictate how it can be applied. It is essential to comply with all legal requirements to ensure that the rebate is valid and enforceable. This includes adhering to the eligibility criteria, submitting the application within the required timeframe, and providing accurate information throughout the process. Failure to comply with these regulations can result in penalties or denial of the rebate.

Quick guide on how to complete ontario hst rebate for new build personalfinancecanada

Complete Ontario HST Rebate For New Build PersonalFinanceCanada effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Ontario HST Rebate For New Build PersonalFinanceCanada on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to modify and eSign Ontario HST Rebate For New Build PersonalFinanceCanada without any hassle

- Locate Ontario HST Rebate For New Build PersonalFinanceCanada and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Ontario HST Rebate For New Build PersonalFinanceCanada and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ontario hst rebate for new build personalfinancecanada

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the gst rebate purchased feature in airSlate SignNow?

The gst rebate purchased feature in airSlate SignNow allows businesses to manage and document their GST claims efficiently. By tracking purchases and automatically generating necessary documents, it simplifies the filing process and ensures compliance with local regulations.

-

How can airSlate SignNow help with calculating gst rebate purchased?

airSlate SignNow provides tools that help businesses calculate their gst rebate purchased accurately. The platform offers templates and automatic calculations based on input data, making it easier to track eligible purchases and maximize potential rebates.

-

Is pricing for airSlate SignNow reasonable for small businesses looking for gst rebate purchased solutions?

Yes, airSlate SignNow offers flexible pricing plans that are cost-effective for small businesses. These packages are designed to provide value while helping firms manage their gst rebate purchased needs without incurring unnecessary expenses.

-

What integrations does airSlate SignNow support for managing gst rebate purchased?

airSlate SignNow supports various integrations with accounting software and tools that streamline the process of managing gst rebate purchased. This connectivity enhances data flow between your financial systems and ensures seamless documentation of all relevant transactions.

-

Are there any features to automate the process of gst rebate purchased?

Absolutely! airSlate SignNow includes automation features that enable users to automate repetitive tasks involved in gst rebate purchased. This includes generating invoices, reminders for submissions, and tracking the status of gst claims, saving businesses time and effort.

-

Can I track the status of my gst rebate purchased claims with airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of their gst rebate purchased claims in real-time. This feature provides insights and updates, ensuring that businesses stay informed about the progress of their rebates and can address any issues promptly.

-

What are the benefits of using airSlate SignNow for gst rebate purchased?

Using airSlate SignNow for gst rebate purchased provides numerous benefits, including increased accuracy, time savings, and improved compliance. The platform's user-friendly interface and robust features help streamline your processes, resulting in a more efficient business operation.

Get more for Ontario HST Rebate For New Build PersonalFinanceCanada

- Employee availability form 13637195

- Vetco intake form

- Iantd student medical form doc

- Record of master calendar pre trial appearance and order form

- Iowa child labor permit form

- Seller transferor is not as of the date of transfer a resident of the state of maine form

- Certification of lock in for purposes of the form

Find out other Ontario HST Rebate For New Build PersonalFinanceCanada

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself