Instructions for Form 1099 MISC

What is the Instructions for Form 1099 MISC

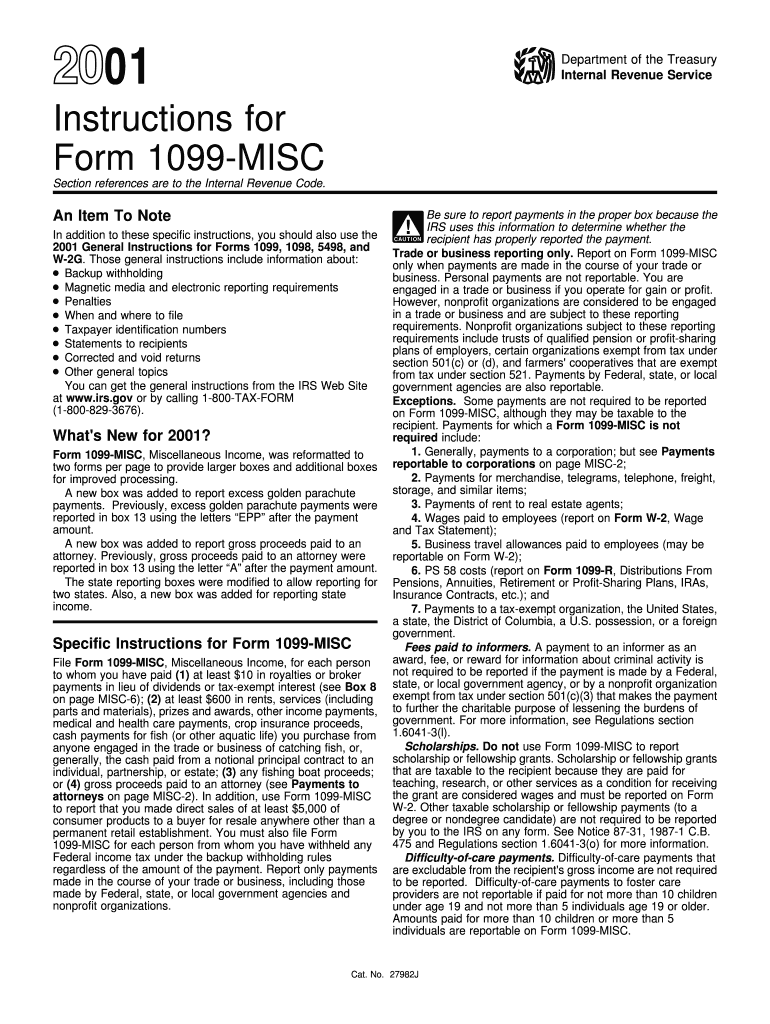

The Instructions for Form 1099 MISC provide essential guidance for reporting various types of income that are not classified as wages, salaries, or tips. This form is commonly used by businesses to report payments made to independent contractors, freelancers, and other non-employees. Understanding these instructions is crucial for ensuring compliance with IRS regulations and accurately reporting income. The form covers various payment categories, including rents, royalties, and other income types, which must be reported to the IRS and the recipient.

Steps to Complete the Instructions for Form 1099 MISC

Completing the Instructions for Form 1099 MISC involves several key steps:

- Gather necessary information about the payee, including their name, address, and taxpayer identification number (TIN).

- Determine the type of payment made to the payee, as this will dictate which boxes on the form need to be filled out.

- Fill in the required fields accurately, ensuring that all amounts are correct and that the form is signed where necessary.

- Review the completed form for any errors or omissions before submitting it to the IRS and providing a copy to the payee.

Legal Use of the Instructions for Form 1099 MISC

The legal use of the Instructions for Form 1099 MISC is governed by IRS guidelines that stipulate the requirements for reporting income. Accurate completion and timely submission of this form are essential to avoid penalties. Businesses must ensure they are compliant with federal regulations, including providing the correct information to both the IRS and the recipients. Failure to adhere to these guidelines can result in fines and increased scrutiny from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions for Form 1099 MISC are critical for compliance. Typically, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which payments were made. Recipients must also receive their copies by this date. It is important to stay updated on any changes to these deadlines, as the IRS may occasionally adjust them. Missing these deadlines can lead to penalties and interest charges.

Who Issues the Form

The Form 1099 MISC is issued by businesses or organizations that make payments to non-employees. This can include sole proprietorships, partnerships, corporations, and other entities that engage independent contractors or freelancers. Each issuer is responsible for ensuring that the form is completed accurately and submitted to the IRS and the payee in a timely manner. Understanding the responsibilities of the issuer is essential for compliance.

Examples of Using the Instructions for Form 1099 MISC

Examples of using the Instructions for Form 1099 MISC include reporting payments made to independent contractors for services rendered, such as graphic design or consulting work. Other examples include reporting rent payments made to landlords or royalties paid to authors or artists. Each scenario requires careful consideration of the payment type and accurate reporting to ensure compliance with IRS regulations.

Quick guide on how to complete 2001 instructions for form 1099 misc

Effortlessly Prepare Instructions For Form 1099 MISC on Any Device

The management of online documents has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly option to traditional printed and signed paperwork, as you can locate the correct form and safely store it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Instructions For Form 1099 MISC seamlessly on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-driven process today.

How to Modify and eSign Instructions For Form 1099 MISC with Ease

- Obtain Instructions For Form 1099 MISC and select Get Form to initiate the process.

- Make use of our tools to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, and mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Instructions For Form 1099 MISC and maintain effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Did you fill out the form "1099 misc"? If so, for what purpose? Within the context of work, is it like a contract?

One of the most common reasons you’d receive tax form 1099-MISC is if you are self-employed or did work as an independent contractor during the previous year. The IRS refers to this as “non-employee compensation.”In most circumstances, your clients are required to issue Form 1099-MISC when they pay you $600 or more in any year.As a self employed person you are required to report your self employment income if the amount you receive from all sources totals $400 or more. In this situation, the process of filing your taxes is a little different than a taxpayer who only receives regular employment income reported on a W-2.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

How much does it cost to outsource the printing and filing of 5000 1099 Misc forms?

Most of the larger places in the US will cost you around $4-6 per employee. 5000 is a lot, so I'm sure you'll find someone who will negotiate. So to do it "right" and full-service from a named payroll company, I'm guessing $20,000.Now retail, maybe $2-3 of that is for e-filing services and $2-3 is for printing/mailing. So if employees are printing their own, getting emails, or getting links to a secure FTP site, then maybe you can save half of that by not mailing. Check the rules, but that's pretty common. For the other half, I'd bet plenty of companies have really good deals, including the IRS--I'd bet money they allow you upload a 5,000 line CSV for free or next to it.Of course there's India and stuff--real outsourcing--but I'd have to quintuple check the legalities of sending employee information across international lines, HIPAA and all that. And even if an international outsource printed and enveloped it, you'd have to have it flown here to ship, and you'd have to solve the e-file aspect. As with everything it's a trade-off of how much risk you want to pay to transfer.So negotiating in the real world, I'd bet $10,000 to do it right. These are guesstimates--not quite guesses, but not quite estimates, but a start for your thoughts. Hopefully a payroll accountant will strike me down.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

How do I file a 1099-MISC form for an independent contractor?

While completing the fillable document, a business entity must use the name, address and Social Security or tax identification number as indicated in your W-9. The individual contractors must report their miscellaneous earnings (from 1099) on a 1040 tax return as well.You can find a lot of information here: http://bit.ly/2Nkf48f

-

What is the cheapest way for me to do my taxes for my 1099 MISC form?

Yes, always go for cheap. The problem here is that you can find free or almost free tax prep services. You can go to what appears to be cheap retail tax prep chains. You can buy cheap tax software. You can do all these things cheaply. Or so it appears.The problem is that your “cheap” solution may be the most expensive solution you will ever encounter. So you do it yourself, because you have a cheap software program. Guess what? You just shot yourself in the foot. Unless, of course, you know all the ins and outs of the tax law. Unless you have a good grasp of the relevant portions of 38.000 pages of tax gobbly-goop, written by lawyers, for lawyers, in a language that only approximates English. Unless, of course, you kept up with the hundreds of changes that occurred during the year, including the Code, Regulations, Revenue Procedures, and tax court cases. Don’t bet that your $ 45 tax program did that. They didn’t. They can’t.If you believe that you know enough to properly complete a Schedule C with the lowest amount of tax with no formal training in tax law and without spending at least 40 hours a year in refresh training, you are deluding yourself. “But it’s only a simple tax return.” Sure, you have convinced yourself. Maybe, probably not.If you think a CPA is “too expensive” then you have just been seduced by the power of advertising. You have succumbed to the siren call of ego empowerment. Is it arrogance? Is it false confidence? Gee, I don’t know. What I do know is that a good CPA can usually save a client many times their cost. It may not happen on one return, but over a series of years, the advice, counsel, planning and technical expertise you get with a CPA or EA will pay handsome dividends. Over my 40 years of practice, I have seen many self and tax prep chain prepared returns, and in virtually all of the cases have found something that would have saved the taxpayer lots of money. More than justified the cost.But, of course, these are intangibles, unquantifiables. You know exactly what that cheap tax prep software costs, so focus on that. Forget about the hundreds or thousands of dollars in extra taxes you will pay because you don’t know the ins and outs of the law. Actually, the IRS once did a study on this and found that most taxpayers overpay their taxes. Kinda seems contrary to what you would expect, right? I mean when they audit you, they want more money. That’s correct. Oh, and when you self-prepare, you are on your own if you are challenged. No problem, right? If you buy into that, please, you need serious reality therapy. The tax system is an adversarial system. You wouldn’t face a Ninja with a water squirt pistol would you?Enough said. SWSWSW. Some will, some won’t, so will it be. Sorry I ranted on about this, but I have faced this issue with so many people, including members of my family, and it’s a sore point. I just hate to see people overpay their taxes deceived into thinking they got a “deal” on some cheap tax software.

Create this form in 5 minutes!

How to create an eSignature for the 2001 instructions for form 1099 misc

How to generate an eSignature for your 2001 Instructions For Form 1099 Misc online

How to make an electronic signature for the 2001 Instructions For Form 1099 Misc in Google Chrome

How to generate an electronic signature for signing the 2001 Instructions For Form 1099 Misc in Gmail

How to generate an eSignature for the 2001 Instructions For Form 1099 Misc right from your smart phone

How to generate an electronic signature for the 2001 Instructions For Form 1099 Misc on iOS devices

How to make an electronic signature for the 2001 Instructions For Form 1099 Misc on Android devices

People also ask

-

What are the Instructions For Form 1099 MISC?

The Instructions For Form 1099 MISC provide detailed guidance on how to report various types of income that are paid to non-employees, such as freelancers or independent contractors. This form is essential for businesses to ensure compliance with IRS regulations when reporting payments made during the tax year.

-

How can airSlate SignNow help with the Instructions For Form 1099 MISC?

airSlate SignNow simplifies the process of completing and eSigning the Instructions For Form 1099 MISC by providing a user-friendly platform for document management. With our solution, you can easily fill out, sign, and send tax forms securely, ensuring timely submission to the IRS.

-

Is there a cost associated with using airSlate SignNow for the Instructions For Form 1099 MISC?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution allows you to manage tax documents like the Instructions For Form 1099 MISC efficiently, providing great value without sacrificing quality.

-

Can I integrate airSlate SignNow with other accounting software for the Instructions For Form 1099 MISC?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your financial documents, including the Instructions For Form 1099 MISC. This integration helps streamline your workflow and ensures that your tax reporting is accurate and efficient.

-

What features does airSlate SignNow offer for managing the Instructions For Form 1099 MISC?

airSlate SignNow offers features such as customizable templates, electronic signatures, and secure document storage, all of which are beneficial for managing the Instructions For Form 1099 MISC. These tools help improve efficiency and reduce errors when preparing and submitting tax documents.

-

How do I get started with airSlate SignNow for the Instructions For Form 1099 MISC?

Getting started with airSlate SignNow is easy! Simply sign up for an account, choose your pricing plan, and you can begin creating and managing your Instructions For Form 1099 MISC right away. Our intuitive interface makes it simple for anyone to use, regardless of technical expertise.

-

What benefits does airSlate SignNow provide for small businesses handling the Instructions For Form 1099 MISC?

For small businesses, airSlate SignNow offers a cost-effective solution to manage the Instructions For Form 1099 MISC efficiently. By simplifying document workflows and enabling quick eSigning, our platform helps small business owners save time and reduce stress during tax season.

Get more for Instructions For Form 1099 MISC

- Rhine waal university application form

- Mandatory tuberculosis screening form m4 medical students 2014 med fau

- Community service verification form waubonsie valley high school

- Senior ad order form clovis east high school

- Humber college acceptance letter form

- Editorial outline frankenstein english 11 bwikispacesb form

- United independent school district national junior honor hpwebserver2 uisd form

- Characteristics of living organisms worksheet form

Find out other Instructions For Form 1099 MISC

- Sign Hawaii Rental Invoice Template Simple

- Sign California Commercial Lease Agreement Template Free

- Sign New Jersey Rental Invoice Template Online

- Sign Wisconsin Rental Invoice Template Online

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later