Form NY DTF it 370 PF Fill Online, Printable, Fillable, Blank

What is the it370 form?

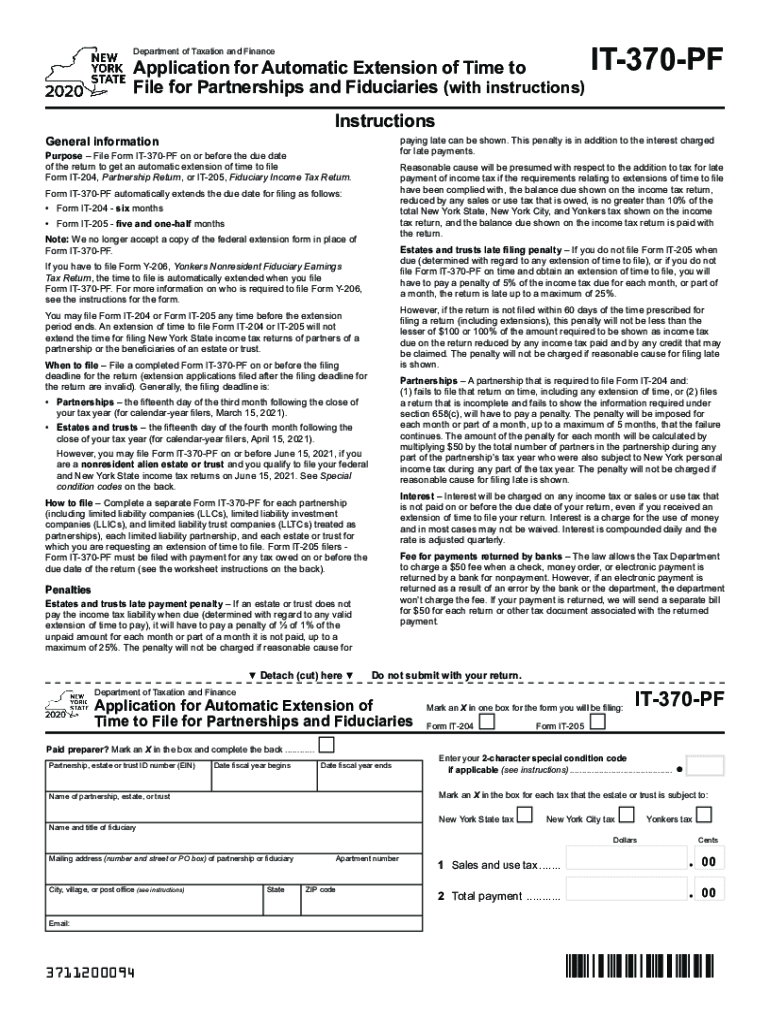

The it370 form, officially known as the New York State IT-370, is a tax form used by individuals in New York to request an extension for filing their personal income tax returns. This form is essential for taxpayers who need additional time to prepare their returns, allowing them to avoid late filing penalties. The it370 form is specifically designed for residents of New York and must be submitted to the New York State Department of Taxation and Finance.

Steps to complete the it370 form

Completing the it370 form involves several straightforward steps:

- Download the it370 form from the New York State Department of Taxation and Finance website or access it through a reliable digital platform.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are requesting an extension.

- Provide an estimate of your total income tax liability for the year.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form either electronically or by mail to the appropriate tax authority.

Legal use of the it370 form

The it370 form is legally recognized as a valid request for an extension of time to file your New York State personal income tax return. It is important to submit this form before the original due date of your tax return to ensure compliance with state tax regulations. Failing to file the it370 form on time may result in penalties, including interest on any unpaid taxes.

Filing deadlines for the it370 form

The deadline for submitting the it370 form typically aligns with the due date of the original tax return. For most taxpayers, this is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to be aware of these dates to avoid any penalties associated with late submissions.

Required documents for the it370 form

When completing the it370 form, you may need to gather certain documents to ensure accuracy:

- Previous year’s tax return for reference.

- W-2 forms from employers.

- 1099 forms for any additional income sources.

- Records of deductions and credits you plan to claim.

Form submission methods

The it370 form can be submitted in various ways to accommodate different preferences:

- Online: Many taxpayers choose to file electronically through approved e-filing services.

- By Mail: You can print the completed form and send it to the New York State Department of Taxation and Finance via postal mail.

- In-Person: Some individuals may prefer to deliver their forms directly to a local tax office.

Quick guide on how to complete 2019 form ny dtf it 370 pf fill online printable fillable blank

Prepare Form NY DTF IT 370 PF Fill Online, Printable, Fillable, Blank effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the needed form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage Form NY DTF IT 370 PF Fill Online, Printable, Fillable, Blank on any platform using airSlate SignNow Android or iOS applications and elevate any document-centric task today.

The easiest method to modify and eSign Form NY DTF IT 370 PF Fill Online, Printable, Fillable, Blank without stress

- Obtain Form NY DTF IT 370 PF Fill Online, Printable, Fillable, Blank and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign function, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of missing or lost documents, tedious form searching, or errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form NY DTF IT 370 PF Fill Online, Printable, Fillable, Blank and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form ny dtf it 370 pf fill online printable fillable blank

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is the it370 form, and why is it important?

The it370 form is a crucial document used for various tax-related purposes, including adjustments to tax filings. Understanding its proper use is essential for ensuring compliance with tax regulations, which can save businesses from potential penalties. Using airSlate SignNow, you can eSign your it370 form quickly and securely.

-

How can airSlate SignNow help me with the it370 form?

airSlate SignNow enables you to easily send, receive, and eSign the it370 form online, streamlining your document workflow. This solution reduces the time spent on paperwork, allowing you to focus on more critical business tasks. Moreover, its user-friendly interface makes the process accessible for everyone in your team.

-

Is there a cost associated with using airSlate SignNow for the it370 form?

Yes, airSlate SignNow offers flexible pricing plans to cater to various business needs, including options for those who need to manage the it370 form regularly. With a subscription, you gain access to premium features that enhance your document management process. Check our pricing page for detailed information and choose a plan that fits your requirements.

-

What features does airSlate SignNow provide for handling the it370 form?

airSlate SignNow includes features like legally binding eSignatures, document templates, and secure cloud storage specifically designed to assist in managing documents such as the it370 form. Additionally, you can track the signing process in real-time and receive notifications when your form is signed. These features enhance efficiency and streamline your workflows.

-

Can I integrate airSlate SignNow with other applications for filing the it370 form?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems to help you manage your documents efficiently. These integrations allow for easy access and sharing of the it370 form, improving collaboration within your team. Explore our integrations for optimal workflow management.

-

Is airSlate SignNow compliant with legal requirements for the it370 form?

Yes, airSlate SignNow ensures compliance with legal standards for electronic signatures, making it a reliable choice for handling the it370 form. We adhere to regulations such as the ESIGN Act and UETA, ensuring your signed documents are secure and valid. You can trust that your documents are protected while remaining legally binding.

-

What are the benefits of using airSlate SignNow for the it370 form compared to traditional methods?

Using airSlate SignNow for the it370 form offers numerous benefits over traditional methods, including faster processing times, reduced paper usage, and improved document security. You can complete the signing process from anywhere, making it more convenient for all parties involved. This efficiency leads to signNow time and cost savings for your business.

Get more for Form NY DTF IT 370 PF Fill Online, Printable, Fillable, Blank

- Competition volleyball skills assessment for individuals specialolympicspa form

- Eyelash extensions manual beginners courseeyelash extensions manual beginners course qxp form

- Medical records release form dermatology specialists pa

- State of new jersey employers first report of accidental injury or occupational illness form

- Deadlock letter form

- Tax ampamp licensinggriffin ga form

- Arizona withholding tax 769995072 form

- Affidavit for organizational tax exemption form

Find out other Form NY DTF IT 370 PF Fill Online, Printable, Fillable, Blank

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself