Form 433 a OIC Rev 4 Internal Revenue Service

What is the Form 433 A OIC

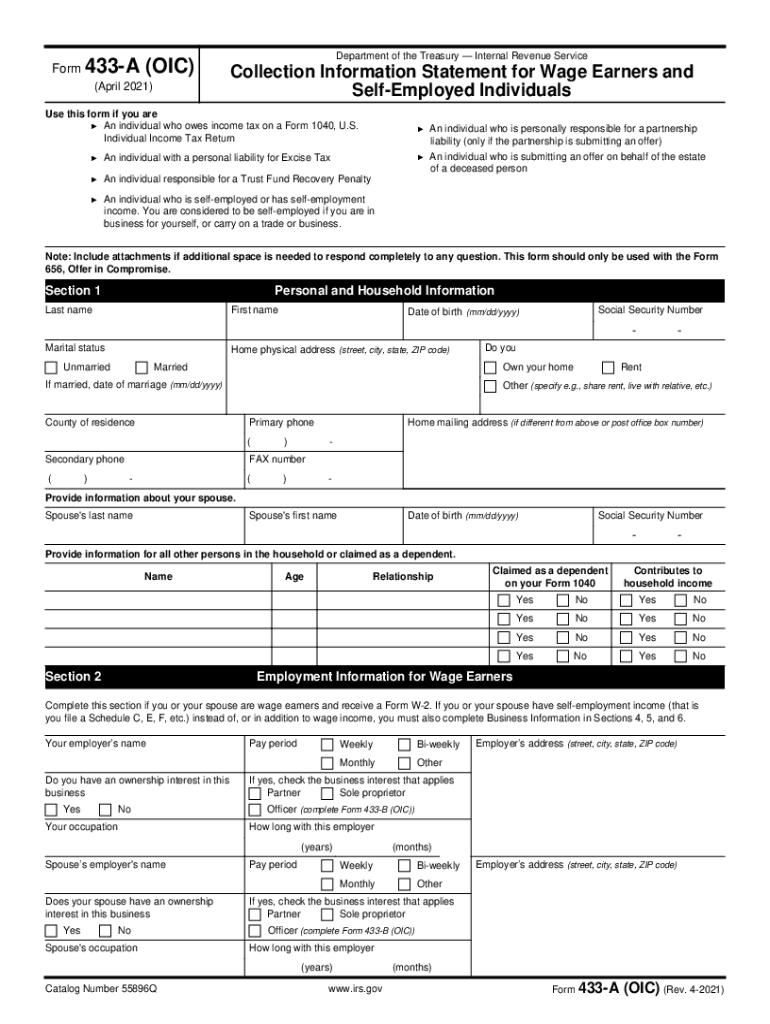

The Form 433 A OIC, also known as the 2021 Form 433A, is an official document used by the Internal Revenue Service (IRS) for individuals seeking to settle their tax debts through an Offer in Compromise (OIC). This form allows taxpayers to provide detailed financial information, which the IRS uses to determine their ability to pay and assess whether settling for less than the full amount owed is appropriate. The form must be completed accurately to ensure the IRS can evaluate the taxpayer's financial situation effectively.

Steps to Complete the Form 433 A OIC

Completing the Form 433 A OIC requires careful attention to detail. Here are the key steps to follow:

- Gather necessary financial documents, including income statements, bank statements, and expense records.

- Fill out personal information, including name, address, and Social Security number.

- Provide details about your income, including wages, self-employment income, and any other sources.

- List your monthly expenses, ensuring to include necessary living costs like housing, utilities, and transportation.

- Detail your assets, including bank accounts, real estate, and personal property.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the Form 433 A OIC

The legal use of the Form 433 A OIC is governed by IRS regulations that outline the requirements for submitting an Offer in Compromise. The form must be signed and dated by the taxpayer, affirming that the information provided is true and accurate. Failure to comply with these legal stipulations may result in the rejection of the offer or potential penalties. It is essential to understand that submitting this form does not guarantee acceptance of the OIC; the IRS will conduct a thorough review based on the provided financial information.

Eligibility Criteria for the Form 433 A OIC

To qualify for submitting the Form 433 A OIC, taxpayers must meet specific eligibility criteria set by the IRS. These include:

- The taxpayer must have filed all required tax returns.

- The taxpayer must not be in an open bankruptcy proceeding.

- The taxpayer's total tax liability must be eligible for an OIC.

- The taxpayer must demonstrate an inability to pay the full tax liability.

Required Documents for Form 433 A OIC

When submitting the Form 433 A OIC, taxpayers must include supporting documentation to validate their financial claims. Required documents typically include:

- Recent pay stubs or proof of income.

- Bank statements for the last three months.

- Documentation of monthly expenses, such as bills and receipts.

- Proof of assets, including property deeds and vehicle titles.

Form Submission Methods

The Form 433 A OIC can be submitted to the IRS through various methods. Taxpayers have the option to:

- Submit the form electronically through the IRS e-File system, if eligible.

- Mail the completed form to the appropriate IRS address based on their location and the type of tax owed.

- Hand-deliver the form to a local IRS office, if preferred.

Quick guide on how to complete form 433 a oic rev 4 2021 internal revenue service

Manage Form 433 A OIC Rev 4 Internal Revenue Service effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without hassle. Handle Form 433 A OIC Rev 4 Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Form 433 A OIC Rev 4 Internal Revenue Service with ease

- Obtain Form 433 A OIC Rev 4 Internal Revenue Service and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Select important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose how to deliver your form, whether by email, SMS, or a sharing link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 433 A OIC Rev 4 Internal Revenue Service and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 433 a oic rev 4 2021 internal revenue service

How to make an eSignature for a PDF file in the online mode

How to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What is the 2021 form 433a used for?

The 2021 form 433a is used to provide information about an individual's financial situation to the IRS. It includes details on income, expenses, assets, and liabilities, which can be crucial for settlement negotiations. Completing this form accurately can signNowly impact your ability to resolve tax debts.

-

How can airSlate SignNow help with filling out the 2021 form 433a?

airSlate SignNow offers an easy-to-use platform for electronically signing and sending the 2021 form 433a. Users can fill out the form, collaborate with tax professionals, and ensure that their document is securely signed and submitted. This streamlines the process, making it more convenient and efficient.

-

What are the costs associated with using airSlate SignNow for the 2021 form 433a?

airSlate SignNow provides a cost-effective solution for managing documents like the 2021 form 433a. Pricing plans vary based on features and number of users, but many clients find it affordable compared to traditional printing and mailing methods. Interested users can visit the pricing page for detailed information.

-

Does airSlate SignNow offer integrations for working with the 2021 form 433a?

Yes, airSlate SignNow integrates with various applications to enhance efficiency when working with the 2021 form 433a. These integrations include popular platforms like Google Drive, Dropbox, and various CRM systems. This allows users to access their documents from anywhere and streamline their workflow.

-

What features does airSlate SignNow provide for eSigning the 2021 form 433a?

airSlate SignNow offers robust features for eSigning the 2021 form 433a, including secure electronic signatures, customizable templates, and real-time tracking of document status. These features provide users with peace of mind that their submissions are secure and compliant with legal standards. Users can also easily manage multiple signers.

-

Can I store my completed 2021 form 433a securely with airSlate SignNow?

Absolutely! airSlate SignNow provides secure storage options for all your documents, including the completed 2021 form 433a. Documents are stored in a secure cloud environment, ensuring confidential information is protected and easily accessible whenever you need it.

-

Is there customer support available for assistance with the 2021 form 433a?

Yes, airSlate SignNow offers comprehensive customer support to assist with any questions regarding the 2021 form 433a. Whether you need help with the software or specific questions about your form, their support team is ready to assist you via chat, email, or phone. Quick and knowledgeable support is a key benefit for users.

Get more for Form 433 A OIC Rev 4 Internal Revenue Service

- California all purpose acknowledgment form

- Yamaha yzf 1000 r thunderace reparaturanleitung pdf form

- Rathus assertiveness scale pdf 101085868 form

- Donation card template form

- Acn cancellation form

- Certificate of adoption application to amend a birth record health state mn form

- Tax credit form marana unified school district

- Call 1 877 423 6711 form

Find out other Form 433 A OIC Rev 4 Internal Revenue Service

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer