Form 1040 Schedule E Supplemental Income and Loss

What is the Form 1040 Schedule E Supplemental Income and Loss

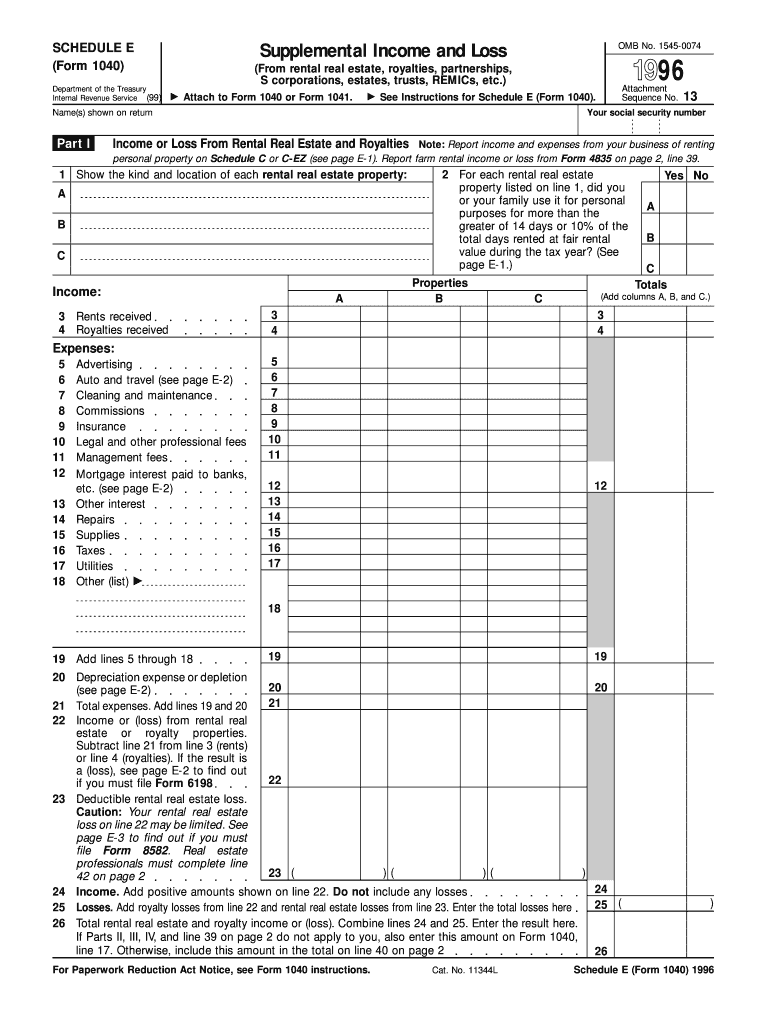

The Form 1040 Schedule E is specifically designed for reporting supplemental income and loss. This includes income from rental properties, partnerships, S corporations, estates, trusts, and royalties. Taxpayers use this form to provide detailed information about their income sources, ensuring compliance with IRS regulations. Understanding the purpose of the Schedule E is essential for accurately reporting income and avoiding potential penalties.

How to Use the Form 1040 Schedule E Supplemental Income and Loss

Using the Form 1040 Schedule E involves several steps to ensure accurate reporting of supplemental income. First, gather all necessary documentation related to your income sources, such as rental agreements, partnership K-1 forms, and royalty statements. Next, complete the form by entering your income and expenses in the appropriate sections. It is crucial to ensure that all figures are accurate, as discrepancies can lead to audits or penalties. Finally, attach the completed Schedule E to your Form 1040 when filing your taxes.

Steps to Complete the Form 1040 Schedule E Supplemental Income and Loss

Completing the Form 1040 Schedule E requires careful attention to detail. Follow these steps:

- Begin by entering your name and Social Security number at the top of the form.

- List each property or income source in the designated sections, providing details such as address and type of income.

- Document any related expenses, including mortgage interest, property taxes, and maintenance costs, to accurately calculate net income.

- Transfer the total income and expenses to the appropriate lines on your Form 1040.

Legal Use of the Form 1040 Schedule E Supplemental Income and Loss

The legal use of the Form 1040 Schedule E is governed by IRS guidelines. Taxpayers must accurately report all supplemental income to comply with federal tax laws. Failure to report income can result in penalties, interest, or even legal action. It is important to maintain thorough records of all income sources and related expenses to substantiate claims made on the Schedule E.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 Schedule E align with the general tax filing deadlines. Typically, individual taxpayers must submit their tax returns by April 15. If additional time is needed, taxpayers can file for an extension, which generally allows for an extra six months. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Examples of Using the Form 1040 Schedule E Supplemental Income and Loss

Examples of using the Form 1040 Schedule E include reporting rental income from residential properties, income from partnerships, and royalties from intellectual property. For instance, if a taxpayer rents out a property, they would report the rental income received, along with any associated expenses such as repairs and management fees. This ensures that the net income is accurately reflected on their tax return, allowing for proper tax calculation.

Quick guide on how to complete 1996 form 1040 schedule e supplemental income and loss

Prepare Form 1040 Schedule E Supplemental Income And Loss effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It presents an excellent eco-friendly option to conventional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Form 1040 Schedule E Supplemental Income And Loss on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 1040 Schedule E Supplemental Income And Loss with ease

- Obtain Form 1040 Schedule E Supplemental Income And Loss and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form 1040 Schedule E Supplemental Income And Loss and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the 1996 form 1040 schedule e supplemental income and loss

How to create an eSignature for your 1996 Form 1040 Schedule E Supplemental Income And Loss in the online mode

How to make an electronic signature for the 1996 Form 1040 Schedule E Supplemental Income And Loss in Google Chrome

How to generate an electronic signature for signing the 1996 Form 1040 Schedule E Supplemental Income And Loss in Gmail

How to create an eSignature for the 1996 Form 1040 Schedule E Supplemental Income And Loss right from your mobile device

How to make an eSignature for the 1996 Form 1040 Schedule E Supplemental Income And Loss on iOS devices

How to create an electronic signature for the 1996 Form 1040 Schedule E Supplemental Income And Loss on Android devices

People also ask

-

What is a schedule e pdf?

A schedule e pdf is a specific document format used to report and document various financial transactions. By utilizing airSlate SignNow, you can easily create, send, and eSign your schedule e pdf, ensuring a streamlined process for all your financial needs.

-

How can airSlate SignNow help me with my schedule e pdf?

airSlate SignNow provides a user-friendly platform that allows you to effortlessly manage your schedule e pdfs. With features like eSigning and document tracking, you can ensure that your schedule e pdf is signed and returned quickly, improving your workflow and productivity.

-

What are the pricing options for using airSlate SignNow to manage schedule e pdfs?

airSlate SignNow offers flexible pricing plans that cater to all business sizes, ensuring everyone can efficiently handle their schedule e pdfs. You can choose from monthly or annual subscriptions, with options that fit your budget and the features required for your document management needs.

-

Is it easy to integrate schedule e pdf functionality with airSlate SignNow?

Yes, airSlate SignNow provides seamless integrations with various applications, making it easy to incorporate schedule e pdf management into your existing systems. You can connect with popular tools, ensuring that your scheduling and documentation process is smooth and efficient.

-

What features does airSlate SignNow offer for schedule e pdf management?

airSlate SignNow includes several powerful features for schedule e pdf management, such as customizable templates, automated workflows, and secure storage. These features make it easier for you to create, send, and track your schedule e pdfs while ensuring compliance with legal standards.

-

How does using airSlate SignNow improve my business’s efficiency with schedule e pdfs?

By using airSlate SignNow to manage your schedule e pdfs, you can streamline your document workflow and signNowly reduce turnaround times. The platform's intuitive interface and automation features help minimize errors and enhance collaboration among team members.

-

Can I collaborate with others on my schedule e pdf using airSlate SignNow?

Absolutely! airSlate SignNow enables collaboration by allowing multiple users to access and eSign schedule e pdfs in real-time. This feature ensures that everyone involved can contribute, leading to faster approvals and completing your documentation process more efficiently.

Get more for Form 1040 Schedule E Supplemental Income And Loss

- The great egg drop montgomery county public schools mcps form

- Tawdry mnemonic form

- Class repeat annotation request admissions amp records irvine form

- Mktg 353 adwords project peer and self evaluation form mihaylofaculty fullerton

- Umbc police department clery incident reporting form a police umbc

- States and capitals form

- Byui health insurance waiver form

- Sanford mychart form

Find out other Form 1040 Schedule E Supplemental Income And Loss

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document