Income Tax Return for Homeowners Associations for Paperwork Reduction Act Notice, See Page 2 Form

Understanding the Income Tax Return for Homeowners Associations

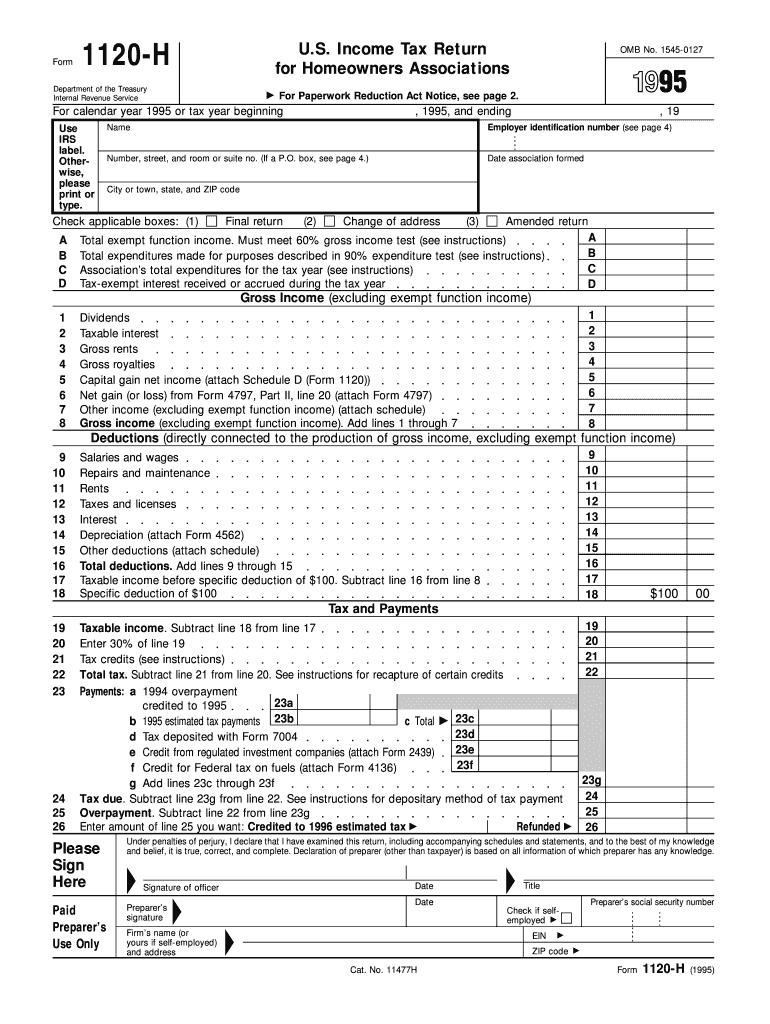

The Income Tax Return for Homeowners Associations is a specific form that associations must file to report their income and expenses. This form is essential for complying with the Paperwork Reduction Act statement, which aims to minimize the burden of paperwork on taxpayers. Associations must ensure they understand the requirements and implications of this form to maintain compliance with IRS regulations.

Steps to Complete the Income Tax Return for Homeowners Associations

Completing the Income Tax Return for Homeowners Associations involves several key steps:

- Gather all necessary financial documents, including income statements and expense receipts.

- Complete the form accurately, ensuring all income and deductions are reported.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline to avoid penalties.

Legal Use of the Income Tax Return for Homeowners Associations

The legal use of the Income Tax Return for Homeowners Associations is crucial for maintaining compliance with federal regulations. This form serves as an official record of the association's financial activities and must be filed accurately. Failure to do so can result in penalties or legal repercussions. Associations should consult with tax professionals to ensure they meet all legal requirements.

IRS Guidelines for the Income Tax Return for Homeowners Associations

The IRS provides specific guidelines for completing and submitting the Income Tax Return for Homeowners Associations. These guidelines outline the necessary documentation, filing procedures, and deadlines. Associations should familiarize themselves with these guidelines to ensure proper compliance and avoid any potential issues with the IRS.

Filing Deadlines for the Income Tax Return for Homeowners Associations

Timely filing of the Income Tax Return for Homeowners Associations is essential to avoid penalties. The IRS sets specific deadlines for submission, which can vary based on the association's fiscal year. It is important for associations to mark these dates on their calendars and prepare their filings in advance to ensure compliance.

Required Documents for the Income Tax Return for Homeowners Associations

When completing the Income Tax Return for Homeowners Associations, several documents are required:

- Financial statements detailing income and expenses.

- Receipts for any deductions claimed.

- Prior year tax returns for reference.

Having these documents organized and ready will facilitate a smoother filing process.

Quick guide on how to complete income tax return for homeowners associations for paperwork reduction act notice see page 2

Complete Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2 effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, amend, and electronically sign your documents swiftly without delays. Manage Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to amend and electronically sign Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2 without hassle

- Obtain Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2 and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to preserve your adjustments.

- Choose how you wish to share your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2 and ensure effective communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I respond to the defective return notice under section 139(9) of the Income Tax Act for error code 2? Can any tax expert help me in interpreting this defect notice?

Hello,It is a bit difficult to interpret a defect notice with just error code.A defective return notice is generally sent if the assessee fails to furnish some necessary information or documents with the tax return as required under law or the return form applicable to you.You will get 15 days of time from the date of receiving the notice to rectify the defect in your return, failing to which might turn your return to invalid.For a better resolution to your problem, it is advisable to consult a CA or tax consultant. If your original return was filed by some CA or tax consultant, you must ask him about this notice.I hope that this answer satisfies your requirement.For any query, please feel free to write to me at badlaniassociates@gmail.com

Create this form in 5 minutes!

How to create an eSignature for the income tax return for homeowners associations for paperwork reduction act notice see page 2

How to make an electronic signature for the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice See Page 2 online

How to generate an electronic signature for the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice See Page 2 in Google Chrome

How to make an electronic signature for signing the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice See Page 2 in Gmail

How to create an electronic signature for the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice See Page 2 straight from your smart phone

How to make an electronic signature for the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice See Page 2 on iOS devices

How to make an eSignature for the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice See Page 2 on Android devices

People also ask

-

What is the purpose of the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2?

The Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2, serves to inform homeowners associations about their tax obligations and the necessary documentation required. This notice outlines the compliance requirements under the Paperwork Reduction Act, ensuring that associations are aware of their responsibilities to file accurate tax returns.

-

How can airSlate SignNow assist with the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2?

airSlate SignNow simplifies the process of completing the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2 by allowing users to easily eSign and send necessary documents. Our platform streamlines document management, ensuring that all required forms are completed accurately and efficiently.

-

What are the pricing options for using airSlate SignNow for managing Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2?

airSlate SignNow offers competitive pricing plans tailored to fit various organizational needs. Whether you are a small homeowners association or a larger entity, our pricing structure allows you to choose a plan that best suits your budget while ensuring compliance with the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2.

-

What features does airSlate SignNow offer for handling documents related to the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2?

airSlate SignNow provides robust features such as customizable templates, automated workflows, and real-time tracking. These tools are designed to help homeowners associations efficiently manage their documents related to the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2, ensuring a smoother filing process.

-

Can airSlate SignNow integrate with other software for managing the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications, enhancing your ability to manage documents related to the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2. This integration capability allows for improved data management and workflow efficiency.

-

What benefits does using airSlate SignNow provide for homeowners associations dealing with Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2?

By using airSlate SignNow, homeowners associations can achieve signNow time savings and reduce paperwork. Our solution ensures compliance with the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2, while simplifying document workflows, allowing associations to focus more on community management.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning documents for the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for individuals who may not be familiar with eSigning documents. Our intuitive interface helps users easily navigate the process of completing the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2 without any hassle.

Get more for Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2

- Myer and lois franklin scholarship form

- Vocal jury form doc

- Request to graduate notice of intent manhattanville college form

- Tardy slip pdf form

- Element worksheet form

- Cloverleaf local schools emergency medical form

- Ron van nurden memorial scholarship application requirements ephrataschools form

- Carl college transcript request form

Find out other Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors