Texas Ag Exemption Form

What is the Texas Ag Exemption Form

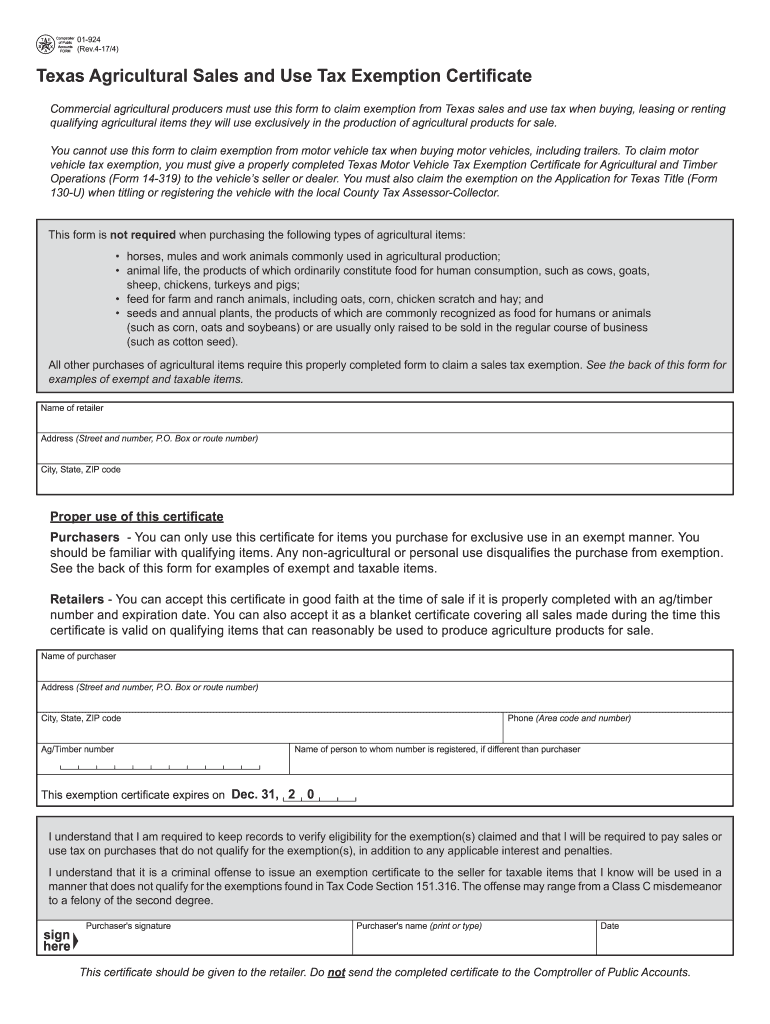

The Texas Ag Exemption Form, commonly referred to as the 01 924 form, is a crucial document for agricultural producers in Texas. This form allows eligible individuals and businesses to claim exemptions from certain sales taxes on purchases related to agricultural production. The exemption applies to items such as feed, seed, and equipment used in the production of agricultural products. Understanding the purpose and legal implications of this form is essential for anyone involved in the agricultural sector in Texas.

How to use the Texas Ag Exemption Form

Using the Texas Ag Exemption Form involves several straightforward steps. First, ensure that you meet the eligibility criteria, which typically include being engaged in agricultural production. Next, download or obtain the form from the appropriate state agency. Fill out the form carefully, providing accurate information about your agricultural activities and the items you intend to purchase tax-free. Once completed, present the form to the seller at the time of purchase to claim your exemption. It is important to keep a copy of the form for your records.

Steps to complete the Texas Ag Exemption Form

Completing the Texas Ag Exemption Form requires attention to detail. Follow these steps to ensure proper completion:

- Gather necessary information, including your name, address, and details about your agricultural operation.

- Clearly specify the items for which you are claiming the exemption.

- Sign and date the form to certify that the information provided is accurate and truthful.

- Submit the form to the seller at the time of purchase.

Double-check all entries for accuracy to avoid any issues during the exemption process.

Eligibility Criteria

To qualify for the Texas Ag Exemption Form, applicants must meet specific eligibility criteria. Generally, individuals or entities must be engaged in the production of agricultural products for sale. This includes farmers, ranchers, and certain agricultural businesses. Additionally, the items purchased must be directly related to agricultural production to qualify for the exemption. It is advisable to review the state’s guidelines to ensure compliance with all requirements.

Required Documents

When applying for the Texas Ag Exemption Form, certain documents may be required to verify your eligibility. These can include:

- Proof of agricultural production, such as receipts or invoices.

- Identification documents that establish your identity and business status.

- Any additional documentation specified by the Texas Comptroller’s office.

Having these documents ready can facilitate a smoother application process and help ensure that your exemption is granted without delay.

Legal use of the Texas Ag Exemption Form

The legal use of the Texas Ag Exemption Form is governed by state tax laws. It is essential to use the form only for its intended purpose—claiming exemptions on purchases related to agricultural production. Misuse of the form, such as using it for non-eligible items, can result in penalties or legal consequences. Therefore, understanding the legal framework surrounding the form is critical for compliance and to avoid potential issues with tax authorities.

Quick guide on how to complete texas ag exemption form

Complete Texas Ag Exemption Form effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Texas Ag Exemption Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Texas Ag Exemption Form with ease

- Find Texas Ag Exemption Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Texas Ag Exemption Form and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas ag exemption form

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is the 924 Texas form and how can airSlate SignNow assist with it?

The 924 Texas form is a document used for various official purposes in Texas. airSlate SignNow simplifies the process of filling out and signing the 924 Texas form, enabling users to manage their documentation efficiently in a digital format.

-

Is airSlate SignNow cost-effective for managing the 924 Texas form?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to complete the 924 Texas form. With a range of pricing plans, users can choose the option that best fits their needs without sacrificing quality or functionality.

-

What features does airSlate SignNow offer for the 924 Texas form?

airSlate SignNow provides features like eSigning, customizable templates, and document tracking that are essential for handling the 924 Texas form. These tools help streamline the entire document process from creation to completion.

-

Can I integrate airSlate SignNow with other applications for the 924 Texas form?

Absolutely! airSlate SignNow offers integration capabilities with various applications, making it easy to manage the 924 Texas form alongside your existing workflow. This seamless integration enhances efficiency and ensures a smooth transition between platforms.

-

What are the benefits of using airSlate SignNow for the 924 Texas form?

Using airSlate SignNow for the 924 Texas form brings several benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that all signatures and related data are stored securely, providing peace of mind for businesses.

-

How does airSlate SignNow ensure the security of the 924 Texas form?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This means that when working with the 924 Texas form, users can trust that their information is protected throughout the signing process.

-

Is there customer support available for questions about the 924 Texas form?

Yes, airSlate SignNow offers robust customer support to assist users with any questions regarding the 924 Texas form. Whether you need help with features or troubleshooting, our support team is ready to assist you.

Get more for Texas Ag Exemption Form

Find out other Texas Ag Exemption Form

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed