T D 9091 Uncle Fed's Tax *Board Form

What is the T D 9091 Uncle Fed's Tax Board?

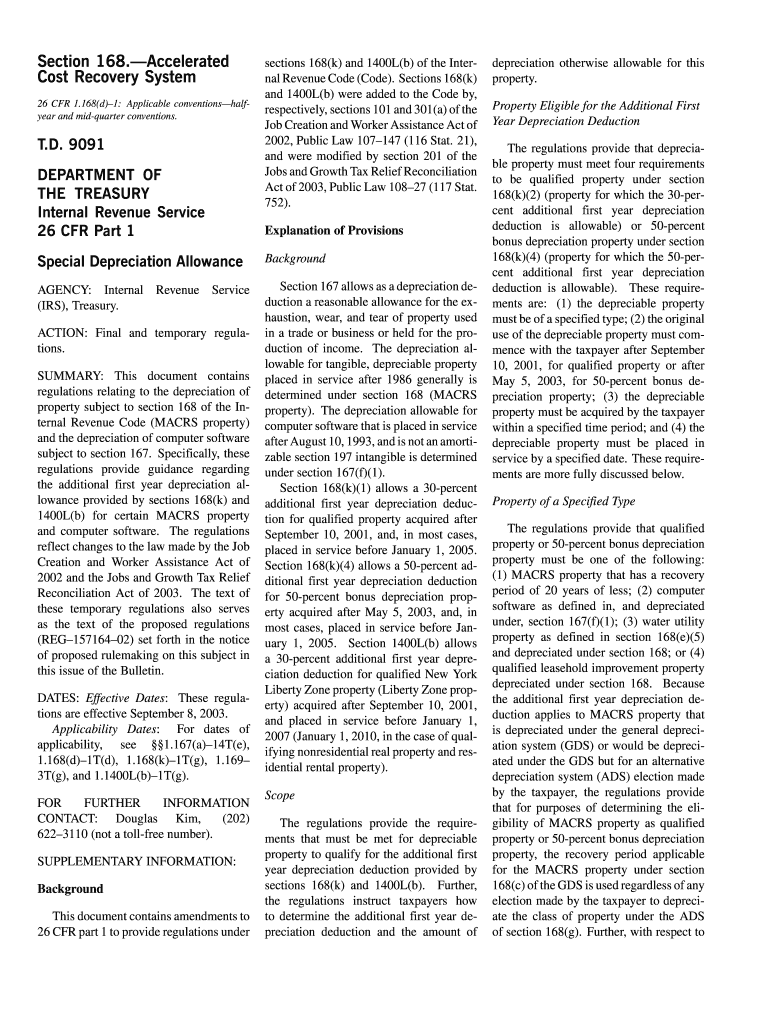

The T D 9091 Uncle Fed's Tax Board is a specific form used for tax reporting and compliance in the United States. It is designed to assist taxpayers in accurately reporting their income and fulfilling their tax obligations. This form is particularly relevant for individuals and entities that need to provide detailed financial information to the Internal Revenue Service (IRS). Understanding the purpose and requirements of this form is crucial for ensuring compliance and avoiding potential penalties.

Steps to Complete the T D 9091 Uncle Fed's Tax Board

Completing the T D 9091 Uncle Fed's Tax Board involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Carefully read the instructions provided with the form to understand the specific requirements.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the appropriate method, whether online, by mail, or in person.

Legal Use of the T D 9091 Uncle Fed's Tax Board

The T D 9091 Uncle Fed's Tax Board is legally recognized as a valid document for tax reporting purposes. When completed correctly, it serves as an official record of a taxpayer's financial activities for the year. Compliance with IRS regulations is essential to ensure the form's legal standing. This includes adhering to deadlines and accurately reporting all required information to avoid issues with tax authorities.

Required Documents for the T D 9091 Uncle Fed's Tax Board

To complete the T D 9091 Uncle Fed's Tax Board, taxpayers must provide several key documents, including:

- W-2 forms from employers showing annual earnings.

- 1099 forms for any freelance or contract work.

- Records of any additional income sources, such as dividends or interest.

- Receipts for deductible expenses, if applicable.

Form Submission Methods

The T D 9091 Uncle Fed's Tax Board can be submitted through various methods, allowing flexibility for taxpayers:

- Online: Many taxpayers opt to file electronically using approved e-filing software.

- By Mail: Completed forms can be sent to the appropriate IRS address based on the taxpayer's location.

- In Person: Taxpayers may also choose to submit their forms at designated IRS offices.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the T D 9091 Uncle Fed's Tax Board. These guidelines include instructions on how to fill out each section of the form, what documentation is required, and the deadlines for submission. Adhering to these guidelines is crucial for ensuring that the form is accepted and processed without issues.

Quick guide on how to complete td 9091 uncle feds tax board

Effortlessly Prepare T D 9091 Uncle Fed's Tax *Board on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Handle T D 9091 Uncle Fed's Tax *Board on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign T D 9091 Uncle Fed's Tax *Board with Ease

- Find T D 9091 Uncle Fed's Tax *Board and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searching, or errors requiring new document prints. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Edit and eSign T D 9091 Uncle Fed's Tax *Board while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

What percent of people don't have the intelligence to fill out tax forms?

Recent statistics that I've seen indicate that about 66% of electronically filed returns are filed by paid preparers. This doesn't necessarily mean that these filers don't have the intelligence but it does indicate that they have a level of discomfort and anxiety and prefer the solace of having a paid preparer fill out and transmit the forms. It all depends on the level of complexity of the form. For the young wage earner living at home with his or her parents, who is able to operate a computer and can operate simple tax return software, I would think that 80% should be intelligent enough to fill out tax forms. Especially because the software is designed to prompt and assist (and check the arithmetic).One of America's most respected jurists, Judge Learned Hand, offers a more thoughtful observation on the law of taxation: ‘In my own case the words of such an act as the Income Tax ... merely dance before my eyes in a meaningless procession; cross-reference to cross-reference, exception upon exception—couched in abstract terms that offer no handle to seize hold of—leave in my mind only a confused sense of some vitally important, but successfully concealed, purport, which it is my duty to extract, but which is within my power, if at all, only after the most inordinate expenditure of time. I know that these monsters are the result of fabulous industry and ingenuity, plugging up this hole and casting out that net, against all possible evasion; yet at times I cannot help recalling a saying of William James about certain passages of Hegal [sic]: that they were no doubt written with a passion of rationality; but that one cannot help wondering whether to the reader they have any significance save that the words are strung together with syntactical correctness.’ Ruth Realty Co. v. Horn, 222 Or. 290, 353 P.2d 524, 526 n. 2 (Or. 1960) (citing 57 Yale L.J. 167, 169 (1947)), overruled on other grounds by Parr v. DOR, 276 Or. 113, 553 P.2d 1051 (Or. 1976). The Humorist Dave Barry had this observation "The IRS is working hard to develop a tax form so scary that merely reading it will cause the ordinary taxpayer's brain to explode.” His candidate for the best effort so far is Schedule J Form 1118 "Separate Limitation Loss Allocations and Other Adjustments Necessary to Determine Numerators of Limitations fraction, Year end Recharacterization Balance and Overall Foreign Loss Account Balances"And don’t forget this observation from Albert Einstein “The hardest thing to understand in the world is the income tax. “ So if Al had trouble understanding taxes, I don't see how a mere mortal has any chance.

-

How can my employer charge me taxes when I didn't fill out any form (like W2, W4, or W9)?

**UPDATE** After my answer was viewed over 4,100 times without a single upvote, I revisited it to see where I might have gone wrong with it. Honestly, it seems like a reasonable answer: I explained what each of the forms asked about is for and even suggested getting further information from a licensed tax preparer. BUT, I’m thinking I missed the underlying concern of the querent with my answer. Now I’m reading that they don’t care so much about the forms as they do about the right or, more accurately, the obligation of their employer to withhold taxes at all.So let me revise my answer a bit…Your employer doesn’t charge you taxes - the government does. The government forces employers to withhold (or charge, as you put it) taxes from the earnings of their employees by threatening fines and even jail time for failing to do so (or for reclassifying them as independent contractors in order to avoid the withholding and matching requirements). Whether you fill out any forms or not, employers will withhold taxes because they don’t want to be fined or go to jail.Now the meta-question in the question is how can the government tax its citizen’s income? Well, that’s a big debate in America. Tax is the only way governments make money and they use that money to provide services for their constituency. Without funding, no federal or state or county program, or employee, would exist. But still, some people believe taxation is illegal, unjustified, and flat out wrong. They believe that free market forces should fund the military, the Coast Guard, Department of Defense, Veterans Affairs, Border Patrol, the FBI, CIA, DEA, FDA, USDA, USPS, the Federal Prison Complex, the National Park Service, the Interstate Highway System, air traffic control, and the Judiciary (just to name a few things). They even believe paying politicians for the work they do, like the President and Congress, is wrong.Others (luckily, most of us) appreciate paying taxes, even if they seem a bit steep at times. We’re happy to benefit from all the things our tax dollars buy us and we feel what we pay gives us back returns far greater than our investment. If you’re on the fence about this issue, consider how expensive health care is and how much you’re getting out of paying for it privately (out of your own paycheck). Same with your education or that of your children. Do you pay for private schools? Private colleges? Do you pay for private child care too? All expensive, right?Well what if we had to pay for private fire fighting? Or all mail had to be shipped via FedEx or UPS? Or if the cost of a plane ticket to anywhere doubled because we had to pay out-of-pocket for air traffic control? What about the military, border control and veterans? How much are you willing to pay out of every paycheck DIRECTLY to the department of defense AND veterans affairs? If we privatized the military, would we still be able to afford $30 billion dollar fighter jets? Who would pay to defend us?I bet people living paycheck to paycheck would be hard pressed to find extra money to pay for the military, when they’re already spending so much for teachers, schools, health care, local emergency response, food safety inspections, social workers, the criminal justice system, road repairs and construction, bridge inspection and maintenance, and natural disaster remediation (just to name a few things).Think about if all the national and local parks were privatized. Visiting one would cost as much or more than it does to go to Disneyland. Think about how much more food would cost if farmers weren’t subsidized and food wasn’t inspected for safety. Imagine how devastating a pandemic would be without the Center for Disease Control to monitor and mitigate illness outbreaks.We all take for granted the myriad of benefits we get from paying taxes. We may like to gripe and moan but taxes aren’t just for the public good, they’re for our own. (That rhymes!)**END OF UPDATE**W-9 forms are what you fill out to verify your identification, or citizenship status, for your employers. They have nothing to do with payroll taxes other than being the primary tool to from which to glean the correct spelling of your name and your Social Security number.W-2 forms are issued by employers to employees for whom they paid the required payroll taxes to the government on their behalf. The W-2 also details the amount of a person’s pay was sent to the government to fund their Social Security and Medicare accounts. W-2 forms are necessary for people when filing their personal income taxes so they can calculate if they under or overpaid.W-4 forms are filled out by employees to assure that the appropriate amount of pay is being withheld (and transferred on their behalf) by their employers to the government. If you don’t fill out a W-4 then your employer withholds the standard default amount for a single individual. You can update your W-4 at any time with your employer and you may want to when the size of your household changes.Even if you aren’t an employee (like you get paid without taxes being withheld for you) and are issued a 1099-MISC form instead of a W-2, you’re STILL responsible for paying your taxes as you earn that money - in no greater than quarterly installments. If you go over three months without paying taxes when you’re making money - whether your employer is withholding it and paying it on your behalf or you just made the money and no one took any taxes out for you - you’ll be fined and charged interest on your late tax payments.Talk with a licensed tax preparer and they can help you better understand what it all means. Good luck and happy tax season!

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I fill out the Navy TES form if I don't have my 12th boards marksheet?

For filling the form u do not need marksheet .But yes ,if ur shortlisted (based on JEE MAIN RANK/MARK) u will have to produce ur mark sheet before the SSB .If u do not have it u can produce a bonifide certificate and attestated copy of 12 marksheet.U have to specify the reason for not having the marksheet.If u have given it in ur college /job ,u have to get the bonafide from them.If lost contact ur school and get it from them.If lost u have to register a complain in the police station and have the letter ,it will help.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

Create this form in 5 minutes!

How to create an eSignature for the td 9091 uncle feds tax board

How to make an electronic signature for the Td 9091 Uncle Feds Tax Board online

How to generate an eSignature for your Td 9091 Uncle Feds Tax Board in Google Chrome

How to make an electronic signature for signing the Td 9091 Uncle Feds Tax Board in Gmail

How to create an electronic signature for the Td 9091 Uncle Feds Tax Board straight from your smart phone

How to generate an electronic signature for the Td 9091 Uncle Feds Tax Board on iOS devices

How to create an eSignature for the Td 9091 Uncle Feds Tax Board on Android devices

People also ask

-

What services does the TD Recovery Department offer?

The TD Recovery Department provides comprehensive support for managing debt recovery processes. They assist businesses in streamlining their collections while ensuring compliance with relevant regulations. By leveraging technology, they can enhance the efficiency of your recovery efforts.

-

How does airSlate SignNow integrate with the TD Recovery Department?

airSlate SignNow seamlessly integrates with the TD Recovery Department by enabling easy document sharing and eSigning. This integration allows businesses to manage and finalize recovery agreements directly through a secured platform, improving operational efficiency. With templates and automation, it simplifies the recovery process.

-

What are the pricing options for services related to the TD Recovery Department?

Pricing for the TD Recovery Department services varies based on the scope of services needed. airSlate SignNow offers competitive pricing plans that can accommodate businesses of all sizes. To get the best value, businesses are encouraged to review the various packages and select one that meets their recovery needs.

-

Can small businesses benefit from the TD Recovery Department?

Absolutely! The TD Recovery Department tailors its services to fit businesses of all sizes, including small enterprises. With cost-effective solutions like airSlate SignNow, small businesses can efficiently manage their document processes and recover debts with ease, without straining their budgets.

-

What features make airSlate SignNow ideal for the TD Recovery Department?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows, making it an ideal solution for the TD Recovery Department. These tools help users expedite document management, enhance compliance, and improve communication with clients. The user-friendly interface benefits both staff and clients alike.

-

Is the TD Recovery Department compliant with legal regulations?

Yes, the TD Recovery Department ensures that all its processes are compliant with relevant legal regulations. By utilizing airSlate SignNow, businesses can be confident that their document handling follows industry standards, which is crucial in recovery operations. Compliance reduces risks and ensures smoother transactions.

-

What benefits can businesses expect when using the TD Recovery Department?

Businesses utilizing the TD Recovery Department can expect improved efficiency in their collection processes. With the advanced tools from airSlate SignNow, response times improve, and customer experience is enhanced, resulting in faster recovery rates. Overall, businesses can see a positive impact on their cash flow.

Get more for T D 9091 Uncle Fed's Tax *Board

Find out other T D 9091 Uncle Fed's Tax *Board

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement