DRS IP 989, Q & a Attorney's Occupational Tax CT Gov Form

Understanding the DRS IP 989, Q & A Attorney's Occupational Tax

The DRS IP 989, Q & A Attorney's Occupational Tax is a document issued by the Connecticut Department of Revenue Services (DRS) that outlines the tax obligations for attorneys operating within the state. This form is essential for ensuring compliance with state tax regulations, particularly for those who earn income through legal services. It provides clarity on the tax rates applicable to attorneys and the specific requirements for filing.

Steps to Complete the DRS IP 989, Q & A Attorney's Occupational Tax

Completing the DRS IP 989 involves several key steps:

- Gather necessary personal and business information, including your name, address, and taxpayer identification number.

- Review the instructions provided with the form to understand the specific tax obligations and rates applicable to your situation.

- Fill out the form accurately, ensuring that all required fields are completed.

- Calculate the total tax owed based on your reported income from legal services.

- Submit the completed form either online, by mail, or in person, depending on your preference and the guidelines provided by the DRS.

Required Documents for the DRS IP 989

To successfully file the DRS IP 989, you will need to prepare several documents:

- Your taxpayer identification number or Social Security number.

- Records of income earned from legal services during the tax year.

- Any previous tax filings that may affect your current obligations.

- Supporting documentation that verifies your business expenses, if applicable.

Legal Use of the DRS IP 989

The DRS IP 989 serves a crucial legal purpose by ensuring that attorneys comply with state tax laws. Filing this form accurately helps avoid penalties and legal issues related to tax evasion. It is important for attorneys to understand that failure to file or inaccuracies in reporting can lead to audits or legal repercussions.

Form Submission Methods

The DRS IP 989 can be submitted through various methods to accommodate different preferences:

- Online: Many attorneys opt to file electronically through the DRS online portal, which offers a streamlined process.

- Mail: You can print the completed form and send it to the designated address provided by the DRS.

- In-Person: Attorneys may also choose to submit their forms directly at a local DRS office for immediate processing.

Penalties for Non-Compliance

Failing to comply with the requirements of the DRS IP 989 can result in significant penalties. These may include:

- Fines for late filing or underreporting income.

- Interest on unpaid taxes, which can accumulate over time.

- Potential legal action from the state for persistent non-compliance.

Quick guide on how to complete drs ip 989 q ampamp a attorneys occupational tax ctgov

Prepare DRS IP 989, Q & A Attorney's Occupational Tax CT gov effortlessly on any device

Online document administration has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without any hold-ups. Manage DRS IP 989, Q & A Attorney's Occupational Tax CT gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The easiest method to modify and eSign DRS IP 989, Q & A Attorney's Occupational Tax CT gov without difficulty

- Locate DRS IP 989, Q & A Attorney's Occupational Tax CT gov and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you'd like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign DRS IP 989, Q & A Attorney's Occupational Tax CT gov and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the drs ip 989 q ampamp a attorneys occupational tax ctgov

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

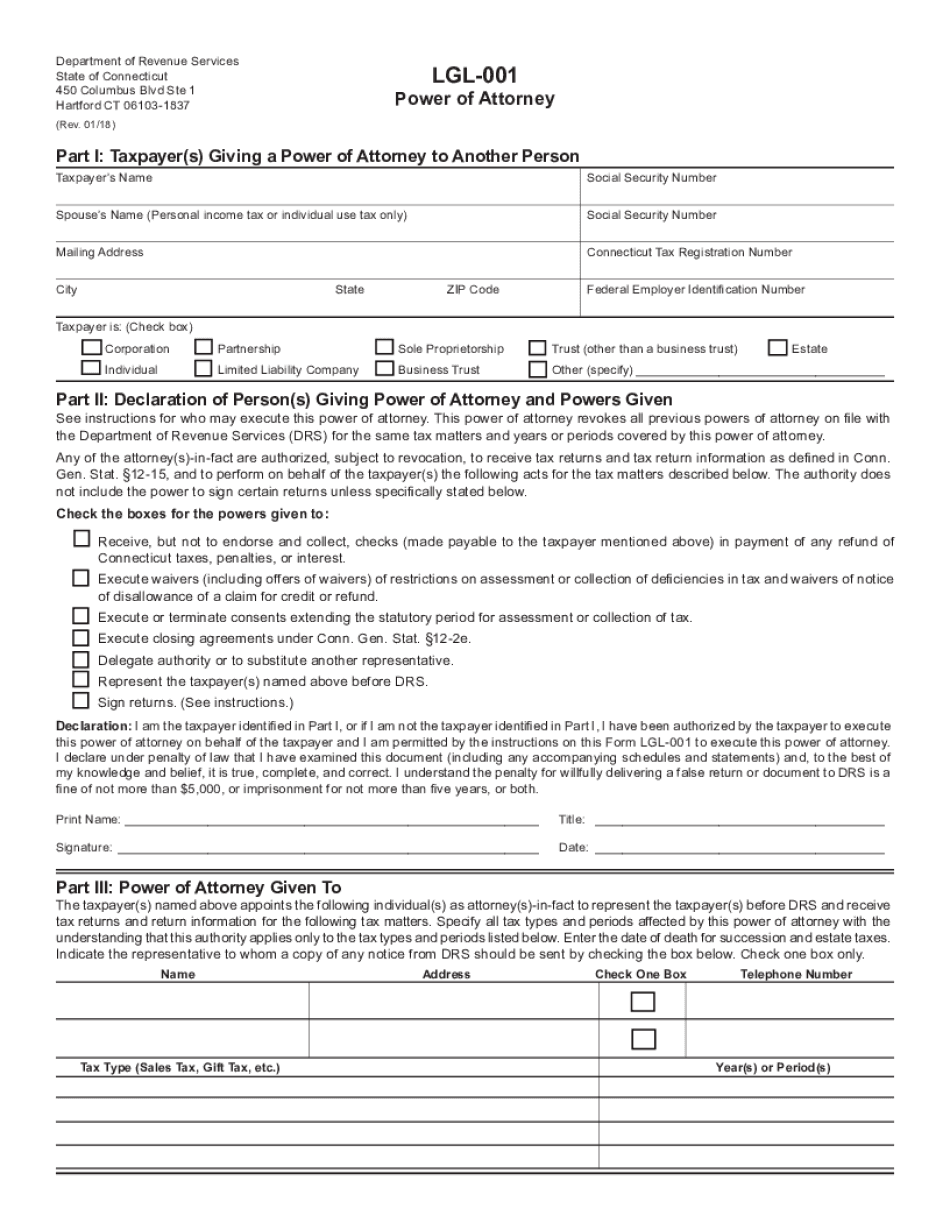

What is the form lgl 001 and how can it benefit my business?

The form lgl 001 is a legal document template designed for businesses that simplifies the signing process. By using airSlate SignNow, you can streamline document workflows and ensure faster turnaround times. This not only enhances productivity but also improves compliance with legal standards.

-

How much does it cost to use airSlate SignNow for the form lgl 001?

airSlate SignNow offers competitive pricing plans to fit various business needs. For the form lgl 001, you can choose from different subscription options that provide access to essential features. Overall, it remains a cost-effective solution to manage your legal documents efficiently.

-

Does airSlate SignNow offer any integrations for the form lgl 001?

Yes, airSlate SignNow supports numerous integrations that can enhance the functionality of the form lgl 001. Whether you need to connect to CRMs, cloud storage, or other tools, you can seamlessly integrate them within the platform. This ensures that your workflows are optimized and documents are easily accessible.

-

What features are available for the form lgl 001 in airSlate SignNow?

The form lgl 001 in airSlate SignNow comes with features like customizable templates, electronic signatures, and audit trails. These tools empower you to manage and track document signing securely. Additionally, the platform is user-friendly, making it easy for anyone to navigate.

-

How secure is the form lgl 001 when using airSlate SignNow?

The form lgl 001 is handled with the highest level of security through airSlate SignNow’s robust encryption protocols. This ensures that your documents are protected at all stages of the signing process. Compliance with data protection regulations is also a priority, giving you peace of mind.

-

Can I customize the form lgl 001 for my business needs?

Absolutely! airSlate SignNow allows you to customize the form lgl 001 to fit your specific requirements. You can modify fields, add branding elements, and configure settings to ensure the document aligns perfectly with your business processes.

-

Is there a mobile app for managing the form lgl 001?

Yes, airSlate SignNow offers a mobile app that allows you to manage the form lgl 001 on the go. This is particularly useful for businesses looking to facilitate remote work and ensure that essential documents can be signed anytime, anywhere. The mobile experience is streamlined and user-friendly.

Get more for DRS IP 989, Q & A Attorney's Occupational Tax CT gov

- Tpp accafia student details form

- Erika insurance form

- Sam greer place housing co operative form

- Nc 4 employees withholding 11 15 allowance certificate ecsu form

- Information technology services change management request form pvamu

- Corrective deed nj form

- Cbrf medication administration training form

- County of hanover virginia application for high mileage discount tax form

Find out other DRS IP 989, Q & A Attorney's Occupational Tax CT gov

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document