Income Tax Return, Audited Financial Statements, Bookeeping Form

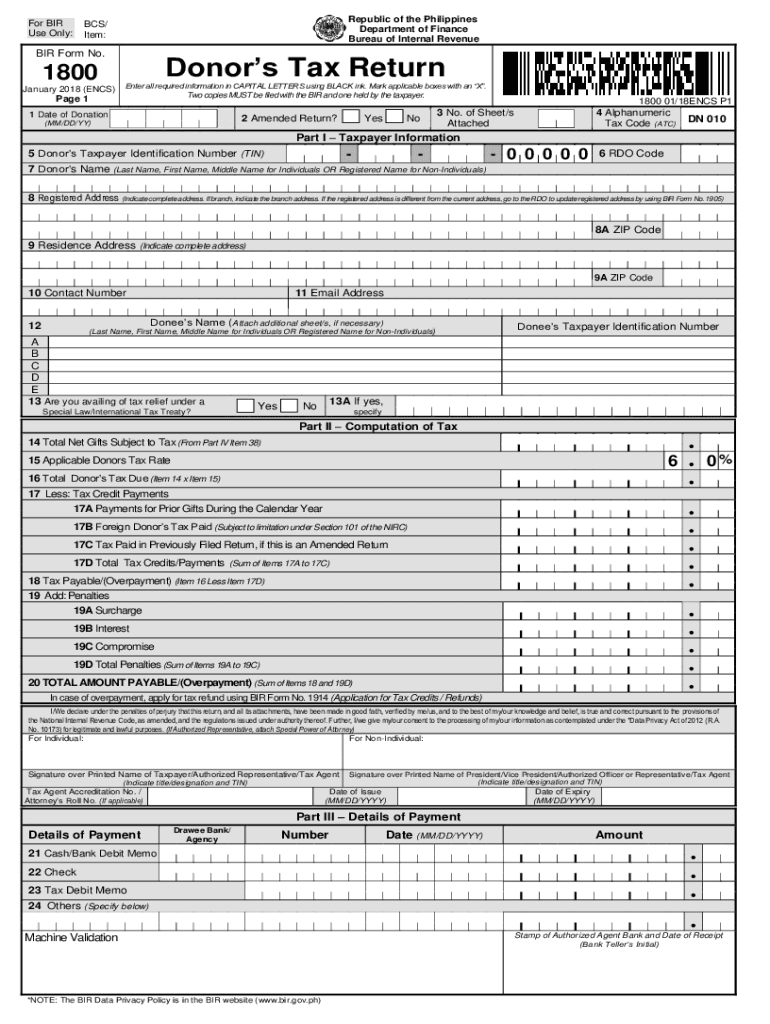

What is the bir form 1800?

The bir form 1800, also known as the donor's tax return, is a crucial document used in the United States for reporting the transfer of property or assets from one individual to another without receiving any compensation in return. This form is particularly relevant for individuals who have made significant gifts or donations, as it helps determine the tax obligations associated with such transfers. The bir form 1800 is essential for compliance with federal tax regulations and ensures that both the donor and recipient fulfill their respective tax responsibilities.

Steps to complete the bir form 1800

Completing the bir form 1800 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the donor and recipient, including their names, addresses, and taxpayer identification numbers. Next, detail the assets being transferred, including their fair market value at the time of the gift. It is also important to indicate any deductions or exemptions that may apply. Once all information is accurately filled out, review the form for completeness before submitting it to the appropriate tax authority.

IRS Guidelines for the bir form 1800

The Internal Revenue Service (IRS) provides specific guidelines for completing and filing the bir form 1800. These guidelines include instructions on determining the fair market value of the donated assets, eligibility for exclusions, and the deadlines for submission. Understanding these guidelines is essential for ensuring compliance and avoiding potential penalties. The IRS also emphasizes the importance of maintaining accurate records of all gifts made, as these may be required for future reference or audits.

Filing Deadlines for the bir form 1800

Filing deadlines for the bir form 1800 are critical to avoid penalties and ensure compliance with tax regulations. Generally, the form must be submitted by the due date of the donor's income tax return for the year in which the gift was made. If the donor is unable to meet this deadline, they may request an extension, but it is important to understand that extensions do not apply to the payment of any taxes owed. Keeping track of these deadlines is essential for both donors and recipients to maintain good standing with tax authorities.

Required Documents for the bir form 1800

When preparing to file the bir form 1800, several documents are required to support the information provided. These may include proof of the donor's identity, documentation of the assets being transferred, and any appraisals that establish the fair market value of the gifts. Additionally, it may be necessary to include prior tax returns or other financial statements that provide context for the transaction. Having these documents ready can facilitate a smoother filing process and help ensure compliance with IRS requirements.

Penalties for Non-Compliance with the bir form 1800

Failure to comply with the requirements associated with the bir form 1800 can result in significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal repercussions for failing to report taxable gifts. It is crucial for both donors and recipients to understand their obligations and ensure timely and accurate submission of the form to avoid these penalties. Regularly reviewing IRS guidelines can help mitigate the risk of non-compliance.

Quick guide on how to complete income tax return audited financial statements bookeeping

Finish Income Tax Return, Audited Financial Statements, Bookeeping seamlessly on any gadget

Digital document management has risen in prominence among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, as you can obtain the necessary format and securely keep it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your documents swiftly without any hold-ups. Handle Income Tax Return, Audited Financial Statements, Bookeeping on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Income Tax Return, Audited Financial Statements, Bookeeping effortlessly

- Obtain Income Tax Return, Audited Financial Statements, Bookeeping and then click Access Form to start.

- Utilize the tools we provide to finalize your document.

- Emphasize crucial parts of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Signature tool, which takes moments and has the same legal validity as a conventional handwritten signature.

- Review all the information and then click on the Complete button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or shareable link, or download it to your computer.

Eliminate the worry of missing or lost documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any gadget you select. Modify and eSign Income Tax Return, Audited Financial Statements, Bookeeping and guarantee excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax return audited financial statements bookeeping

The way to make an eSignature for a PDF online

The way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is the bir form 1800, and why is it important?

The bir form 1800 is a tax form used in various industries for reporting income taxes. Understanding the bir form 1800 is crucial for businesses to ensure compliance with tax regulations and avoid potential penalties. airSlate SignNow can help streamline the process of signing and submitting this form.

-

How does airSlate SignNow simplify completing the bir form 1800?

airSlate SignNow provides an intuitive platform that allows users to fill out and eSign the bir form 1800 quickly and easily. With our user-friendly interface, businesses can navigate the form with ease, reducing the time spent on administrative tasks.

-

What features does airSlate SignNow offer for managing the bir form 1800?

airSlate SignNow offers features such as editable templates, electronic signatures, and secure cloud storage for managing the bir form 1800. These features help businesses save time and ensure their documents are always accessible and compliant.

-

Is there a cost associated with using airSlate SignNow for the bir form 1800?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to be cost-effective while providing the necessary tools to effectively manage the bir form 1800 and other documents.

-

Can airSlate SignNow integrate with other software to assist with the bir form 1800?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRMs and accounting software. This integration makes it easier to manage the bir form 1800 alongside your existing workflows, enhancing productivity.

-

What are the benefits of using airSlate SignNow for the bir form 1800?

Using airSlate SignNow for the bir form 1800 offers several benefits, including faster processing times, reducing errors, and enhanced security. Your documents are digitally signed and stored securely, helping your business comply with tax requirements efficiently.

-

How secure is airSlate SignNow when handling the bir form 1800?

Security is a top priority for airSlate SignNow. We employ industry-leading encryption and security protocols to protect your sensitive information within the bir form 1800, ensuring that your data remains safe from unauthorized access.

Get more for Income Tax Return, Audited Financial Statements, Bookeeping

- Boatus foundation chapter 1 worksheet answers form

- Yes bank a2 form

- Asha ceu form

- Form 10i 26216442

- Form w 3c rev june transmittal of corrected wage and tax statements

- B 200 25 withholding tax on owners of a pass through entity form

- Rural health care practitioner tax credit form

- New solar market development tax credit claim form

Find out other Income Tax Return, Audited Financial Statements, Bookeeping

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors