Form W 9 SP Rev February Request for Taxpayer Identification Number and Certificate Spanish Version Irs

Understanding the W-9 Form Purpose

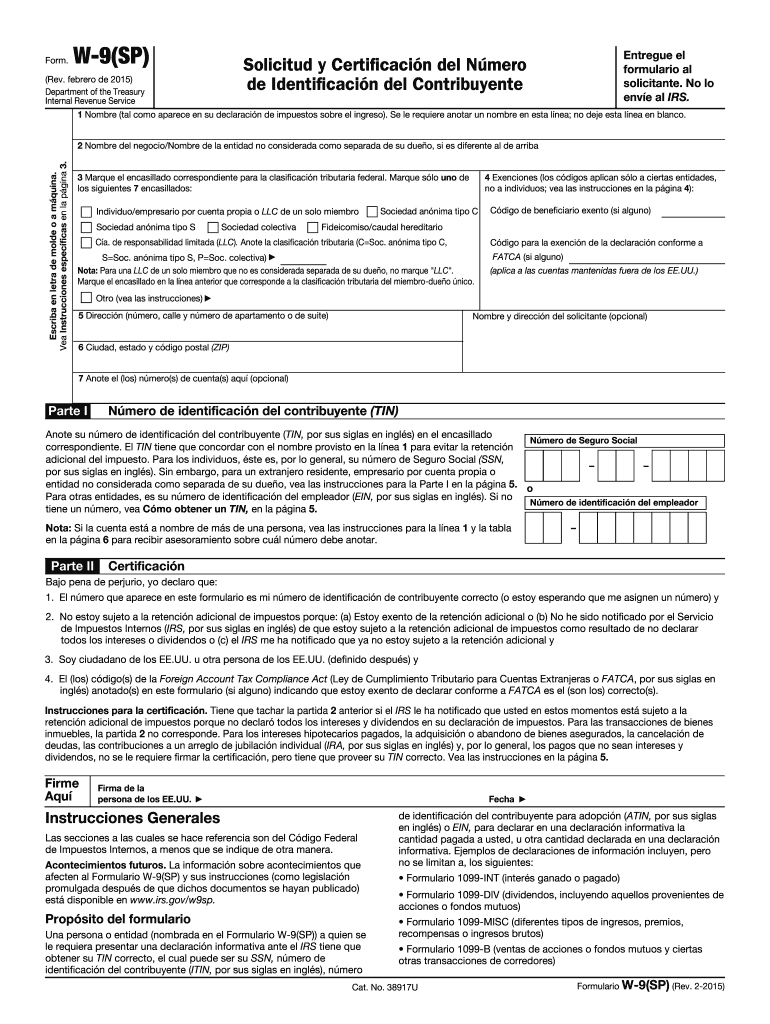

The W-9 form, officially known as the Request for Taxpayer Identification Number and Certification, serves a crucial role in the U.S. tax system. It is primarily used by individuals and businesses to provide their taxpayer identification number (TIN) to entities that are required to report income paid to them. This form is essential for ensuring proper tax reporting and compliance with Internal Revenue Service (IRS) regulations.

Key Elements of the W-9 Form

The W-9 form includes several key components that are vital for accurate completion. These elements consist of:

- Name: The legal name of the individual or business entity.

- Business Name (if applicable): The name under which the business operates, if different from the legal name.

- Tax Classification: The entity type, such as individual, corporation, partnership, etc.

- Taxpayer Identification Number (TIN): This can be a Social Security Number (SSN) or Employer Identification Number (EIN).

- Address: The complete mailing address where the entity can be reached.

Steps to Complete the W-9 Form

Filling out the W-9 form involves a straightforward process. Here are the steps to ensure proper completion:

- Provide your name and business name, if applicable.

- Select the appropriate tax classification that matches your entity type.

- Enter your TIN accurately, ensuring it matches IRS records.

- Fill in your address, including city, state, and ZIP code.

- Sign and date the form to certify that the information provided is correct.

Legal Use of the W-9 Form

The W-9 form is legally binding once signed. It certifies that the taxpayer identification number provided is correct and that the individual is not subject to backup withholding. This form is often requested by businesses when hiring independent contractors or freelancers to ensure compliance with tax reporting requirements.

IRS Guidelines for the W-9 Form

The IRS provides specific guidelines regarding the use and submission of the W-9 form. It is essential to keep up to date with any changes in IRS regulations that may affect how the form is completed or submitted. Generally, the form should be provided to the requester and not submitted directly to the IRS, unless specifically instructed.

Examples of Using the W-9 Form

The W-9 form is commonly used in various scenarios, such as:

- Independent contractors providing services to businesses.

- Freelancers receiving payments for their work.

- Individuals receiving interest or dividends from banks or investment firms.

- Real estate transactions where a TIN is required for reporting purposes.

Quick guide on how to complete form w 9 sp rev february 2015 request for taxpayer identification number and certificate spanish version irs

Easily prepare Form W 9 SP Rev February Request For Taxpayer Identification Number And Certificate Spanish Version Irs on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form W 9 SP Rev February Request For Taxpayer Identification Number And Certificate Spanish Version Irs on any device using airSlate SignNow's Android or iOS applications and enhance your document-based workflow today.

Effortlessly modify and eSign Form W 9 SP Rev February Request For Taxpayer Identification Number And Certificate Spanish Version Irs

- Find Form W 9 SP Rev February Request For Taxpayer Identification Number And Certificate Spanish Version Irs and click Get Form to begin.

- Use the tools available to complete your document.

- Mark relevant sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Form W 9 SP Rev February Request For Taxpayer Identification Number And Certificate Spanish Version Irs and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 9 sp rev february 2015 request for taxpayer identification number and certificate spanish version irs

How to create an eSignature for a PDF online

How to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the primary w 9 form purpose?

The primary w 9 form purpose is to provide the IRS with a taxpayer's correct name, address, and taxpayer identification number. This form is essential for reporting income paid to independent contractors and ensuring compliance with tax obligations. Understanding the w 9 form purpose helps both businesses and freelancers navigate their tax responsibilities more efficiently.

-

How does airSlate SignNow assist with the w 9 form purpose?

airSlate SignNow streamlines the process of completing and signing the w 9 form, making it easy for businesses to gather necessary tax information. With our electronic signature capabilities, users can fill out and send the w 9 form quickly, reducing paperwork and saving time. Our platform ensures that the form is securely stored and easily accessible when needed.

-

Is there a cost associated with using airSlate SignNow for the w 9 form?

Yes, airSlate SignNow offers a variety of pricing plans to suit different business needs, all of which include features to support the w 9 form purpose. Our competitive pricing ensures that businesses can efficiently manage their document signing and compliance processes without breaking the bank. You can choose a plan that fits your budget while enabling you to fulfill the w 9 form purpose efficiently.

-

What features does airSlate SignNow offer for managing w 9 forms?

airSlate SignNow offers several features that enhance the management of w 9 forms, including customizable templates and easy electronic signing. Users can also track the status of their w 9 form submissions, ensuring timely processing. Our platform is designed to simplify compliance with the w 9 form purpose while enhancing user experience.

-

Can I integrate airSlate SignNow with other tools for w 9 forms?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing the way you handle w 9 forms. This allows businesses to incorporate the w 9 form purpose into their existing workflows easily. Integration with tools like CRM and accounting software ensures that data flows smoothly, minimizing errors and improving efficiency.

-

How secure is the information submitted on a w 9 form using airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when it comes to sensitive documents like the w 9 form. Our platform employs advanced encryption and secure storage measures, ensuring that your information is protected at all times. You can confidently manage the w 9 form purpose, knowing that your data is safe and compliant.

-

What benefits does eSigning a w 9 form provide?

eSigning a w 9 form offers numerous benefits, including convenience and speed. With airSlate SignNow, users can complete and sign the w 9 form from anywhere, facilitating quick onboarding of independent contractors. This efficiency helps businesses meet the w 9 form purpose without unnecessary delays.

Get more for Form W 9 SP Rev February Request For Taxpayer Identification Number And Certificate Spanish Version Irs

Find out other Form W 9 SP Rev February Request For Taxpayer Identification Number And Certificate Spanish Version Irs

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document