Publication 1 KO Rev 09 Your Rights as a Taxpayer Korean Version Form

What is the Publication 1 KO Rev 09 Your Rights As A Taxpayer Korean Version

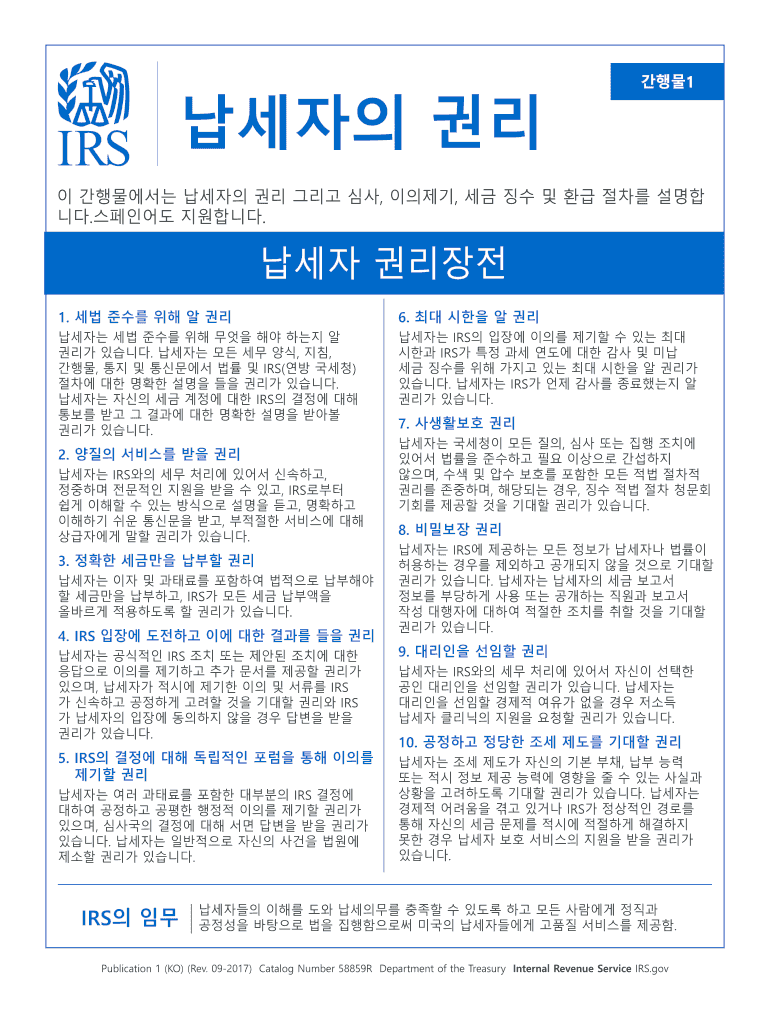

The Publication 1 KO Rev 09 Your Rights As A Taxpayer Korean Version is a vital document that outlines the rights of taxpayers in the United States. This publication serves as a resource for Korean-speaking individuals, providing essential information about taxpayer rights, responsibilities, and the processes involved in tax-related matters. It aims to ensure that all taxpayers are informed about their entitlements and the protections available to them under U.S. tax law.

How to use the Publication 1 KO Rev 09 Your Rights As A Taxpayer Korean Version

Using the Publication 1 KO Rev 09 Your Rights As A Taxpayer Korean Version involves understanding the content and applying it to your specific tax situation. Taxpayers should read through the document to familiarize themselves with their rights, including the right to appeal, the right to privacy, and the right to receive assistance. It is important to reference this publication when interacting with tax authorities or when seeking help regarding tax issues to ensure that you are aware of your rights and options.

Steps to complete the Publication 1 KO Rev 09 Your Rights As A Taxpayer Korean Version

Completing the Publication 1 KO Rev 09 requires careful attention to detail. First, ensure that you have the most current version of the publication. Next, read through each section thoroughly to understand the rights and responsibilities outlined. If applicable, gather any necessary documentation that supports your claims or inquiries. Finally, if you need to take action based on the information, follow the guidelines provided in the publication to ensure compliance with U.S. tax laws.

Key elements of the Publication 1 KO Rev 09 Your Rights As A Taxpayer Korean Version

Key elements of the Publication 1 KO Rev 09 include a detailed explanation of taxpayer rights, such as the right to be informed, the right to challenge the IRS's position, and the right to confidentiality. The publication also highlights the importance of understanding the appeals process and provides guidance on how to seek help if you believe your rights have been violated. Each section is designed to empower taxpayers with the knowledge needed to navigate the tax system effectively.

Legal use of the Publication 1 KO Rev 09 Your Rights As A Taxpayer Korean Version

The legal use of the Publication 1 KO Rev 09 is crucial for ensuring that taxpayers are aware of their rights under U.S. tax law. This publication is recognized by the IRS and serves as an official resource for taxpayers. Understanding and utilizing this document can help individuals protect themselves against unfair practices and ensure that they receive fair treatment from tax authorities. It is important to reference this publication when filing complaints or seeking legal recourse related to tax issues.

IRS Guidelines

The IRS guidelines that accompany the Publication 1 KO Rev 09 provide additional context and clarity regarding taxpayer rights. These guidelines outline the procedures for addressing disputes, the timelines for appeals, and the resources available for taxpayer assistance. Familiarizing oneself with these guidelines can enhance a taxpayer's ability to navigate the complexities of the tax system and ensure compliance with federal regulations.

Penalties for Non-Compliance

Understanding the penalties for non-compliance with tax laws is essential for all taxpayers. The Publication 1 KO Rev 09 highlights potential consequences for failing to adhere to tax regulations, which may include fines, interest on unpaid taxes, and legal action. By being aware of these penalties, taxpayers can take proactive measures to comply with tax obligations and avoid unnecessary complications.

Quick guide on how to complete publication 1 ko rev 09 2017 your rights as a taxpayer korean version

Complete Publication 1 KO Rev 09 Your Rights As A Taxpayer Korean Version effortlessly on any device

Managing documents online has gained traction with businesses and individuals alike. It offers a seamless eco-friendly option to traditional printed and signed paperwork, allowing you to access the right form and safely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without delays. Manage Publication 1 KO Rev 09 Your Rights As A Taxpayer Korean Version on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Publication 1 KO Rev 09 Your Rights As A Taxpayer Korean Version without hassle

- Locate Publication 1 KO Rev 09 Your Rights As A Taxpayer Korean Version and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Publication 1 KO Rev 09 Your Rights As A Taxpayer Korean Version and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the publication 1 ko rev 09 2017 your rights as a taxpayer korean version

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is publication 1 in relation to airSlate SignNow?

Publication 1 refers to the foundational features and offerings of airSlate SignNow. It encompasses our mission to provide users with a streamlined and efficient eSigning experience. This ensures that businesses can manage their documents with ease and confidence.

-

How does airSlate SignNow enhance document workflows under publication 1?

Publication 1 highlights the intuitive interface of airSlate SignNow, allowing users to create, send, and sign documents effortlessly. The platform automates workflows, reducing turnaround times signNowly. This enhances collaboration and accelerates business processes.

-

What pricing options are available for publication 1?

With publication 1, airSlate SignNow offers flexible pricing plans designed for businesses of all sizes. Each plan includes a range of features to cater to different needs, from individual users to large teams. This ensures that everyone can find a cost-effective solution that fits their budget.

-

Can I integrate publication 1 with other software solutions?

Yes, publication 1 supports various integrations with popular software tools such as Google Drive, Salesforce, and more. This allows for seamless data transfer and enhances the overall user experience. By integrating with other platforms, you can optimize your document management processes.

-

What security measures are included with publication 1?

Publication 1 prioritizes the security of your documents, featuring advanced encryption and authentication methods. This ensures that all eSignatures and document transactions are safe from unauthorized access. Our commitment to security helps you maintain compliance and protect sensitive information.

-

What features can I expect from publication 1?

In publication 1, you can expect features such as customizable templates, real-time tracking, and user-friendly dashboards. These tools are designed to simplify document management and enhance productivity. It's an all-encompassing solution for businesses looking to streamline their signing processes.

-

How does publication 1 benefit remote teams?

Publication 1 offers signNow benefits for remote teams by enabling electronic signatures and digital document management from anywhere. This means team members can collaborate efficiently, regardless of their location. The platform enhances communication and ensures that projects move forward smoothly.

Get more for Publication 1 KO Rev 09 Your Rights As A Taxpayer Korean Version

Find out other Publication 1 KO Rev 09 Your Rights As A Taxpayer Korean Version

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement