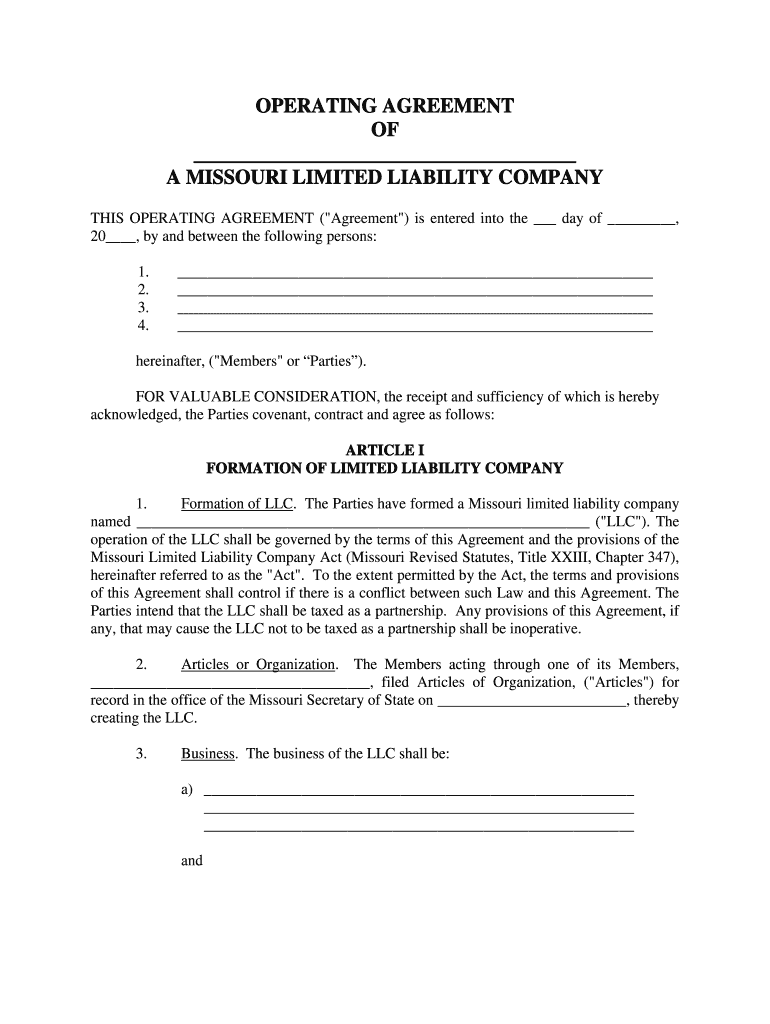

Llc Operating Agreement Missouri Form

What is the LLC Operating Agreement in Missouri

The LLC operating agreement in Missouri is a crucial legal document that outlines the management structure and operating procedures of a limited liability company (LLC). This agreement serves as an internal guideline for the members of the LLC, detailing how the business will be run, the roles and responsibilities of each member, and the distribution of profits and losses. While Missouri law does not require an operating agreement for LLCs, having one is highly recommended to prevent disputes and ensure clarity in operations.

Key Elements of the LLC Operating Agreement in Missouri

When creating an operating agreement for an LLC in Missouri, several key elements should be included to ensure comprehensive coverage of the business's operations:

- Company Information: Include the LLC's name, principal office address, and the purpose of the business.

- Member Contributions: Outline the initial capital contributions made by each member and any additional contributions that may be required.

- Management Structure: Specify whether the LLC will be member-managed or manager-managed, detailing the powers and duties of each party.

- Profit and Loss Distribution: Describe how profits and losses will be allocated among members, which can be based on ownership percentages or other agreed-upon methods.

- Voting Rights: Define the voting rights of members, including how decisions will be made and the required majority for various actions.

- Amendments: Include a process for making amendments to the operating agreement in the future.

Steps to Complete the LLC Operating Agreement in Missouri

Completing an LLC operating agreement in Missouri involves several straightforward steps:

- Gather Information: Collect all necessary details about the LLC, including member names, addresses, and contributions.

- Choose a Template: Select a reliable Missouri LLC operating agreement template that suits your business needs.

- Fill in the Details: Complete the template with the specific information about your LLC, ensuring all key elements are addressed.

- Review and Revise: Have all members review the agreement to ensure accuracy and clarity, making any necessary revisions.

- Sign the Agreement: All members should sign the completed operating agreement to make it official. Consider using electronic signature solutions for convenience.

Legal Use of the LLC Operating Agreement in Missouri

The LLC operating agreement in Missouri is legally binding among the members of the LLC, provided it is executed properly. Although it is not filed with the state, it serves as an essential document in case of disputes or legal issues. Courts generally uphold the terms of the operating agreement, making it vital to ensure that it accurately reflects the members' intentions and complies with state laws.

How to Obtain the LLC Operating Agreement in Missouri

Obtaining an LLC operating agreement in Missouri can be done through various means:

- Templates: Many online resources offer free or paid templates that can be customized to fit your LLC's specific needs.

- Legal Services: Consider consulting with a legal professional who specializes in business law to draft a tailored operating agreement.

- State Resources: Check with the Missouri Secretary of State’s office for any recommended guidelines or resources related to LLC operating agreements.

Digital vs. Paper Version of the LLC Operating Agreement

Both digital and paper versions of the LLC operating agreement are valid in Missouri. However, using a digital format can offer several advantages, including easier sharing among members and the ability to use electronic signatures for convenience. Digital documents can also be stored securely and accessed from anywhere, making it easier to keep the agreement up to date.

Quick guide on how to complete missouri llc operating agreement form

Prepare Llc Operating Agreement Missouri seamlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Llc Operating Agreement Missouri on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Llc Operating Agreement Missouri without effort

- Find Llc Operating Agreement Missouri then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Llc Operating Agreement Missouri and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I get help to modify an operating agreement for a newly formed LLC without hiring a lawyer?

Legally, you can't. A person cannot cannot offer legal services without an active law license, and such issues are far too complex for unintelligent forms based sites (not run by actual attorneys, just legally classified "form assistants") like Legal Zoom, etc; they can only act as a "filing service" to file base docs, and that is only q% of the overall process, if that; it does not suffice, and they mislead people.The other parts of legal entities are very complex and subtle and become exponentially more so with more members. The exception is a CPA, who can do very limited company formation work, but who generally don't really know what they're doing with formation, other than the tax specific aspects, and are never used for ongoing matters or as the lead people for company exit stages. The best option is always a corporate attorney (senior if possible) with a strong enjoyment of the tax law area of the work, or a combo team (e.g corporate lawyer and tax lawyer in the same firm, or a bit quite as common but still good, a corporate attorney and a CPA (some firms actually offer this in house).Normally however you get what you pay for, and if you invest in a good business attorney up front you will never have to even ask such a question because all contingencies would have been handled during setup. If you did that yourself, it's likely things weren't done correctly at the corporate governance level and half the decisions are null and void anyway, falling back to state law defaults (which are intended for large and/or public companies), leaving many unintended consequences. You may need a commercial litigation attorney/firn at this stage depending on size.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

How much does it cost to form an LLC. in Missouri?

Are you doing it yourself without the aid of an attorney?If you are doing this yourself, you’ll pay for the items below at the Missouri Secretary of State website. Specifically, you’ll do business on their Missouri Online Business Filing page. Setup an account if you need to.Fictitious Name Filing = $8.25 (if applicable)This applies if you are using a name other than your own.Articles of Organization - $51.25This is your biggest and primary cost.Certificate of Good Standing - $10.00 (Optional)Will you be setting up a bank account for this LLC? I’m 99% certain EVERY bank in Missouri will want this document. But for now, I’m calling it optional.Other CostsWhen setting up your bank account, don’t be surprised if the institution needs an Operating Agreement. Don’t worry, you can get one free by setting up a free account at Rocket Lawyer.com.If this is a multi-member LLC, then get an attorney to draw one up. You’ll need/want it.Apply for EIN OnlineThere is NO cost for obtaining an EIN for your LLC. Also, if this is a single-member LLC, this step is optional. You can apply online at the IRS website.SummarySo in total, you’re looking at a maximum of $69.50 if you include the fictitious name filing and the certificate of good standing.

-

How does an LLC adopt a new operating agreement?

Good question as an administrative task like this can have drastic effects if it’s not completed properly. Operating agreements often include language addressing how the LLC may alter or revoke the agreement. If not, the rule for adopting a new operating agreement is governed by the default rule in your state. The default rule for the State of Washington is approval by all members, which is easy for your single member LLC.I agree with Dana and and Stephen that you should clearly note in your new operating agreement that this one replaces the former. I also agree with the Anonymous post that recommends seeking counsel on the tax implications that your amendment may have.We’ve helped countless startups with making changes like this at LawTrades. Our platform connects bootstrapping entrepreneurs to a vast network of experienced and affordable startups attorneys. Also, feel free to message me if you have any other questions regarding your operating agreement!

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

Create this form in 5 minutes!

How to create an eSignature for the missouri llc operating agreement form

How to make an electronic signature for your Missouri Llc Operating Agreement Form in the online mode

How to make an electronic signature for your Missouri Llc Operating Agreement Form in Google Chrome

How to generate an eSignature for putting it on the Missouri Llc Operating Agreement Form in Gmail

How to generate an electronic signature for the Missouri Llc Operating Agreement Form right from your mobile device

How to make an eSignature for the Missouri Llc Operating Agreement Form on iOS devices

How to make an eSignature for the Missouri Llc Operating Agreement Form on Android

People also ask

-

What is an LLC Operating Agreement in Missouri?

An LLC Operating Agreement in Missouri is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC). This agreement is essential for defining the roles of members, distribution of profits, and procedures for decision-making, ensuring that all parties understand their rights and responsibilities.

-

Why do I need an LLC Operating Agreement in Missouri?

Having an LLC Operating Agreement in Missouri is crucial as it helps prevent misunderstandings among members and protects your business's limited liability status. It serves as a foundational document that clarifies operations and can be used to resolve disputes, making it a vital component of your LLC's legal framework.

-

How can airSlate SignNow help with creating an LLC Operating Agreement in Missouri?

airSlate SignNow offers an intuitive platform that simplifies the process of creating an LLC Operating Agreement in Missouri. With customizable templates and easy eSignature features, you can quickly draft, edit, and finalize your agreement, ensuring compliance and clarity for all members involved.

-

What features does airSlate SignNow provide for LLC Operating Agreements in Missouri?

airSlate SignNow provides a range of features for LLC Operating Agreements in Missouri, including customizable templates, secure electronic signatures, and document tracking. These features enhance collaboration among members and streamline the signing process, making it efficient and user-friendly.

-

Is airSlate SignNow cost-effective for small businesses needing an LLC Operating Agreement in Missouri?

Yes, airSlate SignNow offers a cost-effective solution for small businesses needing an LLC Operating Agreement in Missouri. With various pricing plans tailored to different business needs, you can access all necessary features without breaking the bank, ensuring that you can manage your documents efficiently.

-

Can I integrate airSlate SignNow with other tools for my LLC Operating Agreement in Missouri?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and software, allowing you to manage your LLC Operating Agreement in Missouri alongside your other business processes. This integration ensures a smooth workflow, enhancing productivity and document management.

-

What are the benefits of using airSlate SignNow for my LLC Operating Agreement in Missouri?

Using airSlate SignNow for your LLC Operating Agreement in Missouri offers numerous benefits, including ease of use, security, and accessibility. The platform allows for quick edits and secure signatures, ensuring that your document is legally binding and compliant with state regulations.

Get more for Llc Operating Agreement Missouri

- New occupant form

- Reasonable accommodation modification verification form

- 2015 community starlab njace 1 search form

- Cincinnati bell landlord permission form

- Seller information and mortgage payoff request form

- Move inmove out checklist legal survival form

- Co signer application form poudre property services

- Carabetta application form

Find out other Llc Operating Agreement Missouri

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will