Loan Modification Agreement Form 2014

What is the Loan Modification Agreement Form

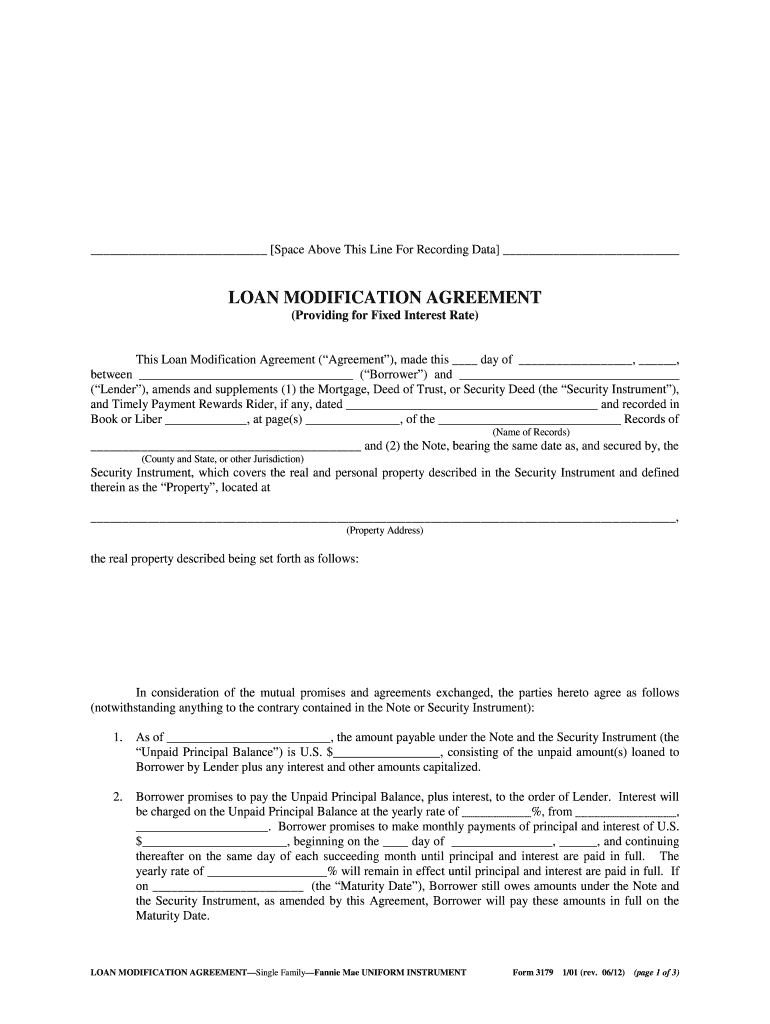

The Loan Modification Agreement Form is a legal document used to modify the terms of an existing loan. This form is essential for borrowers seeking to adjust their loan conditions, such as interest rates, monthly payments, or loan duration, often due to financial hardship. It formalizes the agreement between the borrower and the lender, ensuring both parties understand the new terms and conditions. This form is particularly relevant for homeowners looking to prevent foreclosure or make their mortgage payments more manageable.

How to use the Loan Modification Agreement Form

Using the Loan Modification Agreement Form involves several steps to ensure that the modification process is smooth and legally binding. First, the borrower must fill out the form with accurate information regarding their current loan and the desired modifications. Both the borrower and lender should review the terms outlined in the form to confirm mutual understanding. Once completed, the form must be signed by both parties, which can be done digitally for convenience. After signing, the borrower should keep a copy for their records and submit the form to the lender according to their specified submission methods.

Steps to complete the Loan Modification Agreement Form

Completing the Loan Modification Agreement Form requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, including the original loan agreement and financial statements.

- Fill out the form with accurate personal and loan information.

- Clearly outline the requested modifications, such as changes in payment amounts or interest rates.

- Review the completed form with a financial advisor or legal professional if needed.

- Sign the form digitally or in person, ensuring both parties are present for the signing.

- Submit the form to the lender, following their submission guidelines.

Key elements of the Loan Modification Agreement Form

The Loan Modification Agreement Form includes several key elements that are crucial for its validity. These elements typically consist of:

- Borrower Information: Personal details of the borrower, including name, address, and contact information.

- Lender Information: Details about the lending institution, including name and contact information.

- Loan Details: Information about the original loan, including loan number, amount, and terms.

- Modification Terms: Specific changes being requested, such as new payment amounts or interest rates.

- Signatures: Signatures of both the borrower and lender, indicating agreement to the modified terms.

Legal use of the Loan Modification Agreement Form

To ensure the legal validity of the Loan Modification Agreement Form, it must comply with specific legal requirements. The form should be signed by both parties, and it must clearly outline the modifications being made to the original loan agreement. Additionally, the form should adhere to relevant state and federal laws governing loan modifications. By using a trusted digital platform for eSigning, borrowers can ensure that their agreement meets the necessary legal standards, providing both security and compliance with eSignature laws.

Eligibility Criteria

Eligibility for using the Loan Modification Agreement Form typically depends on several factors. Borrowers must demonstrate a valid reason for seeking a modification, such as financial hardship or changes in income. Lenders may also have specific criteria, including the borrower's credit history and payment record. Generally, homeowners facing difficulties in meeting their mortgage payments are encouraged to explore loan modification options, as it can provide a pathway to more manageable financial obligations.

Quick guide on how to complete loan modification agreement 2012 form

Effortlessly prepare Loan Modification Agreement Form on any device

Digital document management has become favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow offers all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Loan Modification Agreement Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Loan Modification Agreement Form with ease

- Find Loan Modification Agreement Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Loan Modification Agreement Form while ensuring excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan modification agreement 2012 form

The way to generate an eSignature for your PDF file online

The way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is a Loan Modification Agreement Form?

A Loan Modification Agreement Form is a legal document that outlines the changes to the terms of an existing loan. This form is crucial for borrowers seeking to adjust their payment plans, interest rates, or other loan conditions. Using an efficient platform like airSlate SignNow allows you to create and manage your Loan Modification Agreement Form effortlessly.

-

How can I create a Loan Modification Agreement Form with airSlate SignNow?

Creating a Loan Modification Agreement Form with airSlate SignNow is straightforward. You can start with customizable templates and easily fill in the required information. Our user-friendly interface ensures that you can generate a professional Loan Modification Agreement Form in just a few clicks.

-

Is airSlate SignNow cost-effective for generating a Loan Modification Agreement Form?

Yes, airSlate SignNow provides an affordable solution for generating a Loan Modification Agreement Form. Our pricing plans are designed to cater to businesses of any size, ensuring you get the best value for your eSigning and document management needs. You can save both time and money through our intuitive platform.

-

What features does airSlate SignNow offer for a Loan Modification Agreement Form?

airSlate SignNow includes features such as cloud storage, secure eSigning, and collaborative document editing for your Loan Modification Agreement Form. Additionally, users can track changes, get notifications, and maintain an audit trail, ensuring a seamless experience in managing their agreements.

-

Can I integrate airSlate SignNow with other applications for my Loan Modification Agreement Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRM systems and cloud storage services. This means you can easily import or export your Loan Modification Agreement Form data, enhancing your overall workflow and improving productivity.

-

What are the benefits of using airSlate SignNow for Loan Modification Agreement Forms?

Using airSlate SignNow for your Loan Modification Agreement Forms provides numerous benefits, including improved efficiency and reduced turnaround times. The platform ensures that your documents are securely signed and stored, making it easier for both you and your clients to access and manage agreements. Additionally, our tools help maintain compliance and accuracy.

-

How secure is my Loan Modification Agreement Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and secure data storage to protect your Loan Modification Agreement Form and other sensitive documents. You can trust that your information remains confidential and safeguarded against unauthorized access.

Get more for Loan Modification Agreement Form

- Dolch cloze worksheet form

- Bcbs fee schedule request form

- Identifying narrative voice worksheet answers 200814482 form

- Vicap case submission form

- Civfin1 scottish legal aid board form

- Crime victims compensation frequently asked questions form

- Theft report form ci monroe la

- Defendant state of missouri39s motion for summary learn to carry form

Find out other Loan Modification Agreement Form

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation