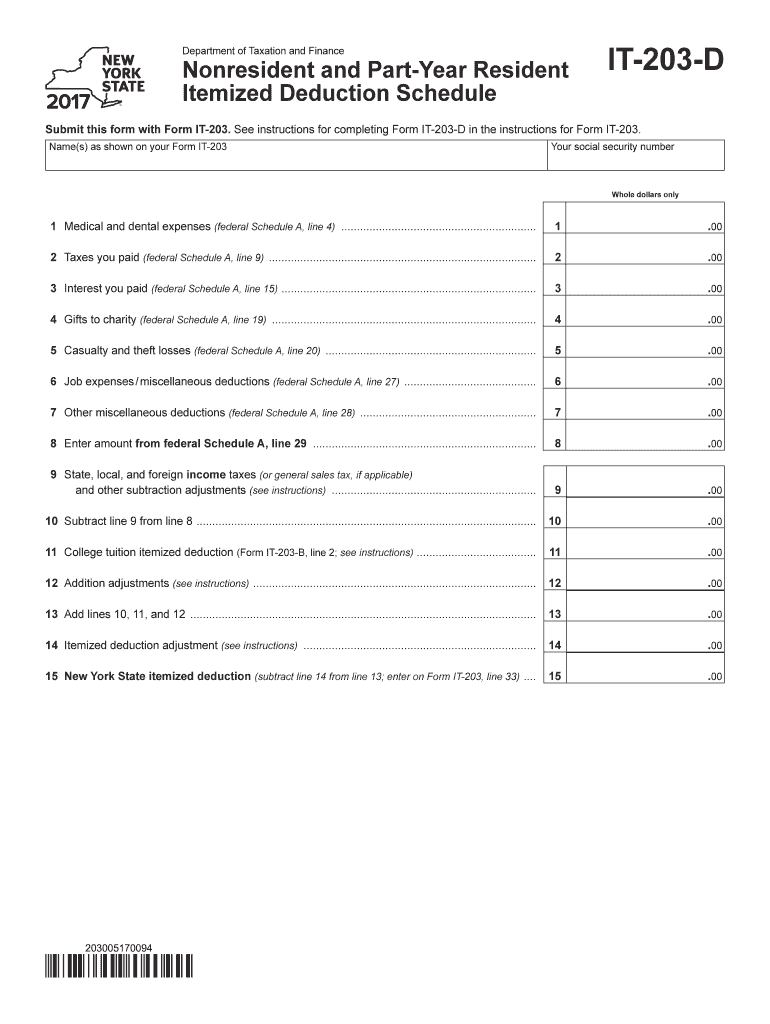

New York Form it 203d 2017

What is the New York Form IT-203?

The New York Form IT-203 is a tax return form specifically designed for non-resident individuals who earn income from New York sources. This form allows individuals who do not reside in New York State to report their income and calculate their tax liability. It is essential for ensuring compliance with state tax regulations, as it helps the New York State Department of Taxation and Finance assess the appropriate taxes owed by non-residents.

How to Use the New York Form IT-203

Using the New York Form IT-203 involves several steps to accurately report income and deductions. First, gather all necessary financial documents, including W-2s and 1099s, that detail your income from New York sources. Next, download the form from the New York State Department of Taxation and Finance website or use a tax software that supports the IT-203. Fill out the form by providing personal information, income details, and any applicable deductions. Finally, review the completed form for accuracy before submitting it to ensure compliance with state tax laws.

Steps to Complete the New York Form IT-203

Completing the New York Form IT-203 requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income earned from New York sources, including wages, interest, and dividends.

- Claim any deductions or credits you are eligible for as a non-resident.

- Calculate your total tax liability based on the provided instructions.

- Sign and date the form before submission.

Legal Use of the New York Form IT-203

The New York Form IT-203 is legally binding when completed accurately and submitted on time. It is crucial for non-residents to understand that failing to file this form can lead to penalties and interest on unpaid taxes. The form must be filed in accordance with New York State tax laws, which require non-residents to report any income sourced from within the state. Compliance ensures that individuals meet their tax obligations and avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the New York Form IT-203 are crucial for compliance. Typically, the form must be filed by April 15 of the year following the tax year in question. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to keep track of these dates to avoid late fees and penalties.

Required Documents

To complete the New York Form IT-203, several documents are necessary:

- W-2 forms from employers reporting income earned in New York.

- 1099 forms for any freelance or contract work performed in the state.

- Documentation for any deductions claimed, such as receipts for business expenses.

- Proof of residency status, if applicable.

Form Submission Methods

The New York Form IT-203 can be submitted in several ways. Taxpayers may choose to file electronically using approved tax software, which often streamlines the process and ensures accuracy. Alternatively, individuals can print the completed form and mail it to the designated address provided in the instructions. In-person submissions are generally not available, so electronic or mail options are the primary methods for submitting the form.

Quick guide on how to complete new york form it 203d

Effortlessly Prepare New York Form It 203d on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without holdups. Manage New York Form It 203d on any device with the airSlate SignNow applications for Android or iOS and enhance any document-based task today.

The Easiest Way to Modify and Electronically Sign New York Form It 203d Effortlessly

- Find New York Form It 203d and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere moments and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or a shared link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign New York Form It 203d to ensure excellent communication throughout every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york form it 203d

Create this form in 5 minutes!

How to create an eSignature for the new york form it 203d

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the ny form it 203, and why do I need it?

The ny form it 203 is a tax form required in New York State for non-resident taxpayers to report income. If you earn income within the state but do not reside there, submitting the ny form it 203 ensures compliance with tax regulations. Using airSlate SignNow makes the submission process easier and more efficient.

-

How does airSlate SignNow help with completing the ny form it 203?

airSlate SignNow offers an intuitive platform to fill out the ny form it 203 digitally. With templates and easy navigation, you can complete the form accurately and securely. This streamlines the process, ensuring you meet deadlines without hassle.

-

What features does airSlate SignNow provide for handling the ny form it 203?

With airSlate SignNow, you get features like eSignature, document tracking, and secure cloud storage to manage the ny form it 203. These capabilities enhance your efficiency and provide peace of mind knowing your documents are protected and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the ny form it 203?

Yes, airSlate SignNow offers various pricing plans to accommodate your needs for handling documents like the ny form it 203. The plans are cost-effective and designed to provide maximum value for businesses needing document management and eSignature solutions.

-

Can airSlate SignNow integrate with other software when completing the ny form it 203?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, enhancing your ability to manage the ny form it 203. Whether it's CRM systems, cloud storage, or other software, these integrations simplify your workflow and reduce the need for multiple tools.

-

What are the benefits of using airSlate SignNow for the ny form it 203?

Using airSlate SignNow for the ny form it 203 provides numerous benefits, including time savings, increased accuracy, and improved collaboration. The platform's user-friendly interface ensures you can complete and sign your forms quickly while maintaining compliance with state regulations.

-

Is airSlate SignNow secure for submitting the ny form it 203?

Yes, airSlate SignNow prioritizes security by employing advanced encryption and secure authentication protocols. This commitment to security ensures that your ny form it 203 and other sensitive documents are safe from unauthorized access and bsignNowes.

Get more for New York Form It 203d

- Samarpan ashram dandi form

- Solicitud de certificado de libertad o gravamen con aviso form

- Kia roadside assistance reimbursement form

- Worksheet 112 civil or criminal law pbronline form

- Uniform monthly percentage surcharge report

- Futuro tax irs gov form

- Form 941 776802390

- Change card utah division of real estate utah gov realestate utah form

Find out other New York Form It 203d

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA