Psers Rollover Form

What is the Psers Rollover Form

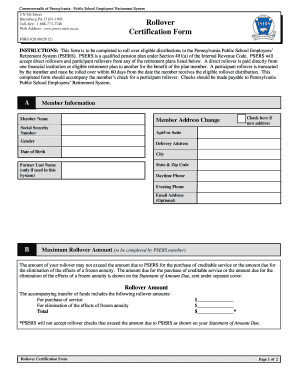

The Psers rollover form is a crucial document used by members of the Pennsylvania State Employees' Retirement System (PSERS) to transfer their retirement funds from one qualified plan to another. This form facilitates the movement of funds without incurring immediate tax liabilities, allowing individuals to maintain their retirement savings in a tax-advantaged environment. It is essential for members who are changing jobs or seeking to consolidate their retirement accounts.

How to use the Psers Rollover Form

Using the Psers rollover form involves several steps to ensure that the transfer of retirement funds is executed smoothly. First, members should obtain the form from the PSERS website or their retirement plan administrator. Once acquired, the form must be filled out accurately, providing necessary information such as personal details, the amount to be rolled over, and the details of the receiving plan. After completing the form, members can submit it according to the specified submission methods, which may include online submission, mailing, or in-person delivery.

Steps to complete the Psers Rollover Form

Completing the Psers rollover form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the PSERS website.

- Fill in your personal information, including your name, address, and PSERS member number.

- Indicate the amount you wish to roll over and provide details about the receiving retirement plan.

- Review the form for accuracy and completeness.

- Sign and date the form to validate your request.

- Submit the form through the appropriate channels as outlined by PSERS.

Legal use of the Psers Rollover Form

The legal validity of the Psers rollover form is supported by various regulations governing retirement account rollovers. To ensure compliance, it is important to follow IRS guidelines and state-specific laws regarding the transfer of retirement funds. The form must be signed and dated by the member to be considered legally binding. Additionally, using a secure electronic signature solution can enhance the legal standing of the completed form.

Required Documents

When completing the Psers rollover form, certain documents may be required to facilitate the rollover process. These typically include:

- A copy of the most recent account statement from the retirement plan being rolled over.

- Information about the receiving plan, such as its name and account number.

- Any additional documentation requested by the PSERS or the receiving institution to verify your identity and account details.

Form Submission Methods

Members can submit the Psers rollover form through various methods, ensuring flexibility and convenience. The primary submission options include:

- Online: Many members choose to submit their forms electronically through the PSERS online portal.

- Mail: Completed forms can be sent via postal service to the designated PSERS address.

- In-Person: Members may also opt to deliver the form directly to a PSERS office for immediate processing.

Quick guide on how to complete psers rollover form

Complete Psers Rollover Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Psers Rollover Form on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related procedure today.

The most efficient way to modify and electronically sign Psers Rollover Form with ease

- Locate Psers Rollover Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Select how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your preference. Modify and electronically sign Psers Rollover Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the psers rollover form

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the psers rollover form and why is it important?

The psers rollover form is a document that allows individuals to transfer their retirement savings from a pension system into a qualifying retirement account. Completing this form ensures that you maintain the tax advantages of your retirement savings while facilitating a smooth transition of funds. It is important for avoiding penalties and ensuring compliance with retirement account regulations.

-

How can I access the psers rollover form?

You can access the psers rollover form online through the airSlate SignNow platform. Simply navigate to the relevant section on our website, and you'll find the form available for download. Once you have it, you can complete and eSign it directly using our easy-to-use tools.

-

Is there a cost associated with using the psers rollover form on airSlate SignNow?

Using the psers rollover form on airSlate SignNow comes with an affordable subscription plan that varies based on your business needs. Our pricing is designed to empower businesses of all sizes to manage their documents effectively without breaking the bank. Transparent pricing ensures you only pay for what you need.

-

What features does airSlate SignNow offer for the psers rollover form?

AirSlate SignNow provides several features for the psers rollover form, including eSigning, document sharing, and secure cloud storage. These features facilitate a seamless workflow, making it easier for users to complete and send the form efficiently. You also benefit from tracking options to monitor the form's status.

-

Can I integrate airSlate SignNow with other applications while using the psers rollover form?

Yes, airSlate SignNow offers robust integration capabilities with various applications such as Google Drive, Dropbox, and CRM systems. This means you can easily manage your documents and the psers rollover form alongside your existing tools, streamlining your workflow and improving productivity.

-

What are the benefits of using airSlate SignNow for the psers rollover form?

Using airSlate SignNow for your psers rollover form allows for enhanced convenience and efficiency. Our platform enables you to complete and send documents electronically, reducing the time spent on traditional paperwork. Additionally, the security features protect your sensitive information during transactions.

-

Is my data secure when completing the psers rollover form online?

Absolutely, airSlate SignNow prioritizes data security. When you complete the psers rollover form online, your information is protected through encryption and stringent compliance measures. We ensure that your personal data is handled with the utmost care to prevent unauthorized access.

Get more for Psers Rollover Form

Find out other Psers Rollover Form

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself