AR1103 Application to Be a Small Business Corporation Dfa Arkansas 2017-2026

What is the AR1103 Application To Be A Small Business Corporation DFA Arkansas

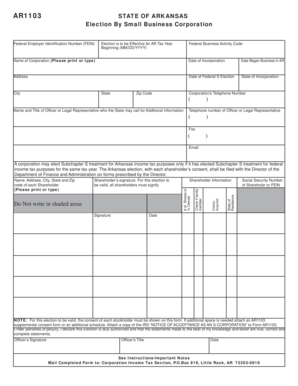

The AR1103 application is a formal request to establish a small business corporation in the state of Arkansas. This document is essential for entrepreneurs looking to register their business as a corporation, which provides liability protection and potential tax benefits. By completing the AR1103, business owners can ensure compliance with state regulations and gain legal recognition for their corporation. This application is typically filed with the Arkansas Secretary of State's office and is a crucial step in the business formation process.

Steps to complete the AR1103 Application To Be A Small Business Corporation DFA Arkansas

Completing the AR1103 application involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the proposed business name, the names and addresses of the initial directors, and the registered agent's details. Next, fill out the application form carefully, ensuring that all information is complete and correct. After completing the form, review it for any errors before submitting it. Finally, submit the application along with the required filing fee to the Arkansas Secretary of State's office, either online or via mail.

Legal use of the AR1103 Application To Be A Small Business Corporation DFA Arkansas

The AR1103 application is legally binding once filed and approved by the Arkansas Secretary of State. It serves as an official record of the corporation's existence and outlines its structure and purpose. To ensure legal compliance, it is important that the application meets all state requirements, including proper signatures and payment of fees. Additionally, the corporation must adhere to ongoing legal obligations, such as filing annual reports and maintaining good standing with state authorities.

Key elements of the AR1103 Application To Be A Small Business Corporation DFA Arkansas

Several key elements must be included in the AR1103 application to ensure its validity. These elements include:

- Business Name: The proposed name of the corporation must be unique and comply with state naming regulations.

- Registered Agent: The application must designate a registered agent who will receive legal documents on behalf of the corporation.

- Directors: Names and addresses of the initial directors must be provided, as they will oversee the corporation's operations.

- Purpose: A brief description of the corporation's business activities is required.

- Filing Fee: The appropriate fee must accompany the application to process it.

Eligibility Criteria for the AR1103 Application To Be A Small Business Corporation DFA Arkansas

To be eligible to file the AR1103 application, applicants must meet specific criteria. The business must be organized for lawful purposes and comply with Arkansas state laws. Additionally, the owners must be of legal age to form a corporation, which is typically eighteen years or older. It is also necessary for the business name to be distinguishable from existing entities registered in Arkansas. Meeting these eligibility criteria is crucial for the successful approval of the application.

Form Submission Methods for the AR1103 Application To Be A Small Business Corporation DFA Arkansas

The AR1103 application can be submitted through various methods to accommodate different preferences. Applicants can choose to file online through the Arkansas Secretary of State's website, which offers a convenient and efficient process. Alternatively, the application can be mailed directly to the Secretary of State's office. For those who prefer in-person interactions, visiting the office to submit the application is also an option. Each method has specific instructions and may have different processing times.

Quick guide on how to complete ar1103 application to be a small business corporation dfa arkansas

Complete AR1103 Application To Be A Small Business Corporation Dfa Arkansas effortlessly on any device

Digital document management has become favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can locate the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without holdups. Handle AR1103 Application To Be A Small Business Corporation Dfa Arkansas on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign AR1103 Application To Be A Small Business Corporation Dfa Arkansas with ease

- Obtain AR1103 Application To Be A Small Business Corporation Dfa Arkansas and then click Get Form to start.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as an ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign AR1103 Application To Be A Small Business Corporation Dfa Arkansas and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ar1103 application to be a small business corporation dfa arkansas

Create this form in 5 minutes!

How to create an eSignature for the ar1103 application to be a small business corporation dfa arkansas

The way to make an electronic signature for a PDF document in the online mode

The way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is ar1103 and how does it relate to airSlate SignNow?

ar1103 is a powerful feature of airSlate SignNow that enhances document signing processes. It provides users with a streamlined interface for sending and eSigning documents securely and efficiently.

-

How much does airSlate SignNow with ar1103 cost?

The pricing for airSlate SignNow, including the benefits of ar1103, is designed to be cost-effective for businesses of all sizes. Specific plans vary based on features and usage, ensuring you find an option that suits your needs.

-

What are the key features of ar1103 in airSlate SignNow?

ar1103 includes features such as customizable templates, advanced security measures, and real-time tracking of document status. These features simplify the signing process, making it more efficient for businesses.

-

What are the benefits of using ar1103 with airSlate SignNow?

The ar1103 feature in airSlate SignNow offers signNow benefits, including reduced turnaround times for document approvals and enhanced collaboration among team members. This empowers businesses to streamline workflows and improve productivity.

-

Can ar1103 integrate with other software?

Yes, ar1103 in airSlate SignNow supports seamless integrations with various third-party applications, including CRM and project management tools. This enhances your existing workflows and ensures a smoother document management experience.

-

Is training available for using ar1103 in airSlate SignNow?

Absolutely! airSlate SignNow offers training resources and tutorials to help users maximize the benefits of ar1103. This ensures you can efficiently navigate and utilize all features for your business needs.

-

How secure is the ar1103 feature in airSlate SignNow?

Security is a top priority for airSlate SignNow, including the ar1103 feature, which utilizes encryption and other advanced security protocols. This ensures that your documents remain confidential and protected from unauthorized access.

Get more for AR1103 Application To Be A Small Business Corporation Dfa Arkansas

Find out other AR1103 Application To Be A Small Business Corporation Dfa Arkansas

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement