Limited Warented Deed Form

What is the limited warranty deed?

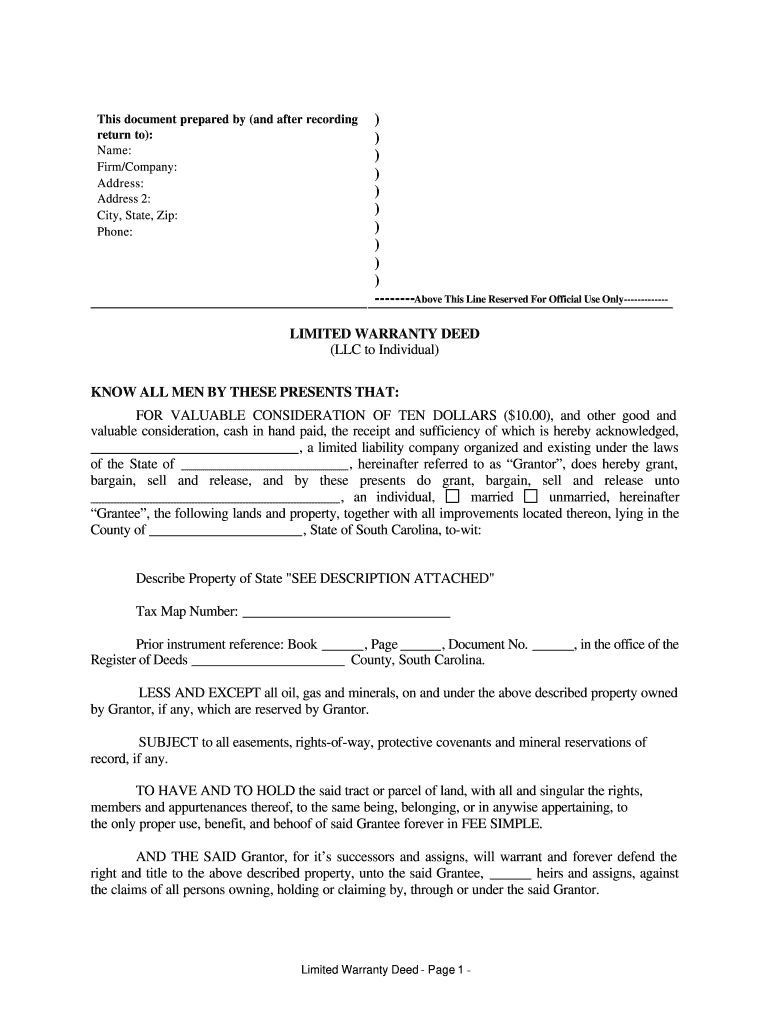

A limited warranty deed is a legal document used in real estate transactions that provides a guarantee from the seller to the buyer regarding the title of the property. Unlike a general warranty deed, which offers broad protections, a limited warranty deed only covers specific periods during which the seller owned the property. This means the seller is only responsible for claims or defects that arose during their ownership, offering less protection to the buyer than a general warranty deed.

Key elements of the limited warranty deed

Several key elements define a limited warranty deed:

- Grantor and Grantee: The parties involved in the transaction, where the grantor is the seller and the grantee is the buyer.

- Property Description: A detailed description of the property being transferred, including boundaries and any relevant identifiers.

- Covenants: Specific promises made by the grantor, typically stating that they have not encumbered the property during their ownership.

- Signatures: The document must be signed by the grantor, and in some cases, notarization is required to validate the deed.

Steps to complete the limited warranty deed

Completing a limited warranty deed involves several steps:

- Gather Information: Collect necessary details about the property, including its legal description and information about both parties.

- Draft the Deed: Use a template or legal software to create the deed, ensuring all required elements are included.

- Review the Document: Double-check all information for accuracy and completeness.

- Sign the Deed: The grantor must sign the deed in the presence of a notary public if required by state law.

- File the Deed: Submit the completed deed to the appropriate county office for recording.

Legal use of the limited warranty deed

The limited warranty deed is legally recognized in many states as a valid means of transferring property. It is often used in transactions where the seller may not have complete knowledge of the property's history or when the seller is not willing to provide the extensive guarantees offered by a general warranty deed. Buyers should be aware of the limitations of this type of deed and consider conducting thorough title searches to identify any potential issues.

State-specific rules for the limited warranty deed

Each state in the U.S. has its own regulations governing the use of limited warranty deeds. It is essential to review the specific laws in your state, as requirements for drafting, signing, and recording the deed can vary. Some states may have particular forms that must be used, while others may require additional disclosures or stipulations to be included in the deed.

Examples of using the limited warranty deed

Limited warranty deeds are commonly used in various real estate transactions, such as:

- Sales of properties acquired through foreclosure, where the seller may have limited knowledge of prior claims.

- Transfers between family members, where the seller may not want to assume full liability for the property's history.

- Commercial real estate transactions, where buyers and sellers agree to limit the scope of warranties provided.

Quick guide on how to complete south carolina limited warranty deed llc to individual

Finalize and submit your Limited Warented Deed swiftly

Advanced tools for digital document exchange and validation are now vital for optimizing processes and the ongoing enhancement of your forms. When managing legal documents and endorsing a Limited Warented Deed, the right signing solution can conserve signNow time and resources with every submission.

Locate, complete, modify, endorse, and distribute your legal paperwork using airSlate SignNow. This service provides everything necessary to establish efficient paper submission workflows. Its extensive library of legal forms and intuitive interface can assist you in finding your Limited Warented Deed rapidly, and the editor featuring our signing capability will enable you to populate and authorize it right away.

Authorize your Limited Warented Deed in a few straightforward steps

- Search for the Limited Warented Deed you need in our library via search or catalog sections.

- Examine the form details and preview it to confirm it meets your requirements and state regulations.

- Click Obtain form to open it for modifications.

- Fill out the form using the detailed toolbar.

- Check the information you provided and click the Sign button to validate your document.

- Select one of three options to affix your signature.

- Complete the adjustments and save the file, then download it onto your device or share it instantly.

Streamline each phase of your document preparation and signing process with airSlate SignNow. Experience a more effective online solution that has every aspect of handling your documents meticulously planned.

Create this form in 5 minutes or less

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the south carolina limited warranty deed llc to individual

How to make an electronic signature for the South Carolina Limited Warranty Deed Llc To Individual online

How to generate an electronic signature for the South Carolina Limited Warranty Deed Llc To Individual in Chrome

How to make an eSignature for putting it on the South Carolina Limited Warranty Deed Llc To Individual in Gmail

How to create an eSignature for the South Carolina Limited Warranty Deed Llc To Individual from your smartphone

How to generate an eSignature for the South Carolina Limited Warranty Deed Llc To Individual on iOS devices

How to make an eSignature for the South Carolina Limited Warranty Deed Llc To Individual on Android devices

People also ask

-

What is a Limited Warented Deed?

A Limited Warented Deed is a legal document that provides a specific guarantee of title for a property, limiting the liabilities of the seller. This type of deed is often used in real estate transactions to ensure that the buyer has some assurance of ownership without the broader warranties associated with a full warranty deed.

-

How can airSlate SignNow help with Limited Warented Deed transactions?

airSlate SignNow offers a streamlined eSignature solution that simplifies the process of executing a Limited Warented Deed. By using our platform, you can easily send, sign, and manage your documents securely, ensuring a quick and efficient transaction for all parties involved.

-

What are the benefits of using airSlate SignNow for a Limited Warented Deed?

Using airSlate SignNow for your Limited Warented Deed provides several benefits, including ease of use, cost-effectiveness, and secure document management. Our platform allows you to track the signing process in real-time, which enhances transparency and helps avoid potential disputes.

-

Is there a cost associated with using airSlate SignNow for Limited Warented Deeds?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including features specifically for handling Limited Warented Deeds. You can choose a plan that fits your budget while enjoying unlimited access to document signing and management capabilities.

-

Can I store my Limited Warented Deed documents securely with airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your documents, including Limited Warented Deeds. This ensures that your sensitive information is protected and easily accessible whenever you need it.

-

What integrations does airSlate SignNow offer for managing Limited Warented Deeds?

airSlate SignNow integrates seamlessly with various applications, such as CRM systems and cloud storage services, to enhance your workflow for managing Limited Warented Deeds. These integrations allow you to automate tasks and ensure that your documents are organized and easily retrievable.

-

How does eSigning a Limited Warented Deed work with airSlate SignNow?

eSigning a Limited Warented Deed with airSlate SignNow is straightforward. Simply upload your document, add the necessary fields for signatures, and send it to the involved parties. They can sign electronically from any device, making the process quick and efficient.

Get more for Limited Warented Deed

Find out other Limited Warented Deed

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure