Form Uc 1

What is the Form UC-1?

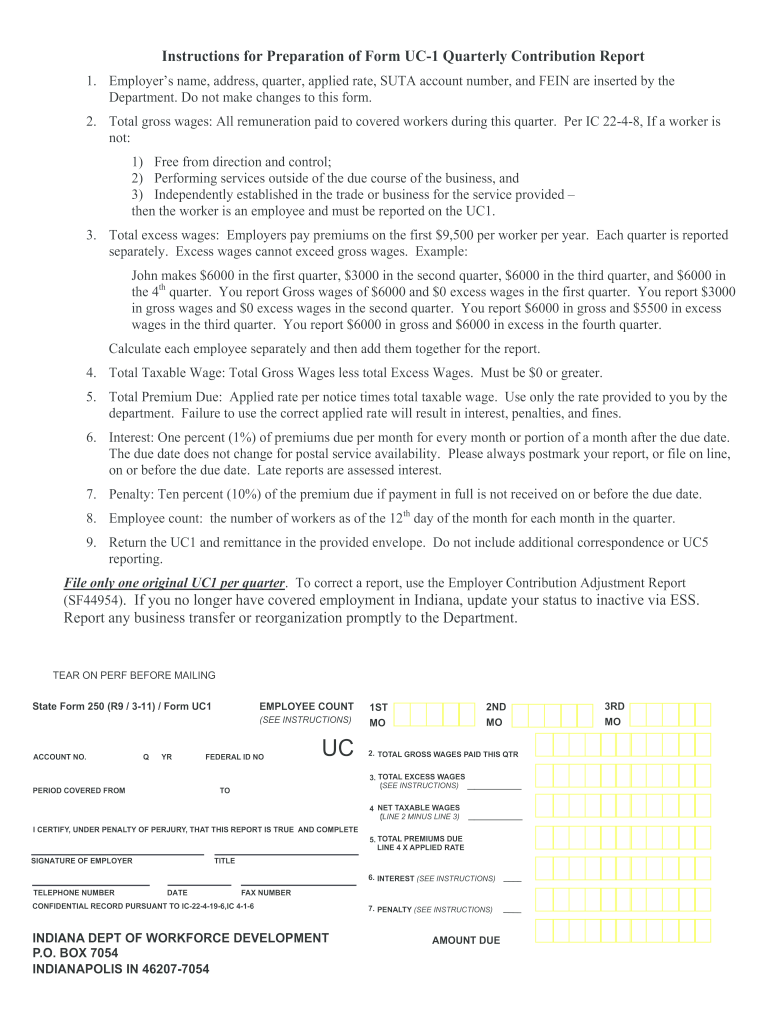

The Form UC-1, also known as the Indiana unemployment tax form, is a critical document used by employers in Indiana to report their unemployment insurance tax obligations. This form is essential for maintaining compliance with state regulations regarding unemployment benefits. Employers must accurately complete and submit the UC-1 to ensure they fulfill their tax responsibilities, which ultimately supports the unemployment insurance system in the state.

Steps to Complete the Form UC-1

Completing the Form UC-1 involves several key steps to ensure accuracy and compliance. Follow these steps for a successful submission:

- Gather necessary information, including your business name, address, and federal employer identification number (FEIN).

- Determine the appropriate reporting period for the form.

- Calculate the taxable wages for your employees during the reporting period.

- Apply the correct tax rate to the taxable wages to determine your total unemployment tax liability.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

How to Obtain the Form UC-1

Employers can obtain the Form UC-1 through the Indiana Department of Workforce Development's website. The form is available in a fillable PDF format, making it easy to complete electronically. Additionally, employers may request a physical copy by contacting the department directly. It is important to ensure that you are using the most current version of the form to comply with state regulations.

Legal Use of the Form UC-1

The legal use of the Form UC-1 is governed by Indiana state law, which mandates that employers accurately report their unemployment tax obligations. Failure to submit this form or providing incorrect information can lead to penalties and fines. Employers must ensure that the form is filed within the specified deadlines to avoid any legal repercussions.

Form Submission Methods

The Form UC-1 can be submitted through various methods, providing flexibility for employers. The primary submission methods include:

- Online submission through the Indiana Department of Workforce Development's e-filing system.

- Mailing a physical copy of the completed form to the designated address provided by the department.

- In-person submission at local workforce development offices, if preferred.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Form UC-1 to remain compliant with Indiana unemployment tax regulations. Generally, the form is due on a quarterly basis. Key deadlines include:

- First quarter: Due by April 30

- Second quarter: Due by July 31

- Third quarter: Due by October 31

- Fourth quarter: Due by January 31 of the following year

Penalties for Non-Compliance

Non-compliance with the submission of the Form UC-1 can result in significant penalties for employers. These may include:

- Fines for late submissions or failure to file.

- Increased tax rates for future unemployment insurance contributions.

- Legal action taken by the state to recover unpaid taxes.

Quick guide on how to complete form uc 1

Accomplish Form Uc 1 effortlessly on any device

Digital document management has gained traction with companies and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, revise, and eSign your documents promptly without complications. Manage Form Uc 1 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to alter and eSign Form Uc 1 with ease

- Locate Form Uc 1 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Adjust and eSign Form Uc 1 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form uc 1

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is the Indiana unemployment tax form?

The Indiana unemployment tax form is a document that employers must complete and submit to report their unemployment insurance taxes owed. This form helps ensure compliance with state regulations regarding unemployment funding, which supports workers during periods of unemployment. Understanding how to accurately fill out the Indiana unemployment tax form is essential for businesses to avoid penalties.

-

How can airSlate SignNow help with the Indiana unemployment tax form?

airSlate SignNow provides an efficient and streamlined solution for completing and signing the Indiana unemployment tax form. With its user-friendly platform, businesses can easily access and send documents for eSigning, ensuring a hassle-free submission process. This saves time and reduces errors in filing your Indiana unemployment tax form.

-

Is there a cost associated with using airSlate SignNow for the Indiana unemployment tax form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Pricing varies based on the features and functionalities you opt for, but consider it an investment in efficiency, especially when managing important documents like the Indiana unemployment tax form. Additional features may also enhance your overall process.

-

What features does airSlate SignNow offer for handling tax forms?

airSlate SignNow offers various features that simplify the process of managing tax forms, including templates, automated reminders, and secure eSigning capabilities. These features ensure that your Indiana unemployment tax form is completed accurately and submitted on time. You can also track the status of your documents in real-time.

-

Are there integrations available with airSlate SignNow for tax-related software?

Yes, airSlate SignNow supports integrations with various tax-related software and platforms, making it easier to import and export your Indiana unemployment tax form data. This interoperability ensures that your tax processes are streamlined and consistent. Consider leveraging these integrations to improve your workflows.

-

What are the benefits of eSigning the Indiana unemployment tax form?

eSigning the Indiana unemployment tax form offers numerous benefits, including faster processing times and increased security. With airSlate SignNow, your signature is legally binding and securely stored, ensuring compliance with state regulations. This electronic approach minimizes paperwork errors and accelerates document turnaround.

-

Can multiple users collaborate on the Indiana unemployment tax form using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on the Indiana unemployment tax form in real-time. This feature is beneficial for teams who need to review, edit, or sign the document collectively. Collaboration ensures that all necessary parties are involved in the process for accurate completion.

Get more for Form Uc 1

- Sample of certificate of pa for business form

- Chegg downloader 420725666 form

- Safety patrol pledge form

- Family central recertification packet form 55596051

- Pet application form 19196771

- Fd258 form

- Anexo 8812 del irs formulario de crdito tributario por hijos

- New york city department of education division of human resources form

Find out other Form Uc 1

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later