Summary of Reporting Cycle Workers' Compensation Board Wcb Ny Form

Understanding the Summary of Reporting Cycle for Self-Insurers

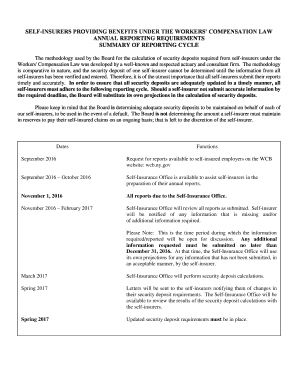

The Summary of Reporting Cycle for self insurers is a crucial document that outlines the reporting obligations for entities that choose to self-insure their workers' compensation liabilities. This summary serves to provide a clear framework for compliance with state regulations and helps ensure that self-insurers maintain accurate records of their claims and financial obligations. By adhering to these guidelines, self-insurers can effectively manage their risk and ensure they are meeting legal requirements.

Steps to Complete the Summary of Reporting Cycle

Completing the Summary of Reporting Cycle involves several important steps:

- Gather necessary documentation, including past claims data and financial records.

- Review state-specific regulations to ensure compliance with reporting requirements.

- Fill out the summary form accurately, providing all required information.

- Verify the completed form for accuracy and completeness before submission.

- Submit the form through the designated method, whether online or via mail.

Each of these steps is essential to ensure that the summary is legally valid and meets all regulatory requirements.

Key Elements of the Summary of Reporting Cycle

The key elements of the Summary of Reporting Cycle include:

- Claim Information: Details about each claim, including dates, amounts, and status.

- Financial Data: Information regarding reserves and payments related to claims.

- Compliance Metrics: Indicators that show adherence to reporting requirements.

- Contact Information: Details for the individual or department responsible for the report.

Understanding these elements helps self insurers provide comprehensive and accurate reporting.

Legal Use of the Summary of Reporting Cycle

The legal use of the Summary of Reporting Cycle is paramount for self insurers. This document serves as a formal record that can be referenced in case of audits or disputes. It must comply with regulations set forth by state workers' compensation boards, ensuring that all reporting is done in accordance with the law. Failure to adhere to these legal requirements can result in penalties or loss of self-insurance status.

Form Submission Methods

Self insurers have several options for submitting the Summary of Reporting Cycle. These methods typically include:

- Online Submission: Many states offer online portals for easy and secure submission.

- Mail: Physical copies can be sent to the appropriate regulatory agency.

- In-Person Submission: Some jurisdictions may allow for direct submission at designated offices.

Choosing the right submission method is important for ensuring timely compliance with reporting deadlines.

Penalties for Non-Compliance

Non-compliance with the Summary of Reporting Cycle can lead to significant penalties for self insurers. These may include fines, increased scrutiny from regulatory bodies, and potential loss of self-insured status. It is essential for self insurers to remain vigilant in their reporting practices to avoid these consequences and ensure that they are fulfilling their legal obligations.

Quick guide on how to complete summary of reporting cycle workersamp39 compensation board wcb ny

Prepare Summary Of Reporting Cycle Workers' Compensation Board Wcb Ny effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the tools needed to create, alter, and eSign your documents quickly without delays. Handle Summary Of Reporting Cycle Workers' Compensation Board Wcb Ny on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Summary Of Reporting Cycle Workers' Compensation Board Wcb Ny without hassle

- Obtain Summary Of Reporting Cycle Workers' Compensation Board Wcb Ny and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional ink signature.

- Verify all details and click on the Done button to save your changes.

- Select how you wish to send your form — via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Summary Of Reporting Cycle Workers' Compensation Board Wcb Ny and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the summary of reporting cycle workersamp39 compensation board wcb ny

The best way to make an eSignature for a PDF file online

The best way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the primary benefit of airSlate SignNow for self insurers providing reporting?

AirSlate SignNow offers self insurers providing reporting an efficient and streamlined process for document management. This solution enables organizations to easily send, sign, and track documents, ensuring compliance and enhancing productivity. With its user-friendly interface, self insurers can quickly generate the reports they need without hassle.

-

How does airSlate SignNow enhance the reporting capabilities for self insurers?

AirSlate SignNow enhances the reporting capabilities for self insurers providing reporting by offering real-time tracking and analytics features. Users can monitor the status of documents and gather vital metrics, helping to improve decision-making and strategic planning. This data-driven approach makes it easier to identify trends and optimize reporting processes.

-

What pricing plans are available for self insurers providing reporting?

AirSlate SignNow offers flexible pricing plans tailored to the needs of self insurers providing reporting. Each plan provides features that scale with your business requirements, ensuring you receive the best value for your investment. You can easily choose a plan that aligns with your budget and operational goals.

-

Are there any specific features that support self insurers providing reporting?

Yes, airSlate SignNow includes several features that specifically support self insurers providing reporting, such as customizable templates, automated workflows, and secure e-signatures. These features enhance efficiency and accuracy in document handling, making it easier for teams to focus on their core responsibilities and reduce administrative burdens.

-

Does airSlate SignNow integrate with other software for self insurers providing reporting?

Absolutely, airSlate SignNow seamlessly integrates with various software solutions commonly used by self insurers providing reporting. This includes popular applications for accounting, CRM, and project management. These integrations enhance workflow efficiency and ensure that all aspects of reporting are connected and easily accessible.

-

How can self insurers providing reporting ensure compliance with regulations using airSlate SignNow?

Self insurers providing reporting can ensure compliance with regulations by utilizing airSlate SignNow's built-in audit trails and secure document storage. The platform adheres to industry standards for security and legal compliance, providing users with peace of mind that their reporting processes meet necessary regulations. This level of compliance is crucial for maintaining trust and accountability.

-

Is technical support available for self insurers providing reporting using airSlate SignNow?

Yes, airSlate SignNow provides dedicated technical support for self insurers providing reporting to ensure they can maximize the platform's capabilities. Users can access resources such as tutorials, live chat, and email support to resolve any issues promptly. This support is vital for maintaining business continuity and productivity.

Get more for Summary Of Reporting Cycle Workers' Compensation Board Wcb Ny

Find out other Summary Of Reporting Cycle Workers' Compensation Board Wcb Ny

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast