Form 42 Share Schemes HM Revenue & Customs 2014

What is the Form 42 Share Schemes HM Revenue & Customs

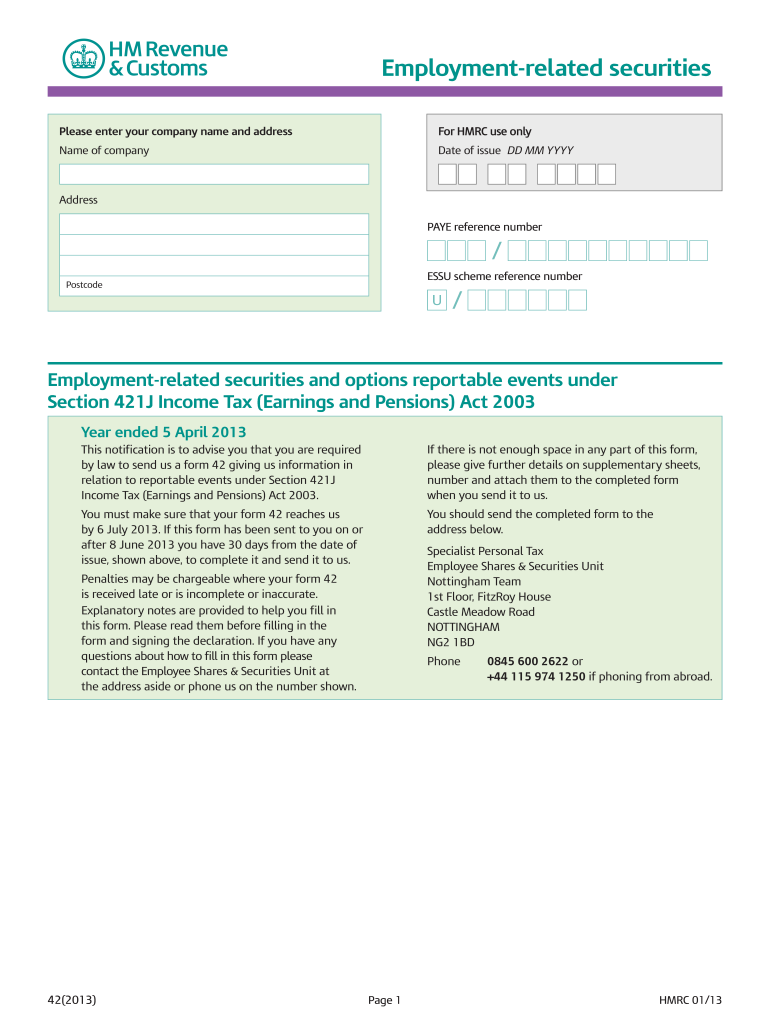

The Form 42 Share Schemes HM Revenue & Customs is a crucial document used in the United Kingdom to report share schemes to HMRC. This form is primarily utilized by companies that offer shares to their employees as part of an incentive or benefits package. The purpose of the form is to provide HMRC with information regarding the share scheme, ensuring compliance with tax regulations. While this form is specific to UK tax law, understanding its implications can be beneficial for U.S. businesses that engage in international operations or have employees in the UK.

How to use the Form 42 Share Schemes HM Revenue & Customs

Using the Form 42 Share Schemes involves several steps to ensure accurate reporting and compliance. Companies must first determine if their share scheme qualifies for reporting under this form. Once eligibility is confirmed, the company should gather necessary information, including details about the scheme, the employees involved, and the shares being offered. After completing the form, it must be submitted to HMRC within the specified deadlines to avoid penalties. For U.S. businesses, understanding the nuances of this form can aid in navigating international tax obligations.

Steps to complete the Form 42 Share Schemes HM Revenue & Customs

Completing the Form 42 Share Schemes requires careful attention to detail. The following steps outline the process:

- Determine eligibility of the share scheme for reporting.

- Gather relevant information about the share scheme, including participant details and share values.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the completed form to HMRC by the deadline.

Each step is essential for ensuring compliance and avoiding potential issues with HMRC.

Legal use of the Form 42 Share Schemes HM Revenue & Customs

The legal use of the Form 42 Share Schemes is governed by UK tax law and regulations. Companies must ensure that their share schemes comply with the relevant legislation to avoid legal repercussions. This includes adhering to reporting requirements and deadlines set forth by HMRC. For U.S. businesses, understanding the legal framework surrounding this form is vital, particularly if they have employees or operations in the UK.

Filing Deadlines / Important Dates

Filing deadlines for the Form 42 Share Schemes are critical for compliance. Companies must submit the form to HMRC within specific timeframes to avoid penalties. Typically, the form should be filed within a certain period after the shares are issued. It is essential for businesses to keep track of these deadlines to ensure timely submission and adherence to legal requirements.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form 42 Share Schemes can result in significant penalties. HMRC may impose fines for late submissions or inaccuracies in reporting. Understanding these penalties is crucial for companies to mitigate risks associated with non-compliance. U.S. businesses operating in the UK should be particularly aware of these implications to avoid financial repercussions.

Quick guide on how to complete form 42 2013 share schemes hm revenue ampampamp customs

Complete Form 42 Share Schemes HM Revenue & Customs effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form 42 Share Schemes HM Revenue & Customs on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The simplest way to edit and eSign Form 42 Share Schemes HM Revenue & Customs with ease

- Obtain Form 42 Share Schemes HM Revenue & Customs and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and has the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your delivery method for your form—via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you select. Edit and eSign Form 42 Share Schemes HM Revenue & Customs and ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 42 2013 share schemes hm revenue ampampamp customs

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is Form 42 for Share Schemes in HM Revenue & Customs?

Form 42 is a document required by HM Revenue & Customs for companies that offer share schemes to employees. It provides necessary information about the shares granted, including their value and the nature of the scheme. Completing Form 42 accurately ensures compliance with tax regulations and avoids issues with HMRC.

-

How does airSlate SignNow help with submitting Form 42 for Share Schemes?

airSlate SignNow simplifies the process of preparing and submitting Form 42 for Share Schemes to HM Revenue & Customs. Our platform allows you to electronically sign and manage documents securely, ensuring that your submissions are timely and accurate. This streamlines the compliance process, enhancing your company's efficiency.

-

What are the pricing options for using airSlate SignNow for Form 42?

airSlate SignNow offers flexible pricing plans to meet the needs of businesses preparing Form 42 for Share Schemes with HM Revenue & Customs. Our plans are competitive and tailored to ensure cost-effectiveness without compromising on features. You can choose a plan that best fits your company's volume of document handling and signing needs.

-

Are there any additional features with airSlate SignNow for managing Form 42?

Yes, airSlate SignNow provides a range of features that assist in managing Form 42 for Share Schemes. These include automated reminders for important deadlines, document templates specifically designed for compliance, and real-time tracking of document statuses. These features make it easier to stay organized and compliant with HMRC requirements.

-

Can airSlate SignNow integrate with other software for managing Form 42?

Absolutely! airSlate SignNow offers integrations with various tools and platforms to enhance your workflow while managing Form 42 for Share Schemes. Whether you use CRM systems, accounting software, or HR applications, you can easily connect them with SignNow for a seamless experience. This helps streamline your entire document signing and management process.

-

What are the benefits of using airSlate SignNow for Form 42 compliance?

Using airSlate SignNow for Form 42 ensures that your submissions to HM Revenue & Customs are accurate and timely, which is crucial for compliance. The platform's electronic signature capabilities enhance security and efficiency. Additionally, the ease of use reduces the time spent on paperwork, allowing more focus on other critical business tasks.

-

Is airSlate SignNow suitable for small businesses dealing with Form 42?

Yes, airSlate SignNow is an ideal solution for small businesses managing Form 42 for Share Schemes. Our cost-effective and user-friendly platform can accommodate the needs of smaller teams without requiring extensive resources. It provides all the essential tools to ensure compliance with HM Revenue & Customs efficiently.

Get more for Form 42 Share Schemes HM Revenue & Customs

Find out other Form 42 Share Schemes HM Revenue & Customs

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer