T1 General Form 2015

What is the T1 General Form

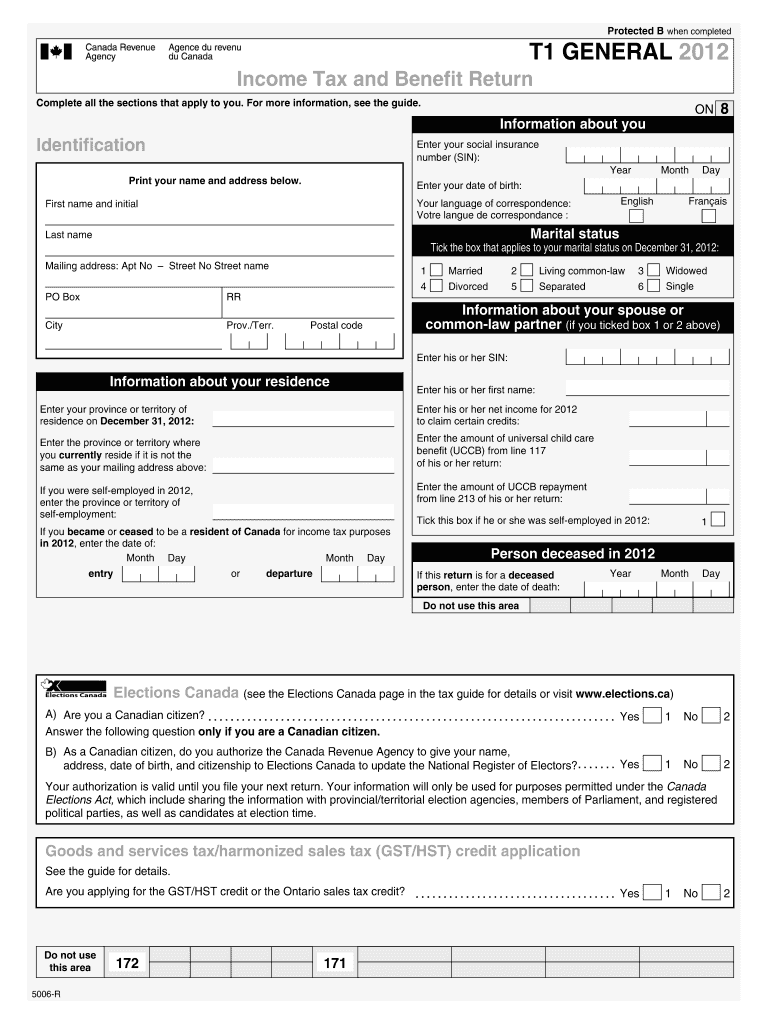

The T1 General Form is a key document used for individual income tax filing in Canada. It allows taxpayers to report their income, claim deductions, and calculate their tax obligations. This form is essential for both residents and non-residents earning income in Canada, ensuring compliance with the Canadian Revenue Agency (CRA) regulations. The T1 General Form includes various sections that cater to different types of income, such as employment, self-employment, and investment income.

Steps to complete the T1 General Form

Completing the T1 General Form involves several important steps to ensure accuracy and compliance. First, gather all necessary documents, including T4 slips from employers, receipts for deductions, and any other relevant financial documents. Next, carefully fill out each section of the form, starting with personal information and moving through income details, deductions, and credits. It is crucial to double-check all entries for accuracy. Once completed, review the form for any missing information and ensure that all calculations are correct. Finally, submit the form either electronically or by mail, depending on your preference.

How to use the T1 General Form

The T1 General Form serves multiple purposes in the tax filing process. Taxpayers use it to report their total income for the year, which includes wages, rental income, and investment earnings. Additionally, the form allows individuals to claim various deductions and credits, such as medical expenses, tuition fees, and charitable donations. By accurately completing the T1 General Form, taxpayers can determine their tax liability or refund amount, making it an essential tool for financial planning and compliance.

Legal use of the T1 General Form

The T1 General Form must be completed and submitted in accordance with Canadian tax laws. It is legally binding, meaning that the information provided must be truthful and accurate. Failing to comply with tax regulations can result in penalties, including fines or audits by the CRA. It is important to understand that any discrepancies or fraudulent claims made on the T1 General Form can lead to serious legal consequences. Therefore, using the form correctly and ensuring all information is verified is crucial for maintaining compliance.

Filing Deadlines / Important Dates

Filing deadlines for the T1 General Form are crucial for taxpayers to remember. Typically, individual tax returns must be submitted by April 30 of the following year. However, if you or your spouse or common-law partner is self-employed, the deadline extends to June 15. It is essential to file on time to avoid late fees and interest charges on any outstanding tax amounts. Additionally, understanding these deadlines helps taxpayers plan their finances effectively throughout the year.

Required Documents

To complete the T1 General Form accurately, several documents are required. These typically include:

- T4 slips from employers detailing income earned

- Receipts for deductible expenses, such as medical and educational costs

- Statements from financial institutions for interest and investment income

- Any other relevant tax documents, such as rental income statements

Having these documents organized and readily available simplifies the completion process and ensures that all income and deductions are reported correctly.

Who Issues the Form

The T1 General Form is issued by the Canada Revenue Agency (CRA), which is responsible for administering tax laws for the Government of Canada. The CRA provides the form and guidelines for its completion, ensuring that taxpayers have the necessary resources to file their taxes accurately. The agency also offers assistance through various channels, including online resources and customer service, to help individuals navigate the tax filing process.

Quick guide on how to complete 2012 t1 general form

Effortlessly Prepare T1 General Form on Any Device

The management of online documents has become increasingly favored among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Handle T1 General Form on any device utilizing airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

Steps to Edit and Electronically Sign T1 General Form with Ease

- Obtain T1 General Form and click Get Form to commence.

- Utilize the tools provided to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether via email, SMS, or an invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced files, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign T1 General Form while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 t1 general form

Create this form in 5 minutes!

How to create an eSignature for the 2012 t1 general form

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is the T1 General Form?

The T1 General Form is a tax form used by individuals in Canada to report their income, claim deductions, and calculate tax credits. Understanding how to fill out the T1 General Form accurately is crucial for compliance and to minimize tax liabilities. Using airSlate SignNow, you can eSign and send your T1 General Form seamlessly.

-

How does airSlate SignNow simplify the T1 General Form process?

airSlate SignNow streamlines the process of filling out the T1 General Form by providing a user-friendly interface for document management and eSigning. This platform enables users to fill in their details, attach necessary documents, and securely send their forms. The straightforward approach helps reduce errors and speeds up submission.

-

Is there a cost associated with using airSlate SignNow for the T1 General Form?

Yes, airSlate SignNow offers different pricing plans tailored to fit various needs which include multiple features for handling documents, including the T1 General Form. They provide transparent pricing to ensure you only pay for what you need. You can try the service with a free trial before committing to a plan.

-

What features does airSlate SignNow offer for managing the T1 General Form?

Key features of airSlate SignNow include customizable templates, secure eSigning, automated workflow management, and cloud storage solutions. These features enhance the efficiency of handling the T1 General Form and enable you to manage your tax documents effortlessly. Such tools can signNowly reduce the time spent on paperwork and improve organization.

-

Can I store my T1 General Form securely with airSlate SignNow?

Absolutely! airSlate SignNow is designed with top-tier security protocols to ensure your T1 General Form and other sensitive documents are stored safely. The cloud storage options offer encryption and controlled access, giving you peace of mind that your information is protected from unauthorized access.

-

Are there integration options available for airSlate SignNow to assist with the T1 General Form?

Yes, airSlate SignNow integrates with various tools and platforms that enhance your workflow when managing the T1 General Form. Integrations with accounting and financial software can streamline data entry and allow for more effective document management. This connectivity boosts productivity and minimizes manual errors.

-

What benefits do I gain from using airSlate SignNow for eSigning the T1 General Form?

Using airSlate SignNow for eSigning the T1 General Form provides numerous benefits, including faster processing, reduced paper waste, and enhanced document security. You can sign documents from anywhere, leading to greater flexibility. These advantages help you manage your tax filings efficiently and give you a competitive edge.

Get more for T1 General Form

Find out other T1 General Form

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now