India Form 60 2015-2026

What is the India Form 60

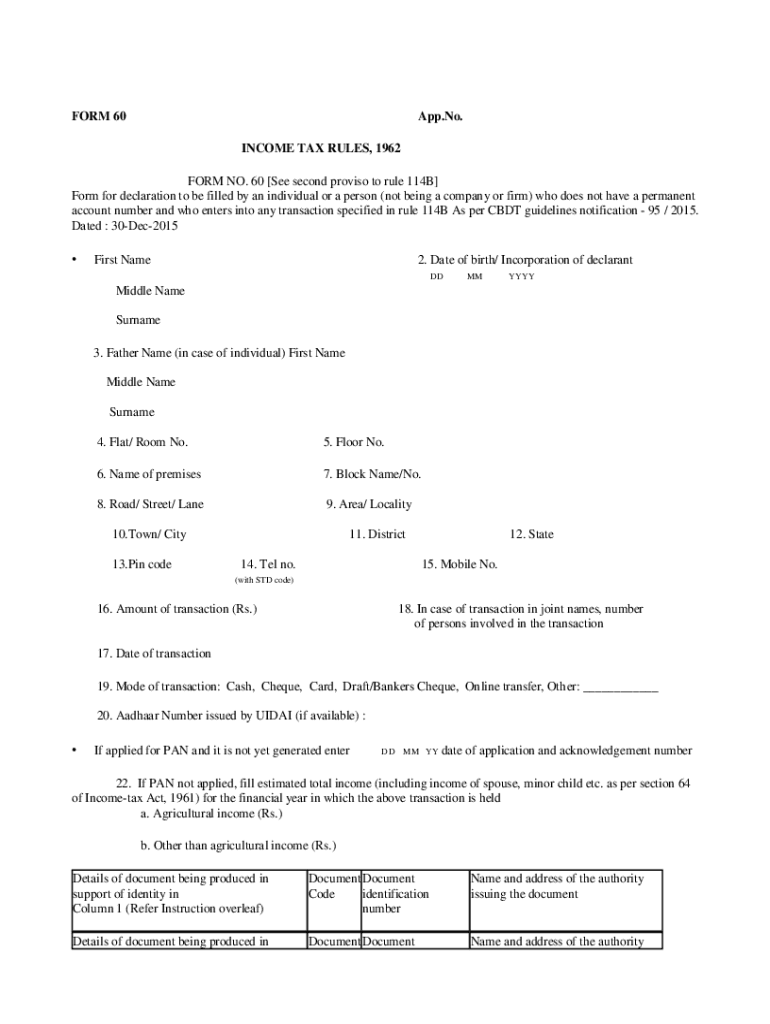

The India Form 60 is a declaration form used primarily for individuals who do not have a Permanent Account Number (PAN) but are required to provide information related to their income for tax purposes. This form serves as an alternative means of identification for tax filing and is particularly useful for those who may not engage in regular taxable activities or who have not yet applied for a PAN. The form collects essential details about the individual, including personal information and the nature of the income, ensuring compliance with Indian tax regulations.

How to obtain the India Form 60

The India Form 60 can be obtained from various sources. It is available at tax offices, and financial institutions, and can also be downloaded from the official website of the Income Tax Department of India. To ensure you have the most current version, it is advisable to access the form directly from official channels. Additionally, some tax preparation services may provide the form as part of their offerings, making it accessible for individuals seeking assistance with their tax filings.

Steps to complete the India Form 60

Completing the India Form 60 involves several straightforward steps:

- Begin by entering your personal details, including your name, address, and contact information.

- Provide details regarding your income sources, specifying the nature of the income you are declaring.

- Affirm that you do not possess a PAN and understand the implications of submitting this form.

- Sign and date the form to validate your declaration.

Once completed, the form can be submitted to the relevant tax authority or financial institution as required.

Legal use of the India Form 60

The India Form 60 is legally recognized for tax purposes as a valid declaration of income for individuals without a PAN. It is essential to ensure that the information provided in the form is accurate and truthful, as any discrepancies may lead to penalties or legal consequences. The form must be submitted in accordance with the guidelines set forth by the Income Tax Department, and it is advisable to retain a copy for personal records.

Key elements of the India Form 60

Key elements of the India Form 60 include:

- Personal Information: Name, address, and contact details of the individual.

- Income Declaration: A clear statement of the income sources being declared.

- Signature: The form must be signed by the individual to confirm authenticity.

- Date: The date of submission, ensuring that it aligns with tax filing deadlines.

Form Submission Methods

The India Form 60 can be submitted through various methods, including:

- Online Submission: Some tax authorities allow for electronic submission of the form through their official websites.

- Mail: The completed form can be sent via postal service to the designated tax office.

- In-Person: Individuals may also choose to submit the form directly at local tax offices or financial institutions.

Quick guide on how to complete india form 60

Complete India Form 60 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage India Form 60 on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to edit and eSign India Form 60 effortlessly

- Locate India Form 60 and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight important sections of the documents or obscure sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign India Form 60 to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the india form 60

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the income tax form 60 download and who needs it?

The income tax form 60 download is a crucial document for taxpayers in India who need to report their income without a PAN card. This form allows individuals to provide necessary details for tax assessment purposes. It's essential for those who may not have a Permanent Account Number to ensure compliance with tax regulations.

-

How can I access the income tax form 60 download?

You can access the income tax form 60 download directly from the official income tax department website or other authorized platforms. Make sure to download the latest version to ensure it meets the current requirements specified by the tax authorities. The airSlate SignNow platform also provides seamless options for eSigning these documents.

-

Is there a fee for downloading the income tax form 60?

There is no fee associated with the income tax form 60 download, as it is a government-issued document available for public use. However, if you opt to use airSlate SignNow to eSign and manage your documents, there may be subscription costs depending on the features you select. This can provide added convenience and security for handling your tax forms.

-

Can I eSign my income tax form 60 using airSlate SignNow?

Yes, you can easily eSign your income tax form 60 using airSlate SignNow's user-friendly interface. The platform allows you to upload the form, add your electronic signature, and send it securely. This streamlines the process, ensuring your document is both legally binding and efficiently managed.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including the income tax form 60 download, offers numerous benefits such as enhanced security, time-saving features, and easy collaboration. You can track document status in real-time and access your signed forms anytime, ensuring peace of mind. Additionally, the cost-effective solution helps your business save money while managing important paperwork.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow. You can connect with popular tools like Google Drive, Dropbox, and CRM systems, making it easier to access and manage your income tax form 60 download and other essential documents. This flexibility enhances productivity and simplifies data management.

-

How secure is airSlate SignNow for handling sensitive tax documents?

AirSlate SignNow prioritizes security, implementing advanced encryption and compliance standards to protect your sensitive tax documents, including the income tax form 60 download. All data transmitted through the platform is securely encrypted, ensuring that your personal and financial information remains confidential. You can trust airSlate SignNow to handle your documents safely.

Get more for India Form 60

- Cafc401 form

- Mla format rubric

- Pacific access category filling form

- Rasmussen college transcripts form

- Covenants conditions and restrictions template form

- Download an additional pledge form jdrf

- Echocardiogram an echocardiogram is an ultrasound exam of your heart it is done by bouncing sound waves off the heart the exam form

- Chm fillable forms

Find out other India Form 60

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form