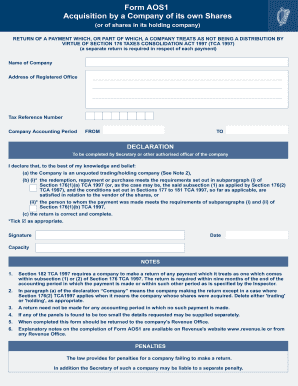

Aos1 Form

What is the Aos1 Form

The Aos1 form is a crucial document used in the context of share acquisitions in Ireland. It is primarily utilized by companies to report information related to the acquisition of shares and the associated tax implications. This form ensures that all necessary details are disclosed to the relevant authorities, facilitating compliance with tax regulations. Understanding the Aos1 form is essential for businesses engaging in share transactions, as it plays a significant role in the overall revenue acquisition process.

How to use the Aos1 Form

Using the Aos1 form involves several steps to ensure accurate completion and submission. Initially, gather all required information regarding the share acquisition, including details about the shares, the parties involved, and any relevant financial data. Once you have this information, fill out the form carefully, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions before submitting it to the appropriate tax authority. Utilizing a digital platform can streamline this process, making it easier to manage and submit the form securely.

Steps to complete the Aos1 Form

Completing the Aos1 form requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Gather necessary documents, including share certificates and transaction records.

- Fill in the basic details, such as the name of the acquiring company and the share details.

- Provide information about the sellers and any financial arrangements.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail, depending on the requirements.

Legal use of the Aos1 Form

The Aos1 form must be used in compliance with relevant legal frameworks to ensure its validity. In the United States, adherence to eSignature laws such as ESIGN and UETA is essential when submitting forms electronically. These regulations ensure that electronic signatures and documents are legally binding, provided that specific conditions are met. Using a reliable eSignature platform can help maintain compliance while enhancing the security and integrity of the document.

Required Documents

When completing the Aos1 form, several documents are typically required to support the information provided. Essential documents include:

- Share certificates that detail the shares being acquired.

- Transaction agreements outlining the terms of the share acquisition.

- Financial statements that may be necessary for tax reporting.

Having these documents ready will facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Form Submission Methods

The Aos1 form can be submitted through various methods, depending on the preferences of the filing entity and regulatory requirements. Common submission methods include:

- Online submission through designated tax authority portals, which often provide an efficient and secure way to file.

- Mailing a physical copy of the completed form to the appropriate tax office.

- In-person submission at local tax offices, if applicable.

Choosing the right submission method can help ensure that the form is processed promptly and accurately.

Quick guide on how to complete aos1 form

Complete Aos1 Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for standard printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Handle Aos1 Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Aos1 Form without hassle

- Obtain Aos1 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you choose. Modify and eSign Aos1 Form and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the aos1 form

The best way to create an eSignature for your PDF document online

The best way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What are ie shares and how can airSlate SignNow help with them?

IE shares refer to investments in companies and require secure documentation processes. airSlate SignNow simplifies the signing and management of documents related to ie shares, ensuring that contracts and agreements can be completed quickly and securely online.

-

How much does airSlate SignNow cost for managing ie shares?

airSlate SignNow offers competitive pricing plans tailored to different business needs. By streamlining the eSigning process for ie shares, companies can save signNowly on administrative costs and improve operational efficiency.

-

What features does airSlate SignNow offer for handling ie shares?

airSlate SignNow includes features such as reusable templates, automated reminders, and secure cloud storage for documents related to ie shares. These features allow businesses to manage multiple contracts seamlessly and promote swift decision-making.

-

Is airSlate SignNow secure for signing documents related to ie shares?

Yes, airSlate SignNow uses advanced encryption and security protocols to protect documents associated with ie shares. Compliance with industry standards ensures that your sensitive information remains confidential throughout the signing process.

-

Can airSlate SignNow integrate with other tools for managing ie shares?

Absolutely! airSlate SignNow integrates with various business tools and platforms, facilitating a smoother workflow for managing ie shares. This integration allows for easy access to documents and enhances collaboration among teams.

-

How does airSlate SignNow improve efficiency for businesses dealing with ie shares?

airSlate SignNow accelerates the documentation process for ie shares by allowing users to eSign documents anywhere, anytime. This efficiency reduces turnaround time and allows businesses to focus on strategic decisions rather than manual paperwork.

-

Are there any mobile capabilities for managing ie shares with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to manage and eSign documents on the go. This feature is particularly beneficial for professionals who handle ie shares and require access to critical documents anytime and anywhere.

Get more for Aos1 Form

- Imrf for 7 10 form

- Verizon application form

- Form 1a application for an airside airport id pass heathrow airport

- U s citizen child original or replacement social security card ssa form

- Photosynthesis diagram and skit form

- Strs drug calculator form

- Application for monetization of leave credits form

- Assistive technology implementation plan sample form

Find out other Aos1 Form

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract