Payroll Direct Deposit New Account Application Form

What is the Payroll Direct Deposit New Account Application

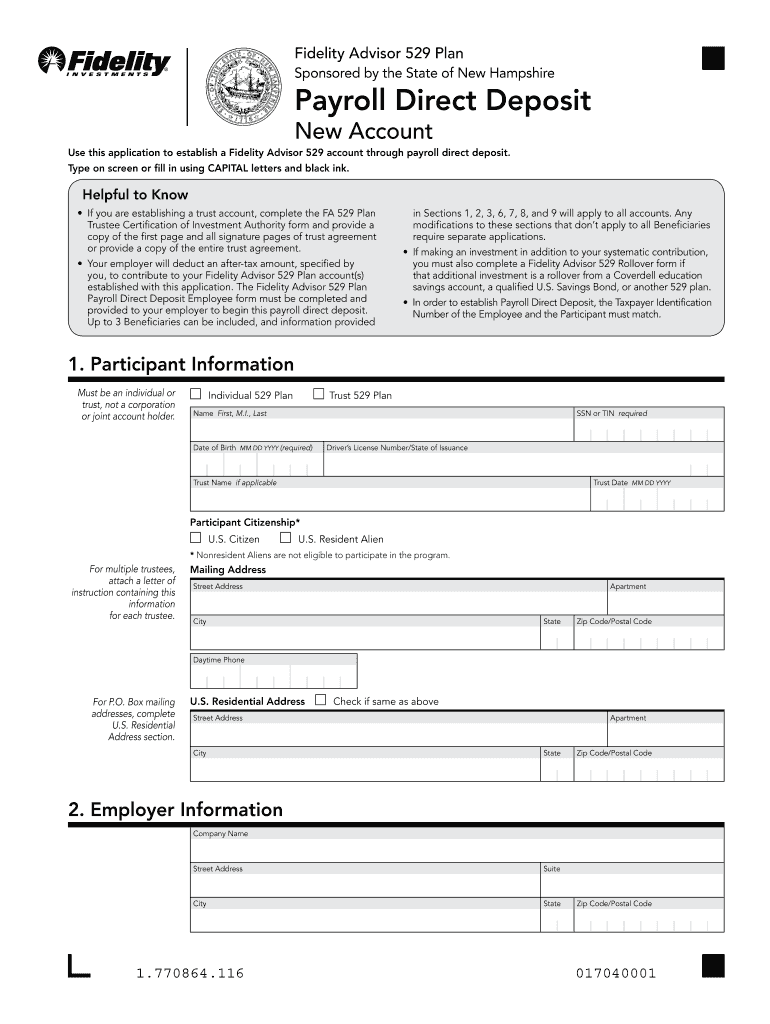

The Payroll Direct Deposit New Account Application is a form used by employees to authorize their employers to deposit their wages directly into their bank accounts. This process eliminates the need for paper checks, providing a faster and more secure way to receive payments. By completing this application, employees can ensure timely access to their funds, which can be particularly beneficial for budgeting and managing personal finances.

Steps to complete the Payroll Direct Deposit New Account Application

Completing the Payroll Direct Deposit New Account Application involves several straightforward steps:

- Obtain the form: Access the application through your employer’s human resources department or their official website.

- Fill in personal information: Provide your name, address, and Social Security number to verify your identity.

- Bank details: Enter your bank’s name, routing number, and account number. Ensure accuracy to avoid delays in processing.

- Signature: Sign and date the application to authorize the direct deposit.

- Submit the form: Return the completed application to your employer’s payroll department as instructed.

Legal use of the Payroll Direct Deposit New Account Application

The Payroll Direct Deposit New Account Application is legally binding once signed by the employee. This form grants permission to the employer to deposit wages directly into the specified bank account. Compliance with federal and state regulations is essential, ensuring that the process adheres to laws governing payroll practices. Employers must also maintain confidentiality regarding employees' banking information, protecting it from unauthorized access.

Required Documents

To complete the Payroll Direct Deposit New Account Application, you may need to provide specific documents, including:

- Identification: A government-issued ID, such as a driver's license or passport.

- Bank information: A voided check or bank statement that includes your account and routing numbers.

- Employment verification: Documentation from your employer confirming your employment status, if necessary.

Application Process & Approval Time

The application process for setting up direct deposit typically involves the following:

- Submission: Once you submit your application, your employer will review the information provided.

- Processing time: Approval may take one to two payroll cycles, depending on your employer’s processing schedule.

- Confirmation: You should receive confirmation from your employer once your direct deposit is active.

Examples of using the Payroll Direct Deposit New Account Application

Employees can benefit from using the Payroll Direct Deposit New Account Application in various scenarios:

- New hires: Completing the application ensures that new employees receive their first paycheck directly into their bank account.

- Account changes: Employees can update their banking information if they switch accounts or banks.

- Temporary arrangements: Employees may use this application for temporary assignments or contract work to facilitate direct payments.

Quick guide on how to complete payroll direct deposit new account application

Effortlessly Prepare Payroll Direct Deposit New Account Application on Any Device

Digital document administration has become increasingly favored by both businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Payroll Direct Deposit New Account Application on any platform using the airSlate SignNow applications for Android or iOS and streamline any document-related procedure today.

How to Alter and Electronically Sign Payroll Direct Deposit New Account Application with Ease

- Find Payroll Direct Deposit New Account Application and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to submit your form—via email, text (SMS), invitation link, or download it to your computer.

No more dealing with lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign Payroll Direct Deposit New Account Application to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

Do I need a bank account to fill out the MHT CET application form?

To apply, you need to pay through online mode. This doesn't necessarily need you to have a bank account. You can ask anyone kind-hearted who is having a bank account to pay and handover the hard cash to that person.Hope this helps.

-

Is it fishy if a company wants you to fill out the direct deposit form before you receive any paper work about being hired?

Hi, To give a little more context, if you are worried about completing a direct deposit form, which should be for receiving remuneration of your wages, then request a your employment contract and tell them you will complete the direct deposit form after the employment has been received. Always be open and honest with a potential em0ployer and set parameters for your employment relationship from the get go. you would like to follow procedures. Every Employer will respect you more for that. I do not think it is fishy but a little odd

-

How long do I have to wait to transfer money to a different bank after a payroll direct deposit to my BofA account?

You must wait 0.0 minutes after the direct deposit has been credited to your B of A account.If you see the money in your account when you log online, it is available to be transferred.With a direct deposit, there is no concept of “waiting for a check to clear” or “uncollected funds.” That’s the beauty of it. :)

-

Why would a bank mail me an SSA-89 form to fill out for a new checking account after it's already been opened with money that's already been deposited (and even though I'm already an existing customer)?

Why would a bank mail me an SSA-89 form to fill out for a new checking account after it's already been opened with money that's already been deposited (and even though I'm already an existing customer)?Banks have rules regarding “knowing their customers” that they must comply with or face penalties. In all likelihood the SSN on your account was flagged for some reason or another. Maybe it was mistyped, or maybe you’re using a fake SSN. Either way, the bank is going to want to see documentation of your SSN or they’ll have to restrict or close the account.You should get ahold of the bank to avoid any hassles with the funds that are in there or any transactions your had set up.

-

How do I deposit a personal check written out to me to my online bank account without a direct deposit?

Dear M. Anonymous,Good question. It can be confusing when you are new to online banking (or to checking accounts in general), so I totally understand. For years, I used a local bank. I deposited checks by going to the physical bank. Once I was at the bank, I would give the check to the teller to deposit, or I would put the check (and deposit slip) in the slot outside. This was long before online banking had been invented.My local bank once made a serious mistake in my account, which I resolved after spending many hours at a bank executive’s desk. The executive could not figure out the problem, but I was able to see that it had been my bank’s error that had caused the discrepancy. This sour experience prompted me to look elsewhere for another bank. I decided to use a bank that is primarily online and that is connected with a world-class organization that also provides car and home insurance to U.S. military officers and their dependents. I had done my research long before I ever selected this organization for my banking and car and home insurance.I currently have a bank account at this organization’s excellent online bank based in San Antonio, Texas (I’m in the D.C. area), and the way I prefer to deposit checks to my bank is by regular mail.For a good long while, my bank had a contract with a UPS Store that could scan checks and deposit them electronically into someone’s bank account, but I always felt a little uneasy doing that, and only used this service a few times. It certainly did not feel too secure to have a non-bank-related person touch my checks. Eventually, my bank stopped offering that as an option. (I would love to know the back story of what prompted my bank to stop doing this.)There are at least six ways to deposit checks including using electronic means (see this WikiHow: How to Deposit Checks).PRO TIP: Of course, the best thing for you to do is to go on your bank’s website and find out their process. Their website might even have a generic deposit ticket you can print out if you want to mail it in.Below are the steps I take to deposit checks by mail to my online bank.Endorse the check (that is, write your signature on the back). Under your signature, write “Deposit to” and then write your bank account number. NOTE: Make sure the check is valid.Fill out a deposit ticket (these are included with your checkbook). If you don’t have paper checks or deposit slips, contact your bank to find out how to get one.Put both the endorsed check and deposit ticket in an envelope addressed to the bank. Seal the envelope. My bank provides me with preaddressed envelopes that do not need postage.MAIL the envelope.Wait a few days, and you should see that deposit showing up in your account online.—Sarah M. 9/12/2018ORIGINAL QUESTION: How do I deposit a personal check written out to me to my online bank account without a direct deposit?

-

How can I submit a direct deposit transfer letter for my Social Security check to go to a new account?

Go to any Social Security office and bring either a voided check or a letter from your bank.Log on to your account at The United States Social Security Administration and update the bank routing and account numbers.

-

Do I have to state the amount in my account when filling out the Schengen application form?

Nope, you don’t need to. While filling out the form you can state that most of the expenditures are prepaid (like accommodation) and you are having enough cash to support your travel.When i was applying for Schengen visa, I did attach my bank statement but I don’t think it’s mandatory.

Create this form in 5 minutes!

How to create an eSignature for the payroll direct deposit new account application

How to create an electronic signature for your Payroll Direct Deposit New Account Application in the online mode

How to make an eSignature for your Payroll Direct Deposit New Account Application in Chrome

How to create an eSignature for putting it on the Payroll Direct Deposit New Account Application in Gmail

How to generate an eSignature for the Payroll Direct Deposit New Account Application straight from your mobile device

How to create an eSignature for the Payroll Direct Deposit New Account Application on iOS

How to generate an electronic signature for the Payroll Direct Deposit New Account Application on Android OS

People also ask

-

What is the Payroll Direct Deposit New Account Application process?

The Payroll Direct Deposit New Account Application process is designed to streamline your payroll setup. With airSlate SignNow, you can easily create, send, and eSign your applications online, ensuring a quick and efficient onboarding experience for your employees. This digital approach reduces paperwork and enhances compliance.

-

How much does the Payroll Direct Deposit New Account Application cost?

airSlate SignNow offers competitive pricing for the Payroll Direct Deposit New Account Application, with various plans tailored to meet the needs of businesses of all sizes. You can choose a plan that includes eSigning capabilities and document management features to enhance your payroll processing.

-

What features are included in the Payroll Direct Deposit New Account Application?

The Payroll Direct Deposit New Account Application includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These features ensure that your payroll applications are processed smoothly and that you can manage employee data effectively.

-

What are the benefits of using airSlate SignNow for Payroll Direct Deposit New Account Applications?

Using airSlate SignNow for Payroll Direct Deposit New Account Applications offers numerous benefits. It simplifies the application process, reduces the time spent on paperwork, and enhances security with encrypted eSigning. Additionally, businesses can improve their overall efficiency and employee satisfaction through a streamlined payroll process.

-

Can I integrate airSlate SignNow with my existing payroll software for the Payroll Direct Deposit New Account Application?

Yes, airSlate SignNow can integrate seamlessly with your existing payroll software. This integration allows for smooth data transfer and ensures that your Payroll Direct Deposit New Account Application is efficiently managed within your preferred payroll system, enhancing productivity.

-

Is the Payroll Direct Deposit New Account Application secure?

Absolutely! The Payroll Direct Deposit New Account Application through airSlate SignNow is highly secure. We utilize industry-standard encryption and compliance measures to protect sensitive payroll information and ensure that your documents are safe during the eSigning process.

-

How can I track the status of my Payroll Direct Deposit New Account Application?

With airSlate SignNow, you can easily track the status of your Payroll Direct Deposit New Account Application in real-time. Our platform provides notifications and updates, allowing you to see when documents are sent, viewed, and signed, ensuring that you stay informed throughout the process.

Get more for Payroll Direct Deposit New Account Application

Find out other Payroll Direct Deposit New Account Application

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now