Marriage Asset and Liabilities Form 2005-2026

What is the statement of assets and liabilities?

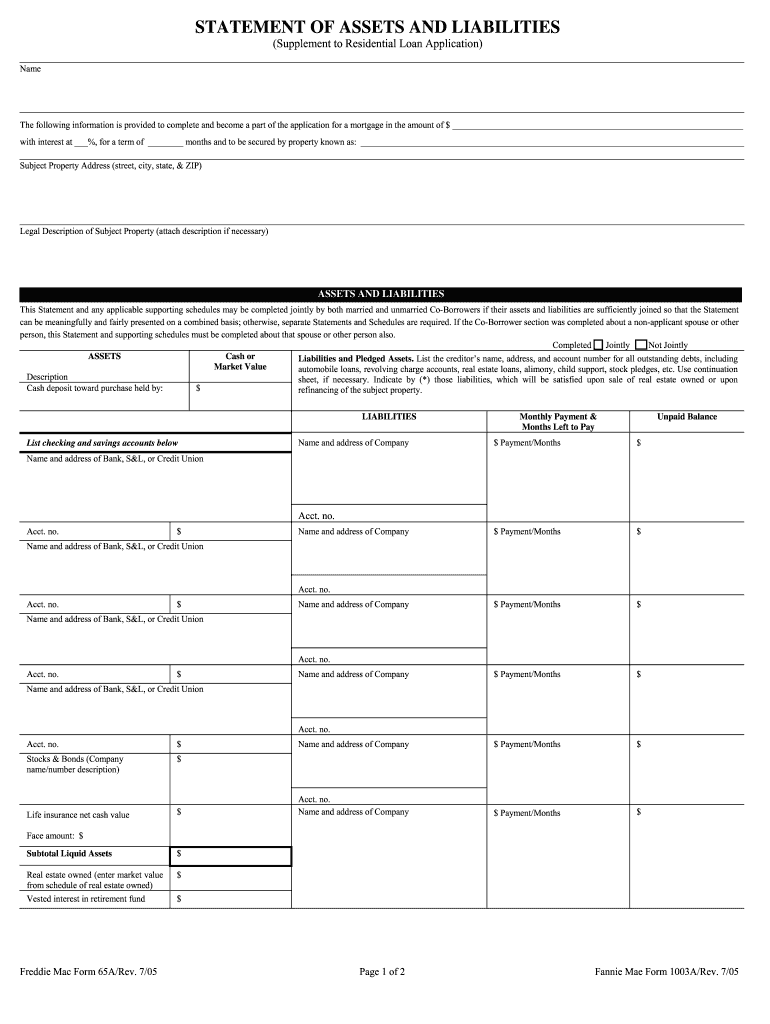

The statement of assets and liabilities is a financial document that outlines an individual's or entity's assets, liabilities, and equity at a specific point in time. This form is crucial for assessing financial health, particularly in contexts such as divorce proceedings, loan applications, or business evaluations. It provides a clear snapshot of what is owned (assets) versus what is owed (liabilities), allowing for informed decision-making regarding financial planning and obligations.

Key elements of the statement of assets and liabilities

Essential components of the statement of assets and liabilities include:

- Assets: These are items of value owned, such as cash, real estate, investments, and personal property.

- Liabilities: This section lists all debts and obligations, including loans, credit card debts, and mortgages.

- Equity: The difference between total assets and total liabilities, representing the net worth of the individual or entity.

Understanding these elements is vital for accurately completing the form and assessing one’s financial situation.

Steps to complete the statement of assets and liabilities

Completing the statement of assets and liabilities involves several key steps:

- Gather financial documents, including bank statements, loan agreements, and property deeds.

- List all assets, ensuring to include their current market value.

- Detail all liabilities, noting the outstanding amounts owed.

- Calculate total assets and total liabilities to determine equity.

- Review the completed form for accuracy and completeness before submission.

Legal use of the statement of assets and liabilities

The statement of assets and liabilities serves various legal purposes, particularly in divorce proceedings, where it helps in the equitable distribution of assets. It may also be required for loan applications, providing lenders with a clear picture of an applicant's financial status. Ensuring that the form is completed accurately and truthfully is essential to avoid legal repercussions.

How to obtain the statement of assets and liabilities form

The statement of assets and liabilities form can typically be obtained from legal professionals, financial advisors, or online resources. Many jurisdictions provide downloadable versions of the form, which can be filled out digitally or printed for manual completion. It is important to ensure that the correct version of the form is used, as requirements may vary by state or situation.

Examples of using the statement of assets and liabilities

Common scenarios where the statement of assets and liabilities is utilized include:

- During divorce proceedings to facilitate asset division.

- When applying for a mortgage or other loans, providing lenders with necessary financial information.

- For personal financial planning, helping individuals assess their net worth and make informed decisions.

These examples illustrate the form's versatility and importance in various financial contexts.

Quick guide on how to complete form assets liabilities

The simplest method to discover and endorse Marriage Asset And Liabilities Form

At the level of a whole organization, unproductive procedures regarding document approval can take up a signNow amount of work hours. Signing documents like Marriage Asset And Liabilities Form is an inherent element of operations in any sector, which is why the effectiveness of each agreement’s lifecycle is crucial to the overall success of the business. With airSlate SignNow, endorsing your Marriage Asset And Liabilities Form is as straightforward and quick as possible. This platform provides you with the latest version of nearly any document. Even better, you can endorse it immediately without needing to install additional software on your computer or printing hard copies.

How to obtain and endorse your Marriage Asset And Liabilities Form

- Explore our collection by category or use the search box to find the document you require.

- View the document preview by clicking Learn more to confirm it is the correct one.

- Press Get form to begin editing right away.

- Fill out your document and input any necessary details using the toolbar.

- Once finished, click the Sign tool to endorse your Marriage Asset And Liabilities Form.

- Choose the signature method that works best for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options as needed.

With airSlate SignNow, you possess everything you need to handle your documentation efficiently. You can find, complete, edit, and even send your Marriage Asset And Liabilities Form in a single tab without any hassle. Enhance your procedures with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct form assets liabilities

FAQs

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

How do I close a newly formed private limited company?

Under Companies Act 2013, a Company can be closed in two ways.Winding UpWinding up is a tedious process and can be done either voluntary by calling up a meeting of all stakeholders and passing a special resolution or can be done on the order of Court or Tribunal. Strike Off” mode was introduced by the MCA to give the opportunity to the defunct companies to get their names struck off from the Register of Companies. On 27th December 2016, MCA has notified new rules i.e. Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016 prescribing rule for winding up or closure of private limited company under companies act 2013. By releasing the form STK 2, ministry of Corporate Affairs has brought the Section 248- 252 of 2013 act into force.Fast track ExitThis is the most awaited procedure, that got active again on 5thApril 2017. This procedure was introduced in Section 248 of Companies Act 2013.Fast Track exit can be done in two ways:Suo Moto by RegistrarThe registrar may strike off the name of Company on its own if:Company has failed to commence any business in a year of its incorporationCompany is not carrying out any business or Activity for preceding 2 financial years and has not sought the status of Dormant Company.The Registrar sends a notice (STK-1) of his intention to remove the name and seeks the representation of Company in 30 days.Note: Liability on the Directors of the company still exists. ROC can invoke penalty clauses anytime, and the penalty may range from INR 50K to INR 5Lakhs per director.Voluntary Removal of Name using Form STK 2Company can also move an application to Registrar of Companies for striking off the name by filing form STK-2 along with a fee of Rs 5000/-. Once form is filed, the Registrar has power and duty to satisfy him that all amount due by the company for the discharge of its liabilities and obligations has been realized. ROC can also issue a show cause notice in case of default in filing returns or other obligations.After above formalities, ROC issues a public notice and strike off the name of Company after its expiry.Note: The form is in approval route. Therefore, concerned ROC can ask for the completion of the fillings.Details Required:Incorporation CertificateDirector Identification NumberPending Litigation Proceedings if anyDocuments Required:Application in form STK-2Government filing fees: INR 5,000/-Copy of Board resolution authorizing the filing of this application;A statement of accounts showing the assets and liabilities of the Company made up to a day, not more than thirty days before the date of application and certified by a Chartered AccountantShareholder’s approval by way of Special ResolutionIn the case of a company regulated by any other authority, approval of such authority shall also be required.Copy of relevant order for delisting, if any, from the concerned Stock Exchange;Indemnity bond [to be given individually or collectively by the director(s)] in Form No. STK-3;Affidavit in Form No. STK-4Note: This form must be signed by a practicing CA or CSCompanies that cannot file for voluntary strike-offA company cannot fill the form STK 2 at any time in the previous 3 months if the company hasHas changed its name or shifted its registered office from one State to another;Has made a disposal for value of property or rights held by it, immediatelyBefore cesser of trade or otherwise carrying on of business, for the purpose of disposal for gain in the normal course of trading or otherwise carrying on of business;Has engaged in any other activity except the one which is necessary or expedient for the purpose of making an application under that section, or deciding whether to do so or concluding the affairs of the company or complying with any statutory requirement;Has made an application to the Tribunal for the sanctioning of a compromise or arrangement and the matter has not been finally concluded; orIs being wound up under Chapter XX of Companies Act or under the Insolvency and Bankruptcy code, 2016Companies that cannot use Fast Track Exit option:Companies Registered Under Section 8Listed companies;Companies that have been delisted due to non-compliance of listing regulations or listing agreement or any other statutory laws;Vanishing companies;Companies where inspection or investigation is ordered and being carried out or actions on such order are yet to be taken up or were completed but prosecutions arising out of such inspection or investigation are pending in the Court;Companies where notices have been issued by the Registrar or Inspector (under Section 234 of the Companies Act, 1956 (old Act) or section 206 or section 207 of the Act)and reply thereto is pending;Companies against which any prosecution for an offense is pending in any court;Companies whose application for compounding is pending;Companies which have accepted public deposits which are either outstanding or the company is in default in repayment of the same;Companies having charges which are pending for satisfaction.,After you Strike off your company:As soon as the name of company is removed from Register, from the date mentioned in the notice under sub-section (5) of section 248 cease to operate as a company and the Certificate of Incorporation issued to it shall be deemed to have been cancelled from such date except for the purpose of realizing the amount due to the company and for the payment or discharge of the liabilities or obligations of the company.- See more at: Different ways to Close a Company in India - WazzeerFor any Legal and Accounting support, Happy to help you, let us talkPS: Wazzeer Loves entrepreneurs #GoGetItIn case, you are thinking of getting some free advise from an experienced Lawyer (and Accountant), checkout Counselapplication of Wazzeer.#WazzeerKACounsel**For any Legal and Accounting support, Happy to help you, let us talkPS: Wazzeer Loves entrepreneurs #GoGetIt

-

How do I get the educational loan for my higher studies?

MS applicants spend considerable time and resources preparing for the GRE, shortlisting and applying to schools, and choosing a final school (when lucky enough to receive multiple admits).The best idea is to gain an understanding of financing options while preparing applications and waiting for University responses. Knowing the options empowers MS aspirants to make the best decisions for the academic and financial futures.Type of Loans-Public sector banks: Collateral loansA number of banks offer education loans with collateral for MS studies abroad. Key features of such loan offers include:Up to 90% CoA cover. In some countries, the remaining 10% must be paid up front into the bank by the borrower; this is sometimes known as margin money.A variable interest rate of ~10.5%. In some cases, a discount may be applied for taking insurance against the loan. For, example, you may receive a 0.5% discount for such insurance although this is still an additional cost which factors into the total cost of a loan.In some countries, public sector banks require both collateral and a co-signer for loans. It’s important to be prepared for extensive paperwork and a long loan approval period.While it’s not a universal norm, the collateral requested in some countries requires a parental property to be put on the line - an option that isn’t available to everyone.Non-Banking Financial Corporation (NBFCs): co-signer loansNBFCs in some countries are enabled to provide financing for international education. Typical features of these loan offers include:An offer of up to 100% CoA cover, though a co-signer is always required, and collateral is often required for high-value loans.A proprietary interest rate which isn’t defined by a governing financial institute. It’s important to understand the full cost of any loan (including factors in hidden fees like loan sanction letter fee and currency conversion charges) to enable loan comparison.Loans might be assessed on the basis of co-signer credit score, as well as their salary and other credentials. This can be a real challenge for MS applicants whose co-signers are retired or have not built their credit histories.International lenders: No co-signer, collateral-free loansSome lenders, such as Prodigy Finance, provide loans to international students, often in the currency of the study destination country. Key features of such loan offers include:Loan cover up to 100% CoA without collateral or co-signers; these are merit-based loans provided on the basis of admission to a top-ranked international school.Customized interest rates that have a fixed component and a variable component – which is often the LIBOR rate of the loan currency.Online application processes that are often quicker than other loan providers - and typically more transparent as well.Prodigy Finance’s future earnings model assess your potential based on your post-masters income and career direction.In addition to no co-signer, collateral-free loans, Prodigy Finance borrowers are also eligible for value-added benefits like scholarships and careers support.Keep in mind that every loan offer has its own merits - and you should consider all of your options carefully. This quick guide is just a jumping off point to get you started. Education is an investment and study loans are a commitment; you’ll want to consider the future as well as the present because that acceptance letter is just the beginning.Want to see the terms Prodigy Finance can offer you?Applying for Prodigy Finance’s no-cosigner, collateral-free loans takes just 30 minutes. And, with no obligation to accept a provisional loan offer, there’s no reason to wait.Check more about Prodigy Finance- Prodigy Finance Answers your Top 10 Education-Loan Questions | YocketYou can decide about which type of Educational Loan you want as per your requirements.Share and upvote if helpful.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

How should I start investing my money as a 26 year old with no related knowledge?

The best investment you can make is to invest in yourself. The second best investment you can make is to reduce costs.Invest in yourselfEducation: You should be investing in your education. That doesn't necessarily mean college or grad school -- but it does mean massive knowledge accumulation to advance your career. Luckily, the cost of attaining knowledge has gone down dramatically. Buy time to focus more on your career. You can invest small amounts of money to buy yourself time. You can invest money to pay for things like grocery deliveries, laundry services, etc. to increase your time. Sometimes you can get a whole hour for less than you make in 10 minutes -- always make that trade-off if you can afford it. If you can put more hours in your career, you should see faster and larger raises, promotions, etc.More details at: What is the best way to maximize profit using my 20K?Cut your expensesThe second best investment for a young person to make is to cut your expenses -- especially the reoccurring expenses. Cutting expenses is much better than corresponding income because you get taxed on income. And if you live in a place like California or Manhattan, then you get taxed A LOT on income (top tax bracket for Fed+State+local is about 54%). For instance: Cut expenses like your monthly cable bill -- if you call your cable or mobile phone provider, you could probably knock off $15/mo in a 30 min phone call. That means you just made $180/year tax free. Cancel other services you don't use. Get a place with lower rent and just live cheaper. Long-term: two years of savingsIf you grow your revenues enough and cut your expenses enough, you will save. If things go well, you might achieve freedom. My definition of financial freedom for a young person is having two years of savings in the bank. That means you could sustain your current lifestyle for two years with no additional income. If you can achieve two years of savings, you can take real risks. You can quit your job to pursue a "crazy" idea. You have freedom to build real wealth.

-

Does an NRI need to fill in Schedule AL (Assets and Liabilities) of ITR-2 if his/her income outside India is more than 50 lakhs?

Presuming that you qualify as NR under the Income-tax Act, 1961, only following incomes would be taxable in India:Income received in IndiaIncome arising or accruing in IndiaIf the above mentioned incomes exceed the prescribed threshold in your case during this financial year (INR 50,00,000), then you have obligation to report your assets and liabilities in India in your income-tax return for that year.Hence, you do not need to report your foreign assets/income in your Indian income-tax return provided you qualify as NR in India for the relevant financial year.Hope the above helps!

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Are personal loans taxable in India?

No. The funds received from personal loans are not counted in your taxable income. This is because these funds are ‘borrowed’ and not part of your income. However, if the lender is not a registered lender, then they might fall under taxable income in your IT Returns. This is why it’s best you borrow funds from a registered bank or non-banking financial institute.On the other hand, the interest you pay on personal loans can be used to avail deductions on your taxable income. Yes, that’s right – you can actually benefit from the interest rate of a personal loan. This silver lining is applicable in the following conditions:1. Purchase/construction/repair of a home.Under the purview of Section 24 of the Indian Income Tax Act, the interest amount paid towards a personal loan that is used to purchase, construct or repair a home can be used to claim equal deduction on taxable income. All you have to do is prove that the funds were used for one of these causes. However, there might be come capping on the amount you can claim as deductions.2. Education:If you use the funds of a personal loan to cover education costs, you can the interest amount paid in a year to claim equal deductions on your taxable income. However, unlike the case of a home purchase or construction or repair, there is capping on the amount you can claim.3. Business: If you are going to invest the funds acquired from a personal loan into your business, then, you can show the personal loan as expenses. This will reduce your net profit and, in turn, reduce your tax liability. On other hand, if you use the funds to buy assets, then you use the interest amount to claim equal deductions.How do I apply for a personal loan?Applying for a personal loan has become easier & easier over the years. Now, you can go from application to approval and even get sanctions in a single day! This is all thanks to the internet and the wonders it has made possible. Therefore, if you are planning on borrowing a personal loan, you can rest assured that things will be super easy as long you follow the below steps:1. Go online: Sure, you could visit a branch or make a trip to your bank. But this would mean enduring the real-world annoyances of filling out forms, submitting paperwork, standing in line, etc. You can skip all this by going online. All you have to do is visit your preferred lender (after doing a detailed comparison) and find the ‘apply now’ button.2. Fill out the forms & upload your documents: Upon hitting the ‘apply now’ button, you should be redirected to an application form. Just fill in the required details and hit submit. The next step with most lenders would be to scan and upload the required documents.3. Get approvals: Once you’ve filled the form & submitted the documents, the lender will evaluate your request and if all is in place, they will approve your application. Then all you have to do is wait for the funds to arrive in your account.If you are still at the consideration phase, then you should try visiting a personal loan aggregator site. These sites will present you a detailed comparison of all the options available in the market. They will also have pre-negotiated deals that lenders won’t provide if your approached them directly. Once you zero in on the loan product you want, you can also apply through these sites in a process similar to the one described above.

-

What are assets and liabilities?

According to Accounting termsASSETSAssets are the economic resources of business or we can say assets are the property owned by the business to get benefit on future.In other words, assets are valuable resources owned by a business which were acquired at a measurable money cost for usefulness.The various types of assets are:1- Fixed assets: those assets which are acquired for the purpose of increasing profit earning capacity of the business and are purchased not for sale purpose, they will remain in the business till the business winds up. Example, land and building, plant and machinery etc2- Current assets: those which can be converted into cash within a short period say one year. These are short term assets for the purpose of converting them into cash. Example, cash in hand, debtors, stock, bank balance etc.3- Liquid assets: similar to current assets, but they are those assets which can be easily and in a very short period of time can be converted into cash, so all current assets except stock and prepaid expenses are considered liquid assets.4- Tangible assets: assets which having some physical existence or we say which can be touched and seen like land and building, machinery, stock etc5- Intangible assets: those assets which can't be seen or touched and there revenue generation is assumed to be uncertain. Moreover they can't be purchased or sold in open market examples are goodwill, patents, trademarks etc.6- Fictitious assets: those assets which do not have any real value and do not have any physical form but are called assets on the basis of legal and technical grounds, as they do not have any real value so they are written off in the future, for example preliminary expenses, discount on issue of shares and debentures etc.7- Wasting assets: those assets when with the passage of time value of assets decreases, example patents, leasehold property.LIABILITIESLiabilities are the claims against those resources or liabilities are the amount which a business owes to outsiders or claim of outside towards business. We should remember one thing that we take all the claims against business except the claims of proprietors. Because claim of proprietors against business is called internal liability or capital.Example of liabilities are, creditors, bills payable, bank overdraft etc.We should note that total assets are always equals to total liabilities.Types of liabilities are:1- Fixed liabilities: which are payable after a long period or normally one year. Example long term loans, debentures etc.2- Current liabilities: those which are payable within one year example, bills payable, creditors etc3- Contingent liabilities: those liabilities which are not a liability for today but it may be liability in future depending on the future events, they are uncertain liabilities so that is why they are called doubtful liabilities also. Example, value of bill discounted, cases pending in court etc.Total assets=total liabilitiesOrTotal assets= internal liabilities+external liabilitiesOrTotal assets= Capital+ liabilitiesOrLiabilities= Assets-capital.Hope it's clear!

Create this form in 5 minutes!

How to create an eSignature for the form assets liabilities

How to generate an electronic signature for the Form Assets Liabilities online

How to create an eSignature for the Form Assets Liabilities in Chrome

How to create an electronic signature for signing the Form Assets Liabilities in Gmail

How to generate an eSignature for the Form Assets Liabilities from your mobile device

How to make an electronic signature for the Form Assets Liabilities on iOS devices

How to create an electronic signature for the Form Assets Liabilities on Android devices

People also ask

-

What is the Marriage Asset And Liabilities Form?

The Marriage Asset And Liabilities Form is a legal document designed to outline the financial assets and liabilities of each spouse prior to marriage. Using this form helps ensure transparency and can facilitate discussions about financial responsibilities and division in case of a separation. airSlate SignNow makes it easy to create and eSign this essential document securely.

-

How can I create a Marriage Asset And Liabilities Form using airSlate SignNow?

Creating a Marriage Asset And Liabilities Form with airSlate SignNow is simple and user-friendly. You can start by selecting a template or customizing your own form to include specific assets and liabilities. Once your form is complete, you can send it for eSignature, which streamlines the entire process.

-

Is the Marriage Asset And Liabilities Form legally binding?

Yes, the Marriage Asset And Liabilities Form becomes legally binding once both parties sign it using airSlate SignNow's eSignature feature. This ensures that the document holds legal weight and can be used in court if necessary. Always consult with a legal professional to ensure compliance with local laws.

-

What are the benefits of using airSlate SignNow for the Marriage Asset And Liabilities Form?

Using airSlate SignNow for the Marriage Asset And Liabilities Form offers numerous benefits, including ease of use, cost-effectiveness, and enhanced security. The platform allows you to create, edit, and send documents quickly, ensuring that both parties can sign from anywhere. Additionally, airSlate SignNow provides secure storage for all your signed documents.

-

Can I integrate airSlate SignNow with other applications for my Marriage Asset And Liabilities Form?

Absolutely! airSlate SignNow offers a variety of integrations with popular applications such as Google Drive, Dropbox, and Salesforce. This allows you to seamlessly manage your Marriage Asset And Liabilities Form and related documents across different platforms, enhancing your workflow and efficiency.

-

What pricing options are available for using airSlate SignNow to create a Marriage Asset And Liabilities Form?

airSlate SignNow offers several pricing plans to suit different needs, including a free trial to explore the features. Depending on your requirements, you can choose from monthly or annual subscriptions that provide unlimited access to create and manage your Marriage Asset And Liabilities Form at an affordable price.

-

How does airSlate SignNow ensure the security of my Marriage Asset And Liabilities Form?

airSlate SignNow prioritizes the security of your documents, including the Marriage Asset And Liabilities Form, by utilizing advanced encryption and secure storage solutions. The platform complies with industry standards to ensure that your sensitive financial information is protected. You can trust that your documents are safe and accessible only to authorized users.

Get more for Marriage Asset And Liabilities Form

- Retrospective chart review crdw request form

- Eduenroll form

- Western illinois university housing petition form

- University of louisville transcripts form

- Readmission to laguardia community college fill online form

- Applying for boston university aid when your biologicaladoptive form

- Information technology management checklist uw milwaukee

- Initial appointment application form

Find out other Marriage Asset And Liabilities Form

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online