Cert 106 Tax Form 2016

What is the Cert 106 Tax Form

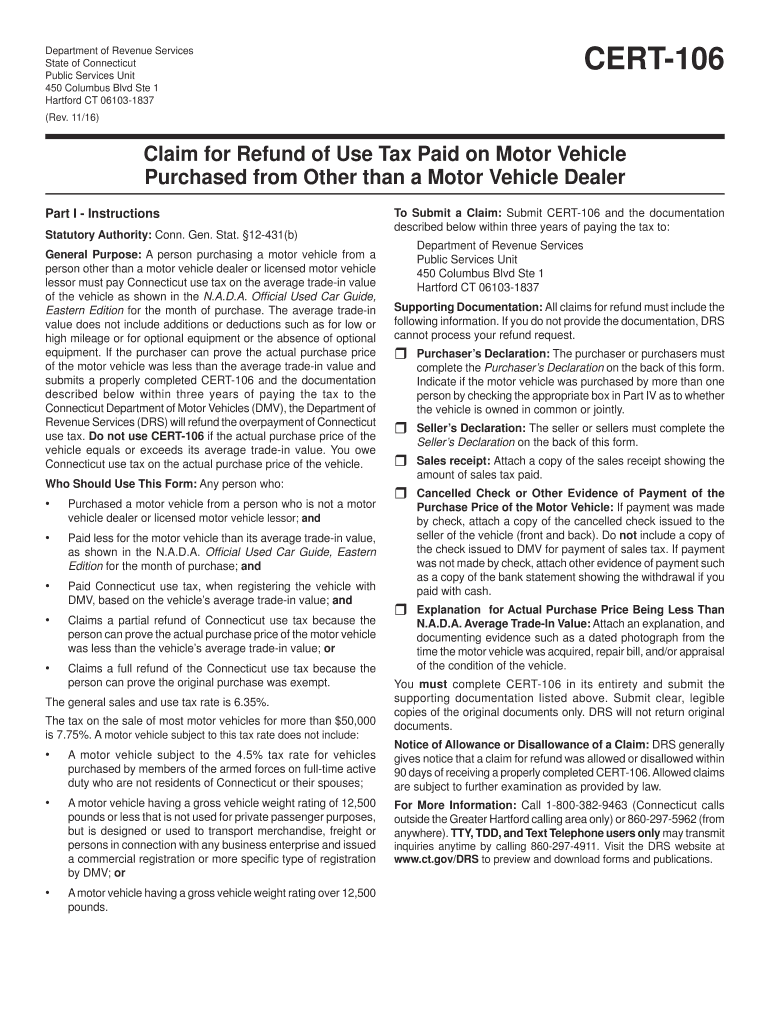

The Cert 106 Tax Form, also known as the Connecticut Department of Revenue Services Cert 106 form, is a crucial document used for tax purposes in the state of Connecticut. This form is primarily utilized by individuals and businesses to claim a refund on certain taxes paid, specifically related to vehicle sales and use taxes. It serves as a formal request for a refund and must be completed accurately to ensure compliance with state regulations.

How to use the Cert 106 Tax Form

Using the Cert 106 Tax Form involves several steps to ensure that the information provided is complete and accurate. First, gather all necessary documentation, including proof of payment and any relevant receipts. Next, fill out the form with accurate details, including your name, address, and the specific reasons for the refund request. Once completed, submit the form according to the guidelines provided by the Connecticut Department of Revenue Services. This may include options for online submission, mailing, or in-person delivery.

Steps to complete the Cert 106 Tax Form

Completing the Cert 106 Tax Form requires careful attention to detail. Follow these steps for successful completion:

- Review the form for any specific instructions provided by the Connecticut Department of Revenue Services.

- Fill in your personal information, including your full name, address, and contact details.

- Clearly state the reason for your refund request, ensuring that it aligns with the criteria set forth by the state.

- Attach any required documentation, such as receipts or proof of tax payment.

- Double-check all entries for accuracy before submitting the form.

Legal use of the Cert 106 Tax Form

The Cert 106 Tax Form is legally binding when completed and submitted in accordance with state laws. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or rejection of the refund request. The form must comply with the relevant tax laws and regulations established by the Connecticut Department of Revenue Services, ensuring that it is used appropriately for its intended purpose.

Required Documents

When submitting the Cert 106 Tax Form, certain documents are required to support your claim. These typically include:

- Proof of payment for the taxes being refunded, such as receipts or transaction records.

- Any additional documentation that substantiates your claim, such as vehicle purchase agreements or tax invoices.

- Identification documents, if necessary, to verify your identity and residency.

Form Submission Methods

The Cert 106 Tax Form can be submitted through various methods to accommodate different preferences. Options typically include:

- Online submission through the Connecticut Department of Revenue Services website, if available.

- Mailing the completed form to the designated address provided by the department.

- In-person submission at local revenue service offices, allowing for immediate assistance if needed.

Quick guide on how to complete cert 106 tax form

Complete Cert 106 Tax Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage Cert 106 Tax Form on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to alter and eSign Cert 106 Tax Form without hassle

- Find Cert 106 Tax Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Modify and eSign Cert 106 Tax Form and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cert 106 tax form

Create this form in 5 minutes!

How to create an eSignature for the cert 106 tax form

The way to make an electronic signature for a PDF document online

The way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the cert106 tax form and why is it important?

The cert106 tax form is essential for businesses to report specific financial information for tax purposes. Understanding this form can help ensure compliance with tax regulations and avoid potential penalties. airSlate SignNow simplifies the process of filling and submitting the cert106 tax form through its eSigning capabilities.

-

How can airSlate SignNow help with managing the cert106 tax form?

airSlate SignNow provides a streamlined platform for completing and eSigning the cert106 tax form with ease. Its user-friendly interface allows users to fill out the form accurately and securely. By using airSlate SignNow, businesses can reduce the time and effort required to manage this critical document.

-

What features does airSlate SignNow offer for handling cert106 tax submissions?

airSlate SignNow offers features like customizable templates, secure eSigning, and integrated storage options specifically for documents like the cert106 tax form. These features help users ensure that their submissions are complete and compliant. Additionally, you can track the progress of your cert106 tax form with automated notifications.

-

Is airSlate SignNow cost-effective for businesses needing to manage cert106 tax forms?

Yes, airSlate SignNow provides a cost-effective solution for businesses looking to manage cert106 tax forms. With various pricing plans, users can choose the one that best suits their needs without compromising on functionality. This allows businesses of all sizes to stay compliant without overspending.

-

Can I integrate airSlate SignNow with other tools for processing cert106 tax forms?

Absolutely! airSlate SignNow offers integrations with various business tools and software that can help streamline the cert106 tax form process. Whether you use accounting software or CRM systems, these integrations can enhance your workflow and keep all relevant documents organized and accessible.

-

How secure is my data when using airSlate SignNow for cert106 tax forms?

airSlate SignNow prioritizes security for all documents, including cert106 tax forms. The platform employs advanced encryption and compliance standards to ensure that your data is protected during eSigning and storage. Users can trust that their sensitive information will remain confidential and secure.

-

What benefits does eSigning offer for the cert106 tax form?

eSigning the cert106 tax form through airSlate SignNow speeds up the submission process and eliminates the hassle of printing and scanning. This digital approach enhances efficiency, allowing businesses to complete their forms quickly and accurately. Furthermore, eSigning provides a legally binding confirmation of submission.

Get more for Cert 106 Tax Form

- Editable hand sanitiser msds form

- Re certification information iahcsmm

- Webtec form

- Bsiteb health amp safety induction form

- Music teacher contract template form

- Bcia 8372 form fill out and sign printable pdf template

- Patient assistance program novo nordisk inc po box form

- Partnership for small business agreement template form

Find out other Cert 106 Tax Form

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF