Alaska P 370 Form

What is the Alaska P 370

The Alaska P 370 form is a state-specific document used primarily for tax purposes in Alaska. This form is essential for individuals and businesses to report specific income types and deductions accurately. It is designed to ensure compliance with state tax regulations and facilitate the proper assessment of tax liabilities. Understanding the purpose and requirements of the Alaska P 370 is crucial for anyone subject to Alaska's tax laws.

How to obtain the Alaska P 370

Obtaining the Alaska P 370 form is a straightforward process. Individuals can access the form through the official Alaska Department of Revenue website or by visiting local tax offices. Additionally, it may be available at various public libraries and community centers. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Steps to complete the Alaska P 370

Completing the Alaska P 370 involves several key steps:

- Gather necessary financial documents, including income statements and receipts for deductions.

- Fill out personal information, including your name, address, and taxpayer identification number.

- Report your income accurately in the designated sections of the form.

- Claim any applicable deductions or credits as outlined in the instructions.

- Review the completed form for accuracy before submission.

Following these steps carefully will help ensure that your Alaska P 370 form is filled out correctly.

Legal use of the Alaska P 370

The Alaska P 370 form must be completed and submitted in accordance with state tax laws to be considered legally valid. This includes ensuring that all information provided is accurate and that the form is submitted by the appropriate deadlines. Electronic submission of the form is permissible, provided that it complies with the necessary eSignature regulations. Utilizing a secure platform for electronic signing can further enhance the legal standing of your submission.

Key elements of the Alaska P 370

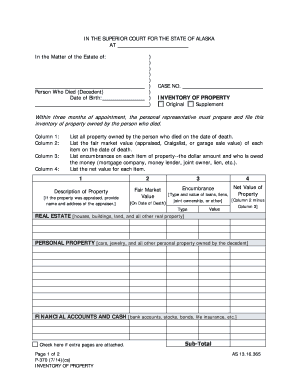

Key elements of the Alaska P 370 include:

- Personal Information: This section requires your name, address, and identification number.

- Income Reporting: Detailed sections for reporting various types of income, including wages and self-employment earnings.

- Deductions: Areas to claim deductions for eligible expenses, which can reduce your taxable income.

- Signature: A signature line to certify that the information provided is accurate and complete.

Understanding these elements is vital for accurate completion and compliance.

Form Submission Methods

The Alaska P 370 form can be submitted through various methods:

- Online: Many taxpayers prefer to submit forms electronically through the Alaska Department of Revenue’s online portal.

- By Mail: Completed forms can be mailed to the appropriate tax office, ensuring they are sent well before the deadline.

- In-Person: Taxpayers may also choose to deliver their forms in person at designated tax offices.

Choosing the right submission method can help ensure timely processing of your form.

Quick guide on how to complete alaska p 370

Finish Alaska P 370 effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly, without any holdups. Manage Alaska P 370 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to edit and eSign Alaska P 370 without difficulty

- Find Alaska P 370 and click Get Form to begin.

- Utilize the resources we offer to fill out your form.

- Emphasize key sections of your documents or redact confidential information using tools provided by airSlate SignNow that are tailored for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Alaska P 370 and ensure excellent communication at any point during your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alaska p 370

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the Alaska P 370 form?

The Alaska P 370 form is a crucial document used for reporting state taxes in Alaska. It helps businesses and individuals ensure compliance with state regulations. By utilizing this form, users can accurately report their income and deductions.

-

How can airSlate SignNow assist with the Alaska P 370 form?

AirSlate SignNow streamlines the process of filling out and eSigning the Alaska P 370 form. Users can easily upload, edit, and send the form for signatures, making tax reporting quicker and simpler. This efficient solution reduces the chances of errors and accelerates the approval process.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers competitive pricing plans tailored to fit various business needs, with features specifically designed for handling documents like the Alaska P 370 form. Plans range from individual use to enterprise solutions, providing flexibility in choosing the right option. Additional discounts may be available for annual subscriptions.

-

Is the Alaska P 370 form compliant with state regulations?

Yes, the Alaska P 370 form created and eSigned using airSlate SignNow adheres to all state regulations. The platform ensures that all forms meet the requirements set forth by Alaska state law. Users can have confidence knowing their documents are compliant and ready for submission.

-

Can I track the status of my Alaska P 370 form?

AirSlate SignNow allows you to track the status of your Alaska P 370 form from preparation to signature. Users receive real-time notifications on the progress of their documents, ensuring transparency and accountability throughout the process. This feature greatly improves the efficiency of handling important tax forms.

-

What integrations does airSlate SignNow offer for managing the Alaska P 370 form?

AirSlate SignNow integrates seamlessly with various accounting and tax software that can assist in managing the Alaska P 370 form. This connectivity helps streamline workflows and ensures that all data is synchronized effectively. Businesses can manage their documents with ease while utilizing their preferred tools.

-

What are the benefits of using airSlate SignNow for the Alaska P 370 form?

Using airSlate SignNow for the Alaska P 370 form provides numerous benefits including increased efficiency, enhanced security, and reduced paper usage. The platform's user-friendly interfaces facilitate easy document preparation, while its eSigning features save time and enhance collaborative efforts. Overall, it simplifies the entire process from start to finish.

Get more for Alaska P 370

- Maricopa county destruction of records form

- Trader moni registration portal form

- City of detroit income tax d 1040 r ly individual ci detroit mi form

- Transmission form nomination hdfc bank

- Claim form meridiana

- Document cover sheet nvc form

- Business continuity agreement template form

- Business credit agreement template form

Find out other Alaska P 370

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors