Std 204 Form

What is the Std 204 Form

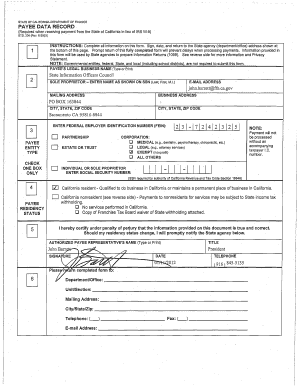

The Std 204 form, also known as the payee data record, is a crucial document used primarily in California for reporting payments made to individuals or entities. This form is essential for businesses and organizations that need to report payments for services rendered, ensuring compliance with state tax regulations. It captures vital information about the payee, including their name, address, and taxpayer identification number, which is necessary for accurate tax reporting.

How to use the Std 204 Form

Using the Std 204 form involves several straightforward steps. First, collect the necessary information about the payee, including their legal name, address, and tax identification number. Next, accurately fill out the form, ensuring that all details are correct to avoid issues with tax reporting. Once completed, the form should be submitted to the appropriate state agency or included with tax filings to ensure compliance with California tax laws.

Steps to complete the Std 204 Form

Completing the Std 204 form requires careful attention to detail. Follow these steps for accurate completion:

- Gather all required information about the payee, including their name, address, and taxpayer identification number.

- Fill in the form clearly, ensuring that all fields are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form as part of your tax reporting requirements.

Legal use of the Std 204 Form

The legal use of the Std 204 form is governed by California state tax laws. It serves as an official record of payments made to individuals or entities, ensuring that both the payer and payee comply with tax obligations. Proper completion and submission of the form help prevent penalties and ensure that the necessary tax information is reported accurately to the state.

Key elements of the Std 204 Form

Key elements of the Std 204 form include:

- Payee Information: This section requires the legal name, address, and taxpayer identification number of the payee.

- Payment Details: This includes the amount paid and the nature of the payment.

- Signature: A signature may be required to validate the information provided on the form.

Form Submission Methods

The Std 204 form can be submitted through various methods, including:

- Online Submission: Many organizations opt to submit the form electronically through secure online platforms.

- Mail: The form can also be printed and mailed to the appropriate state agency.

- In-Person: Submitting the form in person at designated state offices is another option.

Quick guide on how to complete std 204 form

Prepare Std 204 Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents quickly without any holdups. Handle Std 204 Form on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Std 204 Form with ease

- Locate Std 204 Form and click Get Form to begin.

- Use the tools available to complete your document.

- Highlight important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, the hassle of searching for forms, or errors necessitating the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Std 204 Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the std 204 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 204 and how can it be used in airSlate SignNow?

Form 204 is a standardized document commonly used for specific reporting requirements. With airSlate SignNow, users can easily create, send, and eSign Form 204, streamlining the process and ensuring all necessary information is accurately collected.

-

What are the pricing options for using airSlate SignNow for form 204?

airSlate SignNow offers flexible pricing plans that cater to different business needs, starting with a free trial. Each plan includes features that enhance the management of documents like form 204, providing a cost-effective solution for eSigning and document automation.

-

Can I customize form 204 within airSlate SignNow?

Yes, airSlate SignNow allows users to customize form 204 by adding fields, branding, and specific instructions. This level of customization ensures that the document meets your unique requirements while maintaining compliance with necessary regulations.

-

What features does airSlate SignNow offer for managing form 204?

airSlate SignNow provides features such as document templates, automated workflows, and real-time tracking for form 204. These functionalities help ensure that the document lifecycle is efficient and organized from creation to final eSignature.

-

Is airSlate SignNow secure for handling form 204?

Absolutely, airSlate SignNow employs advanced security protocols to protect sensitive information in form 204. With encryption and secure storage, users can trust that their documents are safeguarded throughout the signing process.

-

What integrations are available for form 204 in airSlate SignNow?

airSlate SignNow offers various integrations with popular applications that can enhance the management of form 204. This allows users to seamlessly connect their existing tools, making document management more efficient and streamlined.

-

How can airSlate SignNow improve the efficiency of processing form 204?

Utilizing airSlate SignNow to process form 204 signNowly speeds up workflows by automating eSigning and routing. This efficiency leads to quicker turnaround times and reduced errors compared to traditional paper methods.

Get more for Std 204 Form

- Va form 0927b national veterans tee tournament participant registration application 0927b national veterans tee tournament

- Va ny harbor healthcare system conditions of temporary appointment memo va ny harbor healthcare system conditions of temporary form

- Form declaration under penalty of perjury for the centers for disease control and preventions temporary halt in evictions to

- If you have any questions please contact one of the following driver safety branch offices each request must be signed for form

- Ol 620 problems with driving school or traffic violator school tvs index ready this form is to be used for complaints against

- Reg 206 i statment of personal history employee interstate carrier program icp index ready this form is used as a statement of

- Request for copy of collision report revised 119 washington state patrol collision records section 360 570 2355 form

- Colorado department of transportation fuel log 2 pages bulk fuel transaction log fuel dispensed into trucks end of month form

Find out other Std 204 Form

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation