Ca Jv540s Form

What is the CA JV540S Form

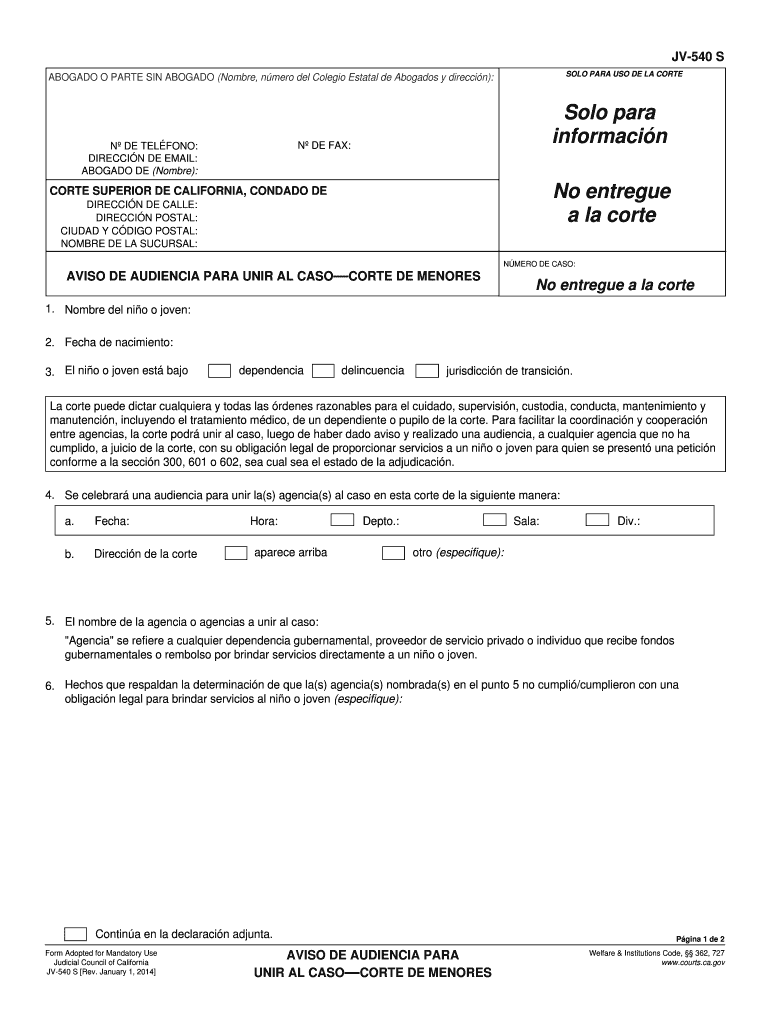

The CA JV540S form, also known as the California Joint Venture 540S form, is a tax document specifically designed for partnerships and joint ventures operating in California. This form is essential for reporting income, deductions, and credits for entities that do not operate as traditional corporations. It allows partners to declare their share of income and expenses, ensuring compliance with state tax regulations.

Understanding the CA JV540S form is crucial for accurate tax reporting and avoiding potential penalties. It is particularly relevant for businesses that operate under a partnership structure, providing a clear framework for financial disclosure and tax obligations.

How to Use the CA JV540S Form

Using the CA JV540S form involves several steps to ensure accurate completion and compliance with state tax laws. First, gather all necessary financial documents, including income statements, expense reports, and any relevant partnership agreements. This information will help you accurately fill out the form.

Next, complete each section of the form, making sure to report all income and deductions as required. It is important to double-check your entries for accuracy before submission. Once completed, the form can be filed electronically or mailed to the appropriate tax authority, depending on your preference and the guidelines provided by the California Franchise Tax Board.

Steps to Complete the CA JV540S Form

Completing the CA JV540S form involves a systematic approach to ensure all necessary information is accurately reported. Follow these steps:

- Gather financial documents related to the partnership, including income and expense records.

- Fill out the basic information section, including the partnership's name, address, and tax identification number.

- Report total income earned by the partnership during the tax year.

- Detail all deductible expenses, ensuring that they are categorized correctly.

- Calculate the net income or loss for the partnership.

- Complete any additional schedules or attachments required for specific deductions or credits.

- Review the entire form for accuracy and completeness before submission.

Legal Use of the CA JV540S Form

The CA JV540S form serves a vital role in ensuring that partnerships comply with California tax laws. Legally, it is required for any partnership or joint venture that generates income within the state. Failure to file this form can result in penalties, including fines and interest on unpaid taxes.

Moreover, the information provided in the CA JV540S form is used by the California Franchise Tax Board to assess tax liabilities and ensure that all entities are contributing fairly to state revenue. Therefore, it is essential to understand the legal implications of this form and to complete it accurately.

Required Documents for the CA JV540S Form

To complete the CA JV540S form, several documents are necessary to provide accurate and comprehensive information. These include:

- Partnership agreement outlining the terms of the partnership.

- Financial statements detailing income and expenses.

- Tax identification number for the partnership.

- Prior year tax returns, if applicable, for reference.

- Documentation for any deductions or credits claimed.

Having these documents ready will streamline the process of filling out the form and help ensure compliance with tax regulations.

Form Submission Methods

The CA JV540S form can be submitted through various methods, providing flexibility for partnerships. Options include:

- Online submission: Many partnerships opt to file electronically through the California Franchise Tax Board's online portal, which often allows for quicker processing.

- Mail submission: The form can also be printed and mailed to the appropriate tax authority. Ensure that it is sent to the correct address as specified by the California Franchise Tax Board.

- In-person submission: Partnerships may choose to deliver the form in person at designated tax offices, although this is less common.

Choosing the right submission method can help ensure timely processing and compliance with state tax deadlines.

Quick guide on how to complete ca jv540s form

Complete Ca Jv540s Form seamlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly without delays. Handle Ca Jv540s Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Ca Jv540s Form with ease

- Find Ca Jv540s Form and then click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as an original wet ink signature.

- Verify all the information and then click on the Done button to confirm your changes.

- Choose your preferred method to share your form via email, SMS, or invitation link, or download it to your computer.

Stop worrying about lost or mislaid documents, time-consuming form hunts, or errors that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from your selected device. Edit and eSign Ca Jv540s Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca jv540s form

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is the ca jv540s form and how does it work?

The ca jv540s form is a specific document used for various regulatory and compliance purposes. With airSlate SignNow, you can easily send, receive, and eSign this form digitally, streamlining the submission process. Our platform ensures that your ca jv540s form is securely handled and can be accessed anytime, anywhere.

-

How can airSlate SignNow help with completing the ca jv540s form?

airSlate SignNow simplifies the completion of the ca jv540s form by allowing users to fill out and eSign documents electronically. You can invite others to collaborate on the form, making it easy to gather required signatures. This feature not only saves time but also minimizes errors commonly associated with manual paperwork.

-

Is the pricing of airSlate SignNow competitive for handling the ca jv540s form?

Yes, airSlate SignNow offers competitive pricing plans designed to suit various business needs, including frequent usage of the ca jv540s form. You can choose from multiple subscription tiers that provide the flexibility and features required without breaking the budget. Our cost-effective solution ensures affordability while delivering high-quality service.

-

What features are available for the ca jv540s form in airSlate SignNow?

With airSlate SignNow, you have access to a variety of features tailored for the ca jv540s form. These include customizable templates, eSignature capabilities, and document management tools. Additionally, the user-friendly interface allows for easy navigation, ensuring a seamless experience for all users involved in the signing process.

-

Can I integrate airSlate SignNow with other applications for the ca jv540s form?

Absolutely! airSlate SignNow easily integrates with a multitude of applications, enhancing your workflow when managing the ca jv540s form. Whether you use CRMs, cloud storage services, or other productivity tools, our integrations allow for seamless data transfer and improved efficiency.

-

What are the benefits of using airSlate SignNow for the ca jv540s form?

Using airSlate SignNow for the ca jv540s form provides numerous benefits, including increased efficiency, reduced processing time, and enhanced security. Digital signing ensures that your documents are legally binding while also being environmentally friendly by minimizing paper usage. Experience a more streamlined document management process that saves time and resources.

-

How secure is the handling of the ca jv540s form in airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the ca jv540s form. Our platform employs robust encryption methods and adheres to strict compliance standards to protect your data. You can trust that your information will remain confidential and secure during the entire signing process.

Get more for Ca Jv540s Form

Find out other Ca Jv540s Form

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer