Wg 004 Form

What is the Wg 004

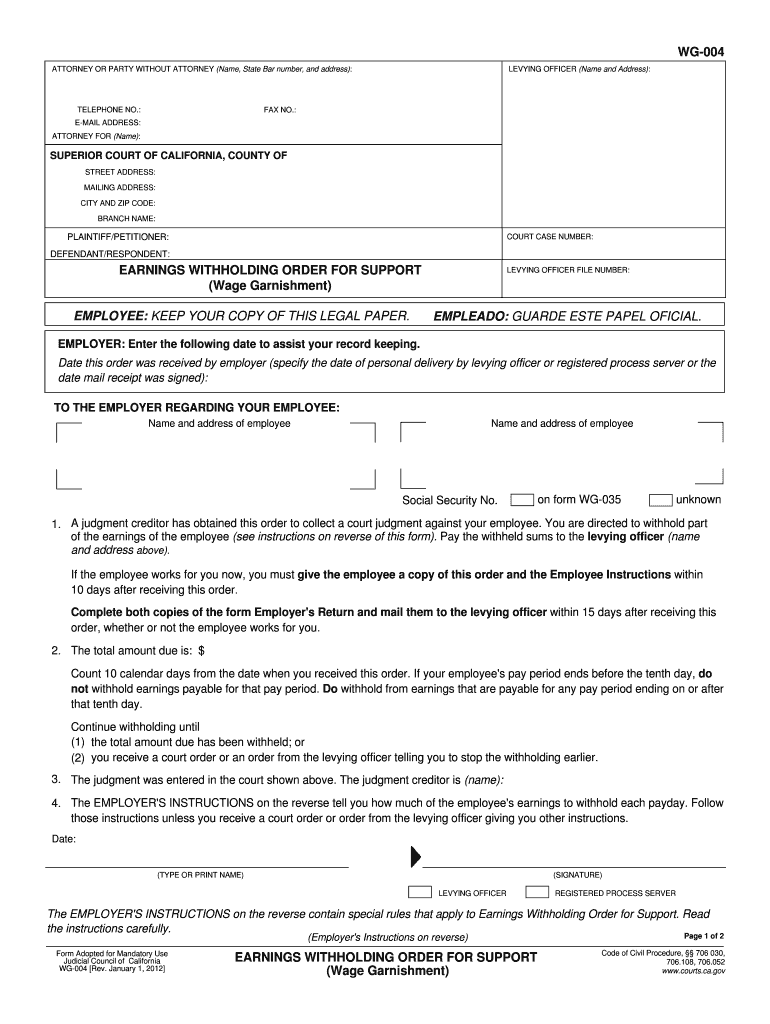

The Wg 004 form, also known as the Earnings Withholding Order, is a legal document used primarily in California to facilitate wage garnishment. This form allows employers to withhold a portion of an employee's earnings to satisfy a debt, such as child support or other court-ordered payments. The Wg 004 is essential in ensuring that the withholding process complies with state laws and protects the rights of both the employee and the creditor.

How to use the Wg 004

Using the Wg 004 form involves several key steps. First, the creditor must obtain a court order that specifies the amount to be withheld from the employee's wages. Once the order is in place, the creditor or their representative can complete the Wg 004 form, detailing the necessary information, including the employee's name, address, and the amount to be withheld. The completed form should then be submitted to the employer, who is responsible for implementing the wage garnishment according to the specified terms.

Steps to complete the Wg 004

Completing the Wg 004 form requires careful attention to detail. Here are the steps to follow:

- Obtain a court order that outlines the garnishment details.

- Fill out the Wg 004 form with accurate information regarding the employee and the garnishment amount.

- Include any necessary supporting documentation, such as the court order.

- Submit the form to the employer's payroll department.

- Keep a copy of the submitted form and any correspondence for your records.

Legal use of the Wg 004

The legal use of the Wg 004 form is governed by California state law, which outlines the conditions under which wages can be garnished. Employers must comply with these laws to avoid legal repercussions. The form must be executed properly, ensuring that all required information is provided and that the garnishment does not exceed the legal limits set forth in the law. This ensures that the employee's rights are protected while fulfilling the creditor's claim.

Key elements of the Wg 004

Several key elements must be included in the Wg 004 form to ensure its validity:

- Creditor Information: Name and contact details of the creditor or their representative.

- Employee Information: Full name, address, and Social Security number of the employee whose wages are being garnished.

- Amount to Withhold: The specific dollar amount or percentage of wages to be withheld.

- Court Order Details: Reference to the court order that authorizes the garnishment.

- Employer Information: Name and address of the employer responsible for processing the garnishment.

Form Submission Methods (Online / Mail / In-Person)

The Wg 004 form can be submitted through various methods, depending on the employer's policies and preferences. Common submission methods include:

- Online: Some employers may allow electronic submission of the form via their payroll systems.

- Mail: The completed form can be sent through postal mail to the employer's payroll department.

- In-Person: Delivering the form directly to the employer's office ensures immediate processing.

Quick guide on how to complete wg 004

Effortlessly prepare Wg 004 on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Wg 004 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Wg 004 with ease

- Find Wg 004 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, or a share link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Wg 004 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wg 004

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What does it mean when earnings are withheld withhold?

When earnings are withheld withhold, it refers to the practice of deducting a portion of income for taxes or other obligations before disbursing payment. This can include federal or state taxes, retirement contributions, or other withholdings. Understanding this concept is essential for businesses utilizing software like airSlate SignNow for document management.

-

How can airSlate SignNow help manage earnings withheld withhold?

airSlate SignNow streamlines the process of managing earnings withheld withhold by allowing businesses to create, send, and sign documents electronically. With features for tracking and reporting, users can easily document and manage any withholdings and ensure compliance with financial obligations, simplifying the overall process.

-

What are the pricing options for airSlate SignNow services concerning earnings withheld withhold?

airSlate SignNow offers flexible pricing plans designed to cater to various business needs regarding earnings withheld withhold. These plans range from basic to advanced, providing features that allow you to efficiently manage documents that deal with earnings and withholdings. It's advisable to review the pricing page for specific details.

-

Which features does airSlate SignNow offer to aid in understanding earnings withheld withhold?

Key features of airSlate SignNow include customizable templates, document tracking, and secure eSigning, all of which can assist users in handling situations where earnings are withheld withhold. The platform also helps in generating reports that provide insights into all transactions involving withheld earnings.

-

Can airSlate SignNow integrate with financial software to address earnings withheld withhold?

Yes, airSlate SignNow seamlessly integrates with several financial and accounting software solutions, which can help manage cases of earnings withheld withhold. This integration allows users to synchronize data and documents electronically, ensuring that all withholding information is accurately reflected in financial statements.

-

How does airSlate SignNow ensure compliance concerning earnings withheld withhold?

airSlate SignNow ensures compliance regarding earnings withheld withhold by allowing businesses to generate legally binding signatures and maintain an audit trail. The platform adheres to digital signature laws and regulations, ensuring that all transactions involving withheld earnings are compliant with legal standards.

-

What benefits does airSlate SignNow provide for businesses handling earnings withheld withhold?

Businesses using airSlate SignNow benefit from greater efficiency and reduced administrative burdens when handling earnings withheld withhold. The capability to manage documents electronically accelerates workflows and minimizes errors, ultimately leading to more accurate financial reporting and improved cash flow management.

Get more for Wg 004

- Hall rental agreement template form

- Sba 10 tab checklist form

- Surgery scheduling request form wesley medical center

- Satisfaction of judgment georgia form

- Cancer family history questionnaire form

- Affidavit of waiver sample form

- Family questionnaire summary sheet pdf form

- Usaf drug and alcohol abuse certificate form

Find out other Wg 004

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter