Sba 10 Tab Checklist Form

What is the Sba 10 Tab Checklist

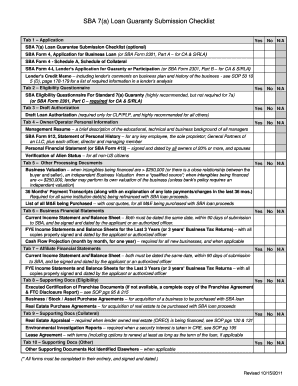

The Sba 10 Tab Checklist is a vital document used in the application process for various Small Business Administration (SBA) loans. This checklist serves as a guide for applicants to ensure they have all necessary information and documentation prepared before submission. It includes specific requirements and steps that must be followed to complete the application accurately. By adhering to this checklist, applicants can streamline their submission process and improve their chances of approval.

How to Use the Sba 10 Tab Checklist

Using the Sba 10 Tab Checklist involves a systematic approach to ensure all required information is gathered and correctly filled out. Start by reviewing each item on the checklist carefully. Make sure to gather the necessary documentation, such as financial statements, business plans, and personal identification. As you complete each section, check it off to confirm that it is done. This methodical approach helps prevent missing critical information that could delay the application process.

Steps to Complete the Sba 10 Tab Checklist

Completing the Sba 10 Tab Checklist involves several key steps:

- Review the checklist thoroughly to understand all requirements.

- Gather necessary documents, including tax returns, bank statements, and business licenses.

- Fill out the checklist, ensuring all sections are completed accurately.

- Double-check all entries for accuracy and completeness.

- Submit the checklist along with your SBA loan application.

Following these steps ensures that your application is well-prepared and meets all necessary criteria.

Legal Use of the Sba 10 Tab Checklist

The legal use of the Sba 10 Tab Checklist is crucial for ensuring compliance with SBA regulations. The checklist is designed to help applicants provide all required information, which is essential for the legal validity of the application. By using the checklist, applicants can confirm that they are adhering to the necessary legal standards, which helps protect against potential issues during the review process. It is important to keep in mind that accurate and honest information is required to maintain compliance.

Required Documents for the Sba 10 Tab Checklist

To successfully complete the Sba 10 Tab Checklist, applicants must prepare various required documents. These typically include:

- Personal and business tax returns for the past three years

- Financial statements, including balance sheets and profit and loss statements

- Business licenses and permits

- Resumes of business owners and key management

- A detailed business plan outlining the business model and financial projections

Having these documents ready will facilitate a smoother application process and help ensure all necessary information is provided.

Quick guide on how to complete sba 10 tab checklist

Easily Prepare Sba 10 Tab Checklist on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the right template and securely manage it online. airSlate SignNow equips you with all the essential tools to swiftly create, modify, and electronically sign your documents without unnecessary delays. Handle Sba 10 Tab Checklist on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Your Ultimate Guide to Modifying and Electronically Signing Sba 10 Tab Checklist Effortlessly

- Obtain Sba 10 Tab Checklist and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method for sending your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign Sba 10 Tab Checklist to ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sba 10 tab checklist

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sba 10 tab feature in airSlate SignNow?

The sba 10 tab feature in airSlate SignNow allows users to easily add signature fields and other relevant information directly to documents. This feature simplifies the eSigning process, making it more efficient for businesses of all sizes. The intuitive interface lets users customize their documents with various tabs, ensuring a seamless experience.

-

How does the sba 10 tab enhance document management?

The sba 10 tab enhances document management by providing a structured way to collect signatures and essential data within your documents. This feature helps streamline workflows and reduces the time spent on document processing. With airSlate SignNow’s sba 10 tab, you can maintain better organization, making it easier to track document statuses.

-

Is the sba 10 tab feature included in the airSlate SignNow pricing plans?

Yes, the sba 10 tab feature is included in all airSlate SignNow pricing plans. This ensures that businesses can access powerful eSignature capabilities without worrying about additional costs for essential features. Choose from various plans that suit your business needs, whether you're a small startup or a larger enterprise.

-

Can I customize the sba 10 tab for different types of documents?

Absolutely! The sba 10 tab in airSlate SignNow is highly customizable, allowing you to tailor it to fit various document types. You can adjust the fields, labels, and layout to match the specific requirements of each document. This level of customization enhances the user experience for both senders and signers.

-

What benefits does the sba 10 tab offer for remote teams?

The sba 10 tab is particularly beneficial for remote teams as it enables swift document processing without the need for physical meetings. This feature reduces turnaround times for contracts and agreements, facilitating faster decision-making. Additionally, airSlate SignNow's secure platform ensures that all signed documents are safely stored and easily accessible.

-

How does sba 10 tab integrate with other software?

The sba 10 tab integrates seamlessly with various software applications, such as CRM systems, cloud storage services, and project management tools. This integration capability enhances your workflow by allowing data to transfer seamlessly across platforms. By using airSlate SignNow with its sba 10 tab, you can connect with the tools you already use to increase efficiency.

-

Is training required to use the sba 10 tab feature?

No formal training is required to use the sba 10 tab feature in airSlate SignNow, as the interface is designed to be user-friendly. Most users can easily navigate and utilize the feature with minimal guidance. However, airSlate does provide resources and support for users who may want to learn best practices for maximizing the sba 10 tab's potential.

Get more for Sba 10 Tab Checklist

Find out other Sba 10 Tab Checklist

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed