California Profit Loss Statement Form

What is the California Profit Loss Statement

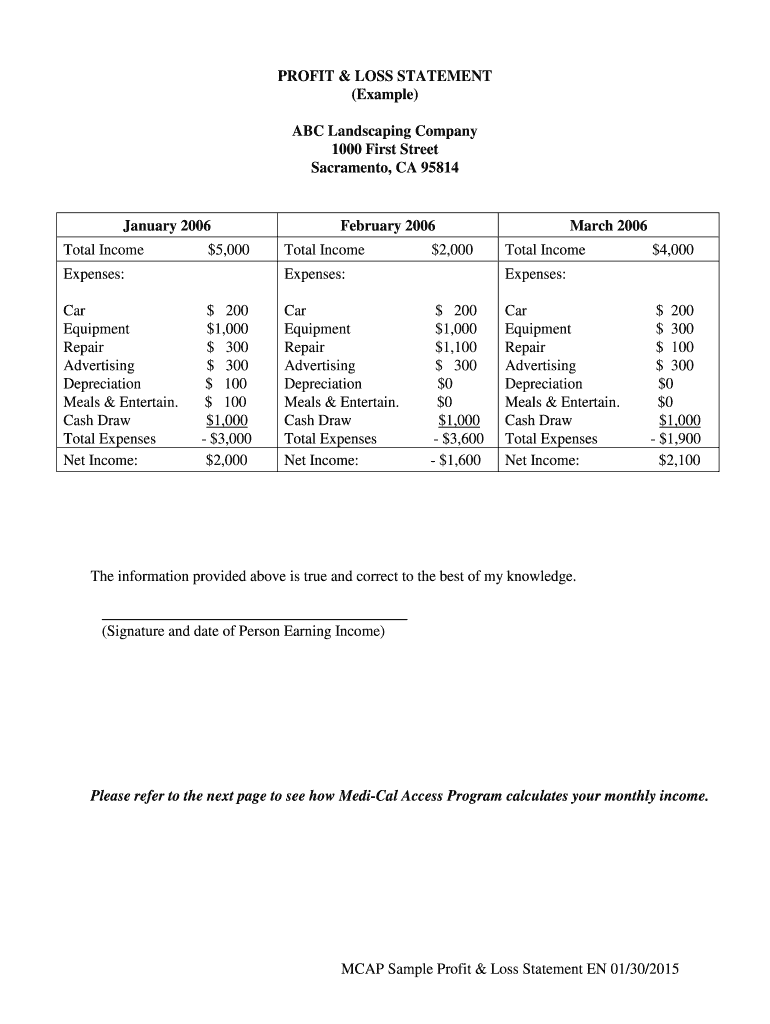

The California Profit Loss Statement is a financial document that outlines the income and expenses of a business operating within California. This statement is essential for tracking the financial performance of a business over a specific period, typically a fiscal year. It provides a clear overview of the profitability of the business by detailing revenues and costs, allowing business owners to make informed decisions based on their financial health.

Key elements of the California Profit Loss Statement

Understanding the key elements of the California Profit Loss Statement is crucial for accurate reporting. The main components include:

- Revenue: Total income generated from sales or services before any expenses are deducted.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold by the business.

- Gross Profit: Revenue minus COGS, indicating the profitability of core business activities.

- Operating Expenses: Costs incurred in the normal course of business, such as rent, utilities, and salaries.

- Net Profit: The final profit after all expenses, taxes, and costs have been deducted from total revenue.

Steps to complete the California Profit Loss Statement

Completing the California Profit Loss Statement involves several steps to ensure accuracy and compliance. Follow these steps to prepare your statement:

- Gather financial records, including invoices, receipts, and bank statements.

- Calculate total revenue for the reporting period.

- Determine the cost of goods sold by adding direct costs associated with production.

- Subtract COGS from total revenue to find gross profit.

- List all operating expenses and sum them up.

- Subtract total operating expenses from gross profit to calculate net profit.

Legal use of the California Profit Loss Statement

The California Profit Loss Statement serves as a legal document that can be used in various contexts, such as tax filings and business evaluations. To ensure its legal validity, it must be accurately completed and maintained in compliance with applicable regulations. This includes adhering to the guidelines set forth by the Internal Revenue Service (IRS) and state tax authorities. Proper documentation and record-keeping are essential for supporting the figures presented in the statement.

How to obtain the California Profit Loss Statement

Obtaining the California Profit Loss Statement can be done through various means. Business owners can create their own statement using accounting software, templates, or spreadsheets. Additionally, financial institutions and accounting firms may provide templates or assistance in preparing the statement. It is important to ensure that the format used complies with California state requirements to maintain accuracy and legality.

Examples of using the California Profit Loss Statement

The California Profit Loss Statement can be utilized in several scenarios, including:

- Assessing the financial performance of a business over a specific period.

- Preparing for tax filings to ensure all income and expenses are reported accurately.

- Securing financing or investment by providing potential investors with a clear picture of profitability.

Quick guide on how to complete california profit loss statement

Effortlessly Prepare California Profit Loss Statement on Any Device

Online document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without delays. Manage California Profit Loss Statement on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Simplest Way to Edit and eSign California Profit Loss Statement with Ease

- Obtain California Profit Loss Statement and click Get Form to begin.

- Utilize our tools to complete your document.

- Emphasize important sections of the documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign California Profit Loss Statement while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california profit loss statement

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is a profit and loss statement PDF?

A profit and loss statement PDF is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period. It provides insights into a company's financial performance and is essential for assessing profitability. You can create and manage your profit and loss statement PDF using airSlate SignNow's intuitive platform.

-

How can airSlate SignNow help me create a profit and loss statement PDF?

airSlate SignNow offers tools that streamline the creation of a profit and loss statement PDF, allowing you to input data quickly and effectively. With our easy-to-use templates, you can generate professional-quality documents in no time. Sign and send your profit and loss statement PDF to stakeholders directly through our platform.

-

Is there a cost associated with using airSlate SignNow for my profit and loss statement PDF?

Yes, airSlate SignNow provides a variety of pricing plans to fit different business needs. Depending on the features you require for your profit and loss statement PDF and other documents, you can choose a plan that offers the best value. Visit our pricing page to find the plan that suits your requirements.

-

Can I share my profit and loss statement PDF with my team?

Absolutely! airSlate SignNow allows you to securely share your profit and loss statement PDF with team members and stakeholders. You can collaborate in real-time, ensuring everyone is on the same page, and receive instant feedback right within the document.

-

What security measures does airSlate SignNow have for managing profit and loss statement PDFs?

airSlate SignNow prioritizes document security, providing various measures like encryption, secure access, and audit trails for your profit and loss statement PDFs. This ensures that your sensitive financial information remains protected from unauthorized access. You can trust our platform to handle your documents safely.

-

Does airSlate SignNow integrate with other accounting software for profit and loss statement PDFs?

Yes, airSlate SignNow integrates with many popular accounting software applications, making it easy to import and export your profit and loss statement PDF data. This integration simplifies your workflow by allowing seamless data transfer between applications. Check our integration list to see if your preferred tools are included.

-

What are the benefits of using airSlate SignNow for profit and loss statement PDFs?

Using airSlate SignNow for your profit and loss statement PDFs can enhance efficiency, save time, and reduce costs. Our platform offers features like eSignature, document templates, and easy collaboration, making financial reporting simple and effective. Leverage our solution to stay organized and professional.

Get more for California Profit Loss Statement

- Academic advising guide associate in arts guide hccfl form

- Anthem prior auth request for form

- Nhsn denominator form

- Birth control vertification paper form

- Ppe evaluation form template 56917802

- Sample invitation letter to provide in support of visitor visa application form

- Da form 31 pdf

- Hud repayment agreement template form

Find out other California Profit Loss Statement

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free