Real Property Income and Expense RPIE FAQ NYC Gov Nyc 2014

What is the Real Property Income and Expense RPIE FAQ NYC gov NYC

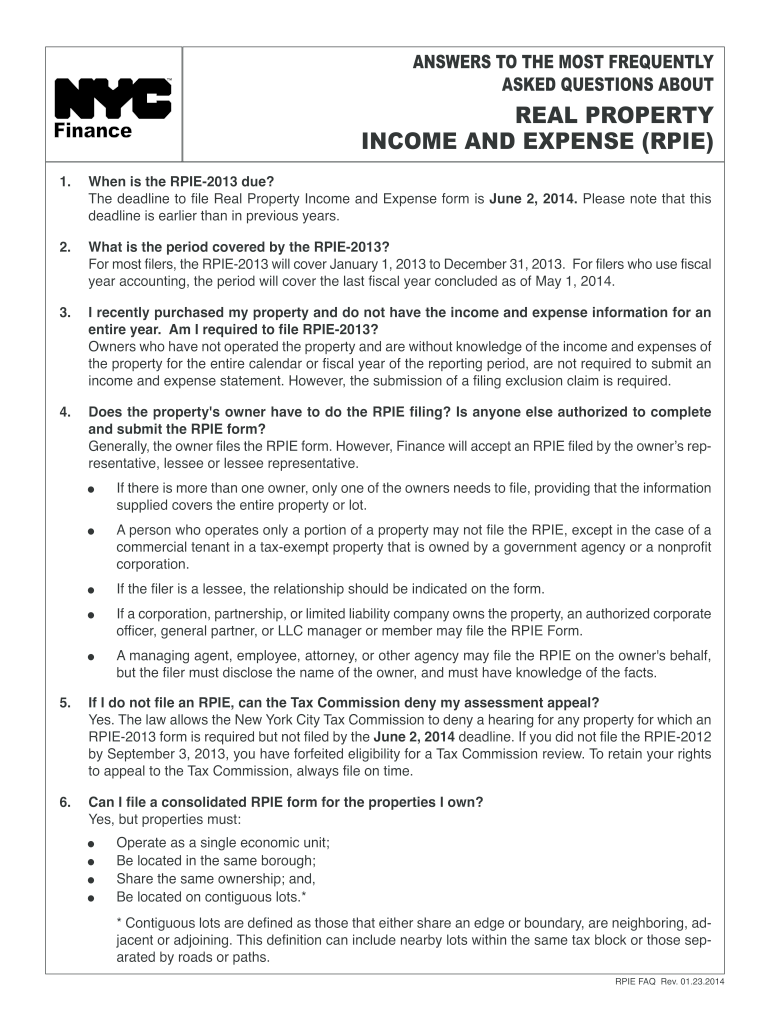

The Real Property Income and Expense (RPIE) form is a critical document required by the New York City Department of Finance. It is designed to collect detailed information about the income and expenses associated with real estate properties. This form is essential for property owners, as it helps the city assess property values for tax purposes. The RPIE FAQ provides guidance on how to complete the form, outlines the necessary information, and clarifies any common questions that may arise during the process.

Steps to complete the Real Property Income and Expense RPIE FAQ NYC gov NYC

Completing the RPIE form involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents related to the property, including income statements, expense reports, and any other pertinent records. Next, carefully fill out each section of the form, ensuring that all information is complete and accurate. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the preferred method outlined by the NYC Department of Finance.

Legal use of the Real Property Income and Expense RPIE FAQ NYC gov NYC

The RPIE form holds legal significance as it is used by the NYC Department of Finance to evaluate property taxes. When completed and submitted correctly, the information provided is considered legally binding. It is crucial for property owners to understand that inaccuracies or omissions can lead to penalties or disputes regarding property tax assessments. Therefore, ensuring compliance with all legal requirements when filling out the RPIE form is essential for property owners.

Required Documents for the Real Property Income and Expense RPIE FAQ NYC gov NYC

To successfully complete the RPIE form, property owners must gather various documents. These typically include:

- Income statements detailing rental income and other revenue sources.

- Expense reports that outline operational costs, maintenance fees, and other expenditures.

- Any supporting documentation that verifies the information provided, such as leases or contracts.

Having these documents ready will streamline the completion process and help ensure that the information submitted is accurate and comprehensive.

Form Submission Methods for the Real Property Income and Expense RPIE FAQ NYC gov NYC

The RPIE form can be submitted through multiple methods to accommodate different preferences. Property owners can choose to file the form electronically via the NYC Department of Finance website, which offers a user-friendly interface for online submissions. Alternatively, the form can be printed and mailed to the appropriate address provided by the department. In-person submissions are also possible at designated locations, allowing for direct interaction with city officials if needed.

Penalties for Non-Compliance with the Real Property Income and Expense RPIE FAQ NYC gov NYC

Failure to comply with the RPIE filing requirements can result in significant penalties for property owners. These may include fines, increased property tax assessments, or even legal action in severe cases. It is essential for property owners to be aware of the deadlines for submission and to ensure that the form is completed accurately to avoid these potential consequences. Timely and accurate filing not only helps in maintaining compliance but also protects property owners from unnecessary financial burdens.

Quick guide on how to complete real property income and expense rpie faq nycgov nyc

Complete Real Property Income And Expense RPIE FAQ NYC gov Nyc effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the required form and securely store it online. airSlate SignNow offers you all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Real Property Income And Expense RPIE FAQ NYC gov Nyc on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Real Property Income And Expense RPIE FAQ NYC gov Nyc with ease

- Obtain Real Property Income And Expense RPIE FAQ NYC gov Nyc and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or mistakes that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your preferred device. Modify and eSign Real Property Income And Expense RPIE FAQ NYC gov Nyc and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct real property income and expense rpie faq nycgov nyc

Create this form in 5 minutes!

How to create an eSignature for the real property income and expense rpie faq nycgov nyc

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the Real Property Income And Expense RPIE FAQ NYC gov Nyc?

The Real Property Income And Expense RPIE FAQ NYC gov Nyc provides essential information and guidance on the RPIE filing process for property owners in New York City. It outlines the required forms, deadlines, and key details to ensure compliance. This FAQ is crucial for property owners to understand their responsibilities and avoid penalties.

-

How do I file my Real Property Income And Expense RPIE in NYC?

To file your Real Property Income And Expense RPIE in NYC, you can access the NYC Department of Finance website to download the necessary forms. The process can be completed online, making it convenient for property owners. Following the guidelines in the FAQ ensures that all required information is included for a successful submission.

-

Are there any penalties for not filing the Real Property Income And Expense RPIE in NYC?

Yes, failing to file the Real Property Income And Expense RPIE in NYC can result in signNow penalties, including fines and an estimate of your income for tax purposes. Adhering to the timeline and guidelines provided in the FAQ can help mitigate these risks. It's essential to stay informed to maintain compliance.

-

What are the benefits of using airSlate SignNow for filing RPIE documents?

Using airSlate SignNow for filing Real Property Income And Expense RPIE documents provides a streamlined and efficient process. SignNow allows for quick electronic signatures and document management, reducing the time spent on paperwork. This can signNowly enhance your workflow, making filing easier and more organized.

-

Can I integrate airSlate SignNow with other software for RPIE management?

Yes, airSlate SignNow offers various integration options with popular software and applications for RPIE management. This flexibility allows users to connect their existing tools and streamline their workflow. By integrating with airSlate SignNow, you can enhance productivity and ensure that all RPIE-related documents are efficiently handled.

-

How much does it cost to use airSlate SignNow for RPIE filings?

airSlate SignNow offers flexible pricing plans designed to cater to a range of business needs, making it a cost-effective solution for RPIE filings. Costs may vary based on the level of service and features you choose. It's recommended to visit the pricing page on our website for detailed information about different plans.

-

What features does airSlate SignNow provide for document management related to RPIE?

airSlate SignNow includes features such as electronic signatures, template creation, and document tracking, making it a robust tool for managing RPIE documents. These features ensure that all your paperwork is organized and easily accessible. Additionally, the platform enhances collaboration among team members during the filing process.

Get more for Real Property Income And Expense RPIE FAQ NYC gov Nyc

- Work arrangement form

- Registration of trademarkservice mark california secretary of state sos ca form

- Jd fm 172 5300734 form

- Domestic new client information form

- Signatory letter 1 statement 2 medical declaration les roches form

- Loan netherlands agreement template form

- Loan no interest agreement template form

- Non emergency medical transportation contract template form

Find out other Real Property Income And Expense RPIE FAQ NYC gov Nyc

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement