DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware

What is the Delaware Form 200 02?

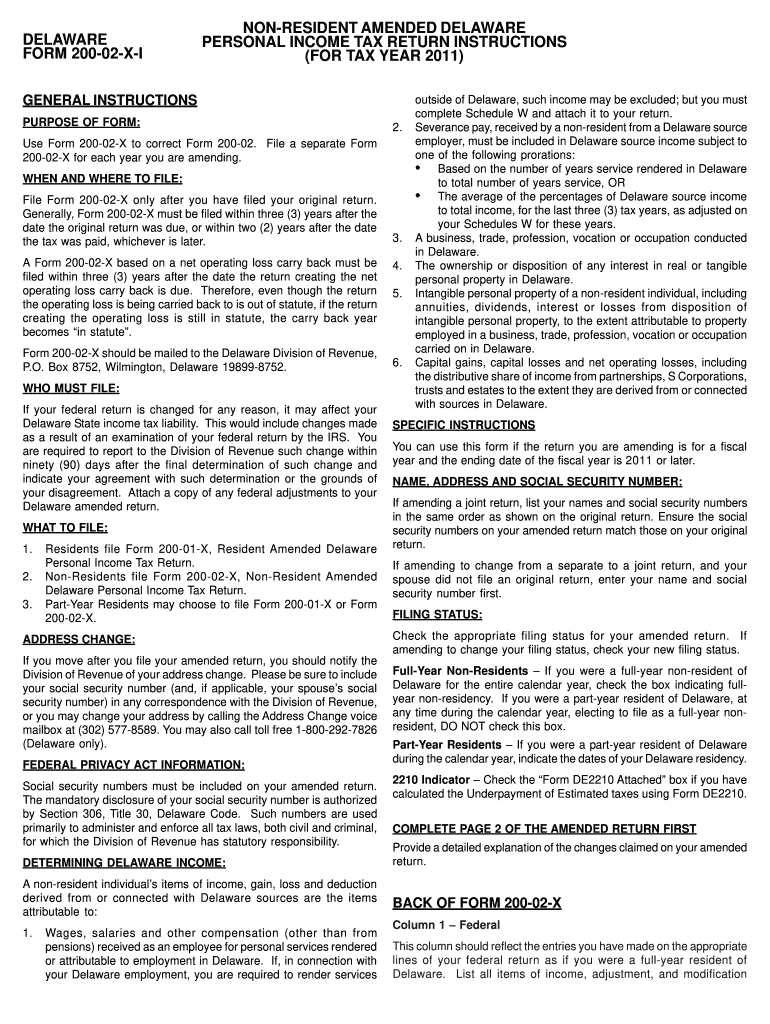

The Delaware Form 200 02 is a tax document specifically designed for non-residents who need to amend their tax returns in the state of Delaware. This form is essential for individuals who have previously filed a return but need to make corrections or updates. It allows taxpayers to report any changes in income, deductions, or credits that may affect their tax liability. Understanding the purpose of this form is crucial for ensuring compliance with state tax regulations.

Steps to Complete the Delaware Form 200 02

Completing the Delaware Form 200 02 involves several important steps to ensure accuracy and compliance. First, gather all relevant financial documents, including your original tax return and any supporting materials for the amendments. Next, clearly indicate the changes being made on the form, providing detailed explanations where necessary. Ensure that all figures are accurate and reflect the correct amounts. Finally, review the completed form for any errors before submission to avoid delays or penalties.

How to Obtain the Delaware Form 200 02

The Delaware Form 200 02 can be easily obtained through the official Delaware Division of Revenue website. The form is available for download in PDF format, allowing taxpayers to print and fill it out at their convenience. Additionally, it may be accessible at local tax offices or through tax preparation services that assist with Delaware tax filings. Ensuring you have the most current version of the form is essential for accurate filing.

Legal Use of the Delaware Form 200 02

The legal use of the Delaware Form 200 02 is governed by state tax laws, which require accurate reporting of income and taxes owed. This form must be filed in accordance with the guidelines set forth by the Delaware Division of Revenue to ensure its validity. Proper completion of the form is necessary for it to be considered legally binding, and it must be submitted within the designated time frames to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Delaware Form 200 02 are critical for compliance. Typically, the amended return must be submitted within three years from the original filing date or within two years from the date the tax was paid, whichever is later. It is essential to keep track of these deadlines to avoid interest and penalties on any unpaid taxes. Marking these dates on your calendar can help ensure timely submission.

Required Documents

When filing the Delaware Form 200 02, certain documents are required to support your amendments. These may include your original tax return, W-2 forms, 1099 forms, and any other documentation that substantiates your reported income and deductions. Having these documents readily available will facilitate a smoother filing process and help ensure that your amendments are accurately reflected in your tax records.

Quick guide on how to complete delaware form 200 02 x i non resident amended revenue delaware

Effortlessly Prepare DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily find the right template and securely save it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and eSign your documents without any delays. Manage DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware on any device using the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The Easiest Way to Modify and eSign DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware with Ease

- Find DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form hunting, and errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

Create this form in 5 minutes!

How to create an eSignature for the delaware form 200 02 x i non resident amended revenue delaware

How to create an eSignature for the Delaware Form 200 02 X I Non Resident Amended Revenue Delaware online

How to create an electronic signature for your Delaware Form 200 02 X I Non Resident Amended Revenue Delaware in Google Chrome

How to generate an electronic signature for putting it on the Delaware Form 200 02 X I Non Resident Amended Revenue Delaware in Gmail

How to make an electronic signature for the Delaware Form 200 02 X I Non Resident Amended Revenue Delaware from your smart phone

How to generate an eSignature for the Delaware Form 200 02 X I Non Resident Amended Revenue Delaware on iOS

How to generate an eSignature for the Delaware Form 200 02 X I Non Resident Amended Revenue Delaware on Android OS

People also ask

-

What is DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware?

DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware is a tax form used by non-resident individuals and entities to report income earned in Delaware. This form helps ensure compliance with state tax regulations, allowing non-residents to amend their tax filings accurately.

-

How can airSlate SignNow assist with DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware?

airSlate SignNow streamlines the process of completing and sending DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware. With our easy-to-use platform, users can eSign documents securely, ensuring that all necessary forms are filed efficiently and on time.

-

Is there a cost associated with using airSlate SignNow for DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware?

While airSlate SignNow offers various pricing plans, the cost is minimal compared to the time saved in managing DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware. Our plans are designed to be cost-effective, catering to both individual and business needs.

-

What features does airSlate SignNow provide for handling tax forms like DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware?

airSlate SignNow includes features such as easy document upload, eSigning, and customizable templates, making it ideal for handling DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware. These features enhance user experience and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for managing DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware?

Yes, airSlate SignNow offers integrations with various software applications, which can help streamline the process of managing DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware. This allows for seamless data transfer and improved efficiency in your tax filing process.

-

What are the benefits of using airSlate SignNow for DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware?

Using airSlate SignNow for DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware provides numerous benefits, including faster turnaround times, enhanced security for your documents, and easy access to your forms anytime, anywhere. This ensures that you remain compliant without unnecessary delays.

-

How secure is airSlate SignNow when handling DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your documents, including DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware. You can trust that your sensitive information is safe while using our platform.

Get more for DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware

- Ihss application forms

- Voluntary sportsathletic event or activity informed consent and

- City and county of san francisco san francisco department form

- 1000 broadway ste 500 form

- Member grievance form blue shield of california

- Agreement of financial responsibility comprehensive form

- Child care billing for month and year form

- Welcome to orthopaedic surgery specialists oss ossburbankcom form

Find out other DELAWARE FORM 200 02 X I NON RESIDENT AMENDED Revenue Delaware

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online