Mccracken County Filliable Forms 2009-2026

What is the Mccracken County Fillable Forms

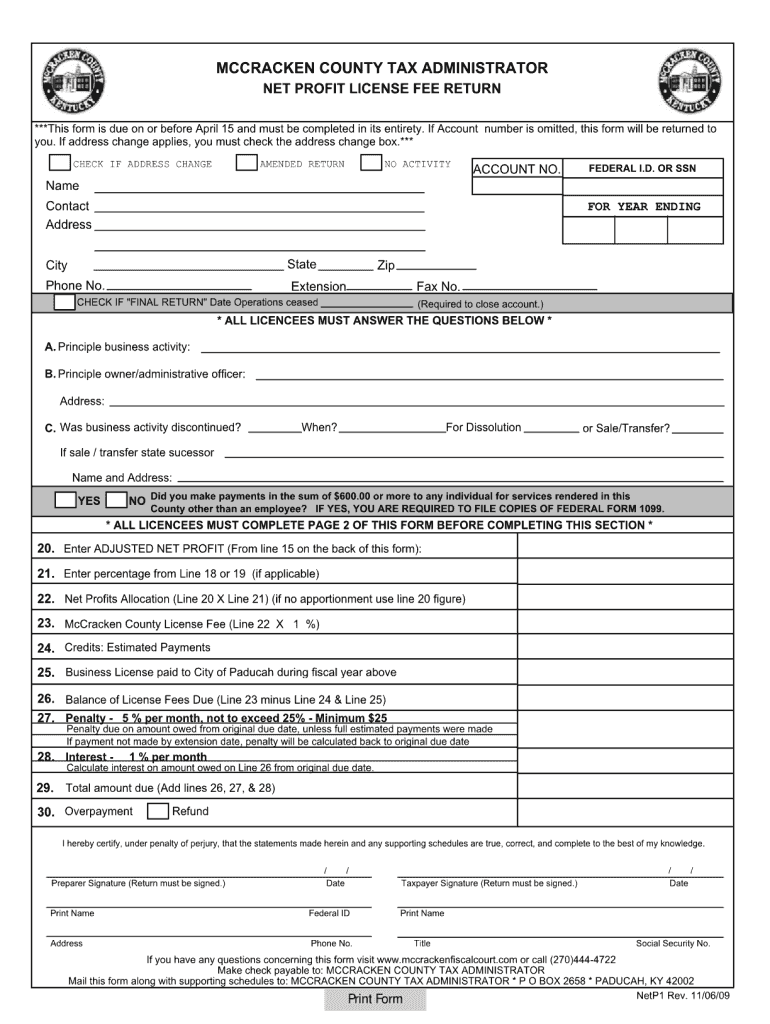

The Mccracken County fillable forms are official documents required for various business activities in the region. These forms facilitate the process of applying for a business license, renewing existing licenses, and submitting necessary tax documents. They are designed to be user-friendly, allowing businesses to input their information directly into the form fields, which helps reduce errors and streamline the submission process. Understanding these forms is essential for compliance with local regulations.

How to Obtain the Mccracken County Fillable Forms

To obtain the Mccracken County fillable forms, businesses can visit the official Mccracken County website or the Kentucky business one-stop portal. These platforms provide access to the necessary forms in a downloadable format. Users can easily find the specific forms they need by navigating through the business section of the website. Additionally, local government offices may provide physical copies of these forms for those who prefer to fill them out by hand.

Steps to Complete the Mccracken County Fillable Forms

Completing the Mccracken County fillable forms involves several straightforward steps:

- Download the appropriate form from the Mccracken County website.

- Open the form using a compatible PDF reader that supports fillable fields.

- Carefully input all required information, ensuring accuracy to avoid delays.

- Review the completed form for any errors or missing information.

- Save the filled form, and if necessary, print it for submission.

Legal Use of the Mccracken County Fillable Forms

The legal use of the Mccracken County fillable forms is governed by local and state regulations. These forms must be completed accurately and submitted within the designated timeframes to ensure compliance with business licensing laws. Failure to adhere to these requirements can result in penalties or delays in obtaining a business license. It is crucial for businesses to familiarize themselves with the legal implications of these forms to maintain operational legitimacy.

Required Documents

When filling out the Mccracken County fillable forms, certain documents may be required to support the application or renewal process. Commonly needed documents include:

- Proof of identity, such as a driver's license or state ID.

- Business formation documents, including articles of incorporation or partnership agreements.

- Tax identification number (TIN) or employer identification number (EIN).

- Proof of address for the business location.

Form Submission Methods

Businesses can submit the completed Mccracken County fillable forms through various methods. The most common submission methods include:

- Online submission via the Mccracken County website, where applicable.

- Mailing the completed forms to the appropriate county office.

- In-person submission at designated government offices during business hours.

Quick guide on how to complete mccracken county ky business license form

Handle Mccracken County Filliable Forms anywhere and any time

Your regular organizational tasks may require additional attention when working with state-specific business documents. Regain your office time and lower the costs associated with paper-based processes using airSlate SignNow. airSlate SignNow offers a range of pre-loaded business documents, including Mccracken County Filliable Forms, which you can utilize and share with your business associates. Manage your Mccracken County Filliable Forms seamlessly with powerful editing and eSignature features and send it directly to your recipients.

How to obtain Mccracken County Filliable Forms in just a few clicks:

- Select a relevant form for your state.

- Click Learn More to view the document and ensure its accuracy.

- Choose Get Form to begin using it.

- Mccracken County Filliable Forms will automatically open in the editor. No further actions are necessary.

- Utilize airSlate SignNow’s advanced editing tools to complete or modify the document.

- Click on the Sign option to create your unique signature and eSign your document.

- When ready, click Done, save changes, and access your document.

- Send the form via email or text, or use a link-to-fill feature with your partners or let them download the document.

airSlate SignNow signNowly saves you time handling Mccracken County Filliable Forms and enables you to find necessary documents in one location. A comprehensive catalog of forms is organized and designed to cover crucial business processes vital for your company. The enhanced editor reduces the likelihood of errors, allowing you to easily fix mistakes and review your documents on any device before sending them out. Start your free trial today to explore all the benefits of airSlate SignNow for your daily business operations.

Create this form in 5 minutes or less

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

What forms should I fill out to start a business?

From a legal business entity standpoint, one does not normally have to file any forms with the state the business is located in to be considered a sole proprietor (SP). However, this highly unadvisable since a SP provides no liability protection.The most popular, and most advisable business entities are a Limited Liability Company (LLC) and a Corporation. These entities are state created entities meaning that you must file the necessary paperwork in the state where you will have the business headquarters. The state’s secretary of state’s office will have all the necessary documents, forms, and rules needed to create the entity of your choice. You will also have to pay a filing fee.It is important that you further discuss the issue with experienced counsel as they will be able to help you decide which entity is best for you, and help you with the filing.

-

What are the required forms to fill out when starting a business?

It depends on where you're based: not only do different countries have different paperwork, but so do different states, counties and even cities. There are some places where you can start a new business without filling out any paperwork (although you'll likely have to deal with tax forms and the like after you've been in business for a while.There are some common forms that you should check on whether you need for your area:Business licenseProfessional license — In addition to a license for operating a business, certain professions are licensed.DBA / Doing business as — If you're doing business under a name other than your own, such as a company name, you may need to file a DBA.Incorporation or organizational documents — Depending on how you organize your business, you may need to file paperwork to incorporate.Tax registration — You will usually need to register with your local state if you're collecting sales tax. You will also probably need to complete paperwork to get a taxpayer identification number or an equivalent for your business.Employee forms — If you have employees, there can be quite a bit of paperwork, including their tax paperwork and any appropriate registration.These really are just a starting point. One of the best things you can do is find a local accountant or other professional to advise you on what you need.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How can I change my initial on my original driver’s license, and how much does it cost? Which form do I have fill out?

Ask your local dept of motor vehicles.

Create this form in 5 minutes!

How to create an eSignature for the mccracken county ky business license form

How to generate an eSignature for your Mccracken County Ky Business License Form in the online mode

How to generate an eSignature for your Mccracken County Ky Business License Form in Google Chrome

How to create an eSignature for signing the Mccracken County Ky Business License Form in Gmail

How to create an eSignature for the Mccracken County Ky Business License Form straight from your smart phone

How to create an electronic signature for the Mccracken County Ky Business License Form on iOS

How to create an eSignature for the Mccracken County Ky Business License Form on Android devices

People also ask

-

What is a business license in Kentucky?

A business license in Kentucky is a legal document that allows individuals or companies to operate a business within the state. This license is essential to ensure compliance with local regulations and can vary based on the type of business you are running. It’s important to obtain a business license in Kentucky to avoid fines and legal issues.

-

How do I apply for a business license in Kentucky?

To apply for a business license in Kentucky, you need to visit your local county clerk’s office or the appropriate state agency. The application process typically requires documentation such as your business name, address, and type of business activity. Ensure you have your business license in Kentucky before starting operations to maintain compliance.

-

What are the costs associated with obtaining a business license in Kentucky?

The costs for a business license in Kentucky can vary signNowly depending on the type of business and the municipality. Fees can range from a few dollars to several hundred dollars. It’s essential to budget for these costs when planning your business and factor them into your overall expenses.

-

How long does it take to get a business license in Kentucky?

The time it takes to obtain a business license in Kentucky can vary based on your location and the completeness of your application. Typically, it can take anywhere from a few days to a couple of weeks. To expedite the process, ensure all documentation is accurate and complete before submission.

-

Do I need a special business license in Kentucky for specific industries?

Yes, certain industries in Kentucky may require additional licenses or permits beyond a standard business license. For example, businesses in sectors like healthcare, food service, or construction may need special permits. It’s crucial to check industry-specific requirements to ensure you comply with local regulations and maintain your business license in Kentucky.

-

What are the benefits of obtaining a business license in Kentucky?

Obtaining a business license in Kentucky legitimizes your business and builds trust with customers and suppliers. It also allows you to operate legally within the state, essential for protecting your business from legal issues. Additionally, a valid business license in Kentucky can enhance your business's credibility and eligibility for loans or grants.

-

Can I renew my business license online in Kentucky?

Many counties in Kentucky offer online renewal options for business licenses, making the process convenient. You can typically complete the renewal form, pay any fees, and submit any required documents electronically. Check with your local county clerk’s office to see if this option is available for your business license in Kentucky.

Get more for Mccracken County Filliable Forms

- Sam houston state on twitter ampquotthe shsu school of nursing form

- Authorized users signature log university of minnesota dehs umn form

- Isss umn form

- F 1 student transfer release form new york university nyu

- Sevis transfer request form pace university pace

- Application for clinic services form

- Ucr w2 form

- Research intake application application submitter contact form

Find out other Mccracken County Filliable Forms

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile