Nys Tax Capital Improvement Form

What is the NYS Tax Capital Improvement Form?

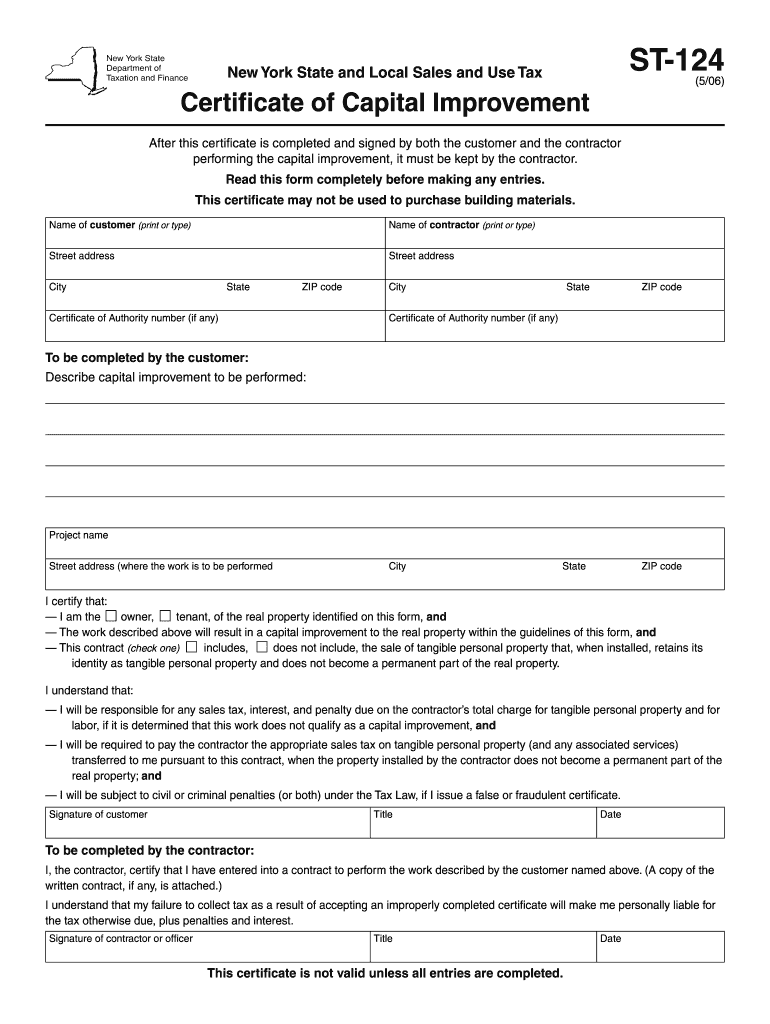

The NYS Tax Capital Improvement Form is a document used in New York State to certify that certain improvements made to a property qualify for a tax exemption. This form is crucial for property owners who wish to benefit from tax relief associated with capital improvements. By completing this form, taxpayers can assert that the enhancements made to their property meet the criteria set forth by the state for capital improvements, which can include renovations, expansions, or other significant upgrades that increase the property’s value.

How to Use the NYS Tax Capital Improvement Form

Using the NYS Tax Capital Improvement Form involves several steps to ensure compliance with state regulations. First, property owners should gather all relevant documentation that supports the claim of capital improvements. This may include receipts, contracts, and photographs of the work completed. Next, the form must be filled out accurately, detailing the nature of the improvements and their costs. Once completed, the form should be submitted to the appropriate local tax authority for review. Understanding the specific requirements for your locality is essential, as they may vary across different jurisdictions in New York State.

Steps to Complete the NYS Tax Capital Improvement Form

Completing the NYS Tax Capital Improvement Form involves a systematic approach:

- Gather Documentation: Collect all invoices, contracts, and any other proof of the improvements made.

- Fill Out the Form: Provide detailed information about the property and the improvements, including dates and costs.

- Review for Accuracy: Double-check all entries to ensure accuracy and completeness before submission.

- Submit the Form: Send the completed form to your local tax authority, either online or via mail, depending on local guidelines.

Legal Use of the NYS Tax Capital Improvement Form

The legal use of the NYS Tax Capital Improvement Form is governed by New York State tax laws. To be considered valid, the form must be filled out in accordance with state guidelines and submitted within the designated time frames. It is important for property owners to understand that misrepresenting information on the form can lead to penalties, including fines or disqualification from receiving tax benefits. Therefore, ensuring that all information is truthful and supported by documentation is essential for legal compliance.

Key Elements of the NYS Tax Capital Improvement Form

Several key elements are essential when completing the NYS Tax Capital Improvement Form:

- Property Information: Include the address and identification details of the property.

- Description of Improvements: Clearly outline the nature of the improvements made, including their purpose and impact on the property.

- Cost Breakdown: Provide a detailed account of the costs associated with the improvements, including labor and materials.

- Signatures: Ensure that the form is signed by the property owner or authorized representative to validate the submission.

Form Submission Methods

The NYS Tax Capital Improvement Form can be submitted through various methods, depending on local regulations. Typically, property owners can choose to submit the form online through their local tax authority's website, by mail, or in person. Each method may have specific guidelines regarding documentation and deadlines, so it is advisable to check with the local tax office for the preferred submission process. Timely submission is crucial to ensure that the benefits of the capital improvements are recognized in the upcoming tax assessments.

Quick guide on how to complete improvment certificate formpdffillercom

Complete Nys Tax Capital Improvement Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the required form and securely maintain it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Nys Tax Capital Improvement Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Nys Tax Capital Improvement Form with ease

- Locate Nys Tax Capital Improvement Form and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to apply your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invite link, or save it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form retrievals, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Nys Tax Capital Improvement Form and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I’m shipping my product to Canada. How do I fill out a NAFTA Certificate of Origin? Are there other documents to be filled out?

Your shipment may need a NAFTA Certificate of Origin and a Shipper’s Export Declaration. To learn more about export documentation, please visit Export.gov to learn more.The U.S. Commercial Service’s Trade Information Center or the trade specialists at your local Export Assistance Center can also help answer these questions. Call 1-800-USA-TRAD(E) or find your local Export Assistance Center.International Trade Law includes the appropriate rules and customs for handling trade between countries. However, it is also used in legal writings as trade between private sectors, which is not right.This branch of law is now an independent field of study as most governments has become part of the world trade, as members of the World Trade Organization (WTO).Since the transaction between private sectors of different countries is an important part of the WTO activities, this latter branch of law is now a very important part of the academic works and is under study in many universities across the world.

-

Where can I get the form for migration certificate?

Migration is issued by the Universities themselves.The best way is to inquire your college they will guide you further.In case you happen to be from A.P.J Abdul Kalam Technical Universityhere is the link to get it issued online.Hope it helpsStudent Service (Dashboard) Dr. A.P.J. Abdul Kalam Technical University (Lucknow)Regards

Create this form in 5 minutes!

How to create an eSignature for the improvment certificate formpdffillercom

How to generate an eSignature for your Improvment Certificate Formpdffillercom online

How to generate an eSignature for the Improvment Certificate Formpdffillercom in Google Chrome

How to create an electronic signature for putting it on the Improvment Certificate Formpdffillercom in Gmail

How to make an electronic signature for the Improvment Certificate Formpdffillercom right from your mobile device

How to create an electronic signature for the Improvment Certificate Formpdffillercom on iOS devices

How to create an eSignature for the Improvment Certificate Formpdffillercom on Android devices

People also ask

-

What is the Nys Tax Capital Improvement Form?

The Nys Tax Capital Improvement Form is a document used by property owners in New York State to apply for tax exemptions related to capital improvements. This form helps streamline the process of claiming exemptions, ensuring that property owners can benefit from tax savings on their improved properties.

-

How can airSlate SignNow help with the Nys Tax Capital Improvement Form?

airSlate SignNow simplifies the process of completing and submitting the Nys Tax Capital Improvement Form by allowing users to eSign and send documents securely online. Our platform ensures that your forms are filled out correctly and submitted on time, reducing the hassle of paper-based processes.

-

Is there a cost associated with using airSlate SignNow for the Nys Tax Capital Improvement Form?

Yes, airSlate SignNow offers several pricing plans designed to fit various business needs. Our cost-effective solution provides access to essential features for managing the Nys Tax Capital Improvement Form, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for handling the Nys Tax Capital Improvement Form?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning for the Nys Tax Capital Improvement Form. These tools enhance efficiency, allowing you to manage your documents with ease and accuracy.

-

Can I integrate airSlate SignNow with other software for the Nys Tax Capital Improvement Form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, making it easy to incorporate the Nys Tax Capital Improvement Form into your existing systems. This interoperability enhances productivity and streamlines your document management processes.

-

What are the benefits of using airSlate SignNow for the Nys Tax Capital Improvement Form?

Using airSlate SignNow for the Nys Tax Capital Improvement Form allows for increased efficiency, reduced paperwork, and improved compliance. Our platform enables users to complete forms quickly while ensuring that all signatures are legally binding and secure.

-

Is airSlate SignNow easy to use for the Nys Tax Capital Improvement Form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete the Nys Tax Capital Improvement Form without extensive training. Our intuitive interface guides users through the process, ensuring a smooth experience.

Get more for Nys Tax Capital Improvement Form

- Form b parentguardian consent for a minor in laboratories

- Parentlegal guardian financial agreement form

- The school of law offers j uakron form

- Form 86 03 020 proctor request form fill out this form to request a proctor

- A toreleaseanddischargetheuniversityfromanyliabilityorresponsibilityforanypersonalorbodily form

- Declaration of residency intent form

- Egg donor program interest form initial questionnaire

- Passfail declaration request form

Find out other Nys Tax Capital Improvement Form

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe